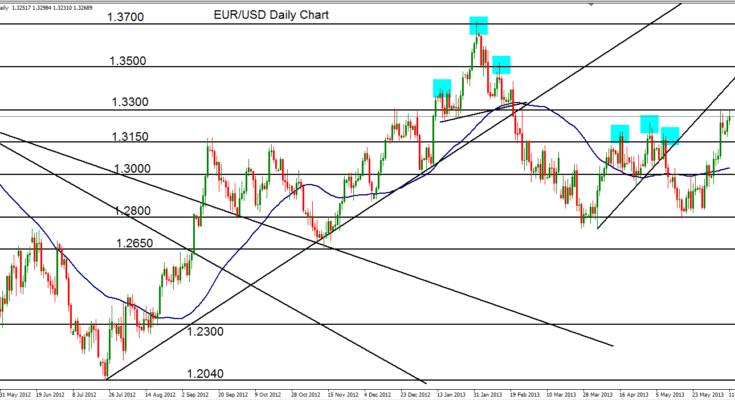

June 11, 2013 – EUR/USD (daily chart) has struggled to continue its advance just under key 1.3300 resistance, a level that has served as major support and resistance in the past, most recently just late last week. This pause below resistance comes after a substantial advance for the past two weeks that brought price up from close to 1.2800 support all the way up to the current highs near 1.3300 resistance.  In the process of this climb, price broke out above key prior resistance levels, including the 1.3000 figure (also around the 50-day moving average) and the 1.3150 level. The pair has also risen above the rough head-and-shoulders pattern of late April and early May.

Having now bumped up against and retested major 1.3300 resistance, EUR/USD is now at a critical juncture. A strong breakout above 1.3300 would clearly confirm a bullish trend continuation, with further upside resistance targets around 1.3500 and then 1.3700. If 1.3300 is respected as resistance with a turn back to the downside, the major intermediate support objective remains around the key 1.3000 level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.