Nasdaq, Inc. (NDAQÂ -Â Free Report) reported first-quarter 2018 adjusted earnings per share of $1.24, beating the Zacks Consensus Estimate of $1.18. The bottom line also improved 31% year over year.

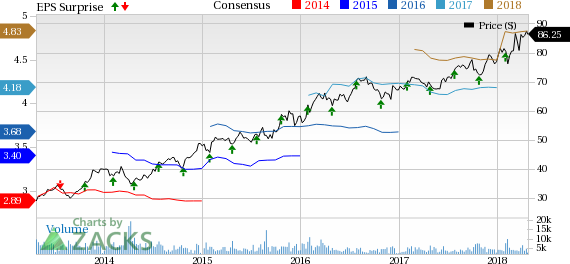

Nasdaq, Inc. Price, Consensus and EPS Surprise

Nasdaq, Inc. Price, Consensus and EPS Surprise | Nasdaq, Inc. Quote

Improved revenues, higher volumes, lower tax incidence and a solid market share aided this upside. The company witnessed revenue improvement across all its segments.

Performance in Detail

Nasdaq’s revenues recorded $666 million, improving 15% year over year. The top line surpassed the Zacks Consensus Estimate of $644 million, primarily owing to 9% organic growth, a $17-million favorable impact on the back of changes in forex rates and a $15-million impact from acquisitions.

Adjusted operating expenses were $353 million in the reported quarter, up 15% from the year-ago quarter. This includes a $19-million increase from acquisitions, an $18-million organic expense rise and a $10-million unfavorable impact from the changes in foreign exchange rates.

Nasdaq projects 2018 non-GAAP operating expense in the range of $1.295-$1.335 billion, down from the earlier guided range of $1.375-$1.415 billion. This primarily reflects the closing of the divestitures of the Public Relations Solutions and Digital Media Services businesses in April.

Segment wise, net revenues at Market Services increased 14.7% from the year-ago quarter to $250 million. This upside was driven by improved revenues from equity derivatives, cash equity trading, fixed income and commodities trading plus clearing and trade management services.

Revenues at Corporate Services grew 7.5% year over year to $172 million, mainly owing to a rise in Corporate Solutions revenues and Listings Services revenues.

Information Services revenues rose 26.1% year over year to $174 million. Higher revenues at Data Products as well as Index Licensing and Services drove the upside.