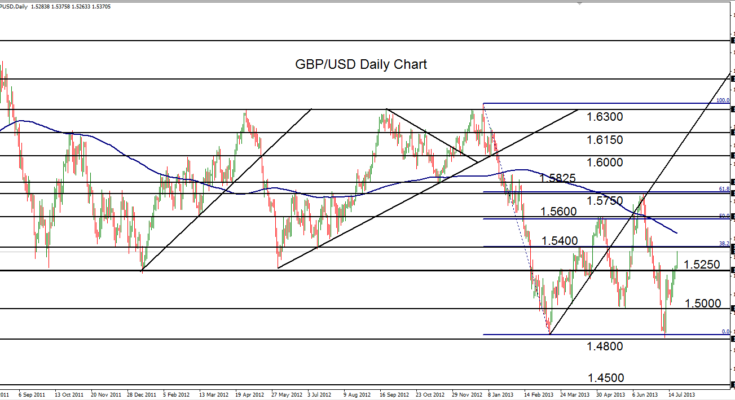

July 22, 2013 – GBP/USD (daily chart) has continued its rise of the past two weeks from the double-bottom low just above 1.4800 to approach major resistance around the 1.5400 level. In the process of the recent advance, the currency pair has broken out above key prior resistance levels, including the 1.5000 figure and 1.5250.

The 1.5400 area is both an important support/resistance level that has served as a turning point several times in the past, as well as the 38.2% Fibonacci retracement of the plunge that occurred from the high above 1.6300 in the beginning of the year down to the low above 1.4800 in mid-March.

Having risen off a double-bottom pattern that retested that 1.4800-area low two weeks ago, price is currently entrenched in an upside correction within an overall bearish trend. If the pair is able to stay below 1.5400 resistance with a subsequent turn back to the downside, the downtrend may seek a continuation with the key objective once again around the noted 1.4800 support level. If there is a breakout above 1.5400, further upside resistance on the current bullish correction resides firmly at the 1.5600 level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.