Today’s analysis is about AUDUSD and its daily and 4h time progress.

We can see that the Aussie is trading in a bigger three-wave correction , since November of 2015 when a higher degree impulsive wave III had ended. The current choppy and overlapping price activity is now labeled as an ongoing corrective wave IV, that can be trading in the final stages. We can see sub-waves A and B already completed, which means the current bullish sharp movement is sub-wave C, that can end near the Fibonacci ratio of 50.0 and near previous swing high at 0.8161 level. From the mentioned region, a new reversal lower could come in play.

AUDUSD, Daily

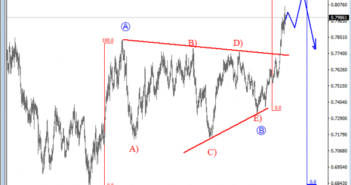

On the 4h chart, we have a closer look of sub-wave C. We know that wave C is a motive wave, which means it must have a five wave structure. We can see three of those five needed sub-waves completed, which means minor wave 4) can now be in action. Wave four is a temporary corrective wave, which means a minimum three wave reversal can be in progress with a potential support zone coming in at 0.7880-0.7900 area. From there a new push higher into sub-wave 5) of C can follow.

AUDUSD, 4H