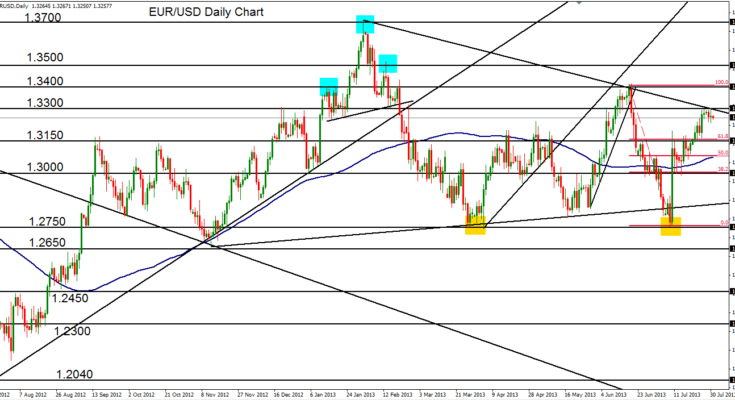

July 31, 2013 – EUR/USD (daily chart) has stalled and pulled back slightly after having hit major resistance around the key 1.3300 level late last week. Currently consolidating just under this level, the currency pair has settled at an important juncture. The current bullish leg that launched from the double-bottom low around 1.2750 three weeks ago could either be in a temporary holding pattern that represents just a minor pullback within the latest short-term uptrend, or it could be the beginning of a new bearish leg.

In the event of the former scenario, a breakout above 1.3300 would confirm a continuation, with strong further resistance immediately to the upside around the key 1.3400 level. In contrast, a bearish bias would be indicated on a breakdown below 1.3150 support, which would potentially lead the way back down towards 1.3000 and the 1.2750 double-bottom low once again. In either case, the longer-term technical outlook is skewed to the downside, with 1.2750 serving as the pivotal level to watch for further potential euro declines against the dollar.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.