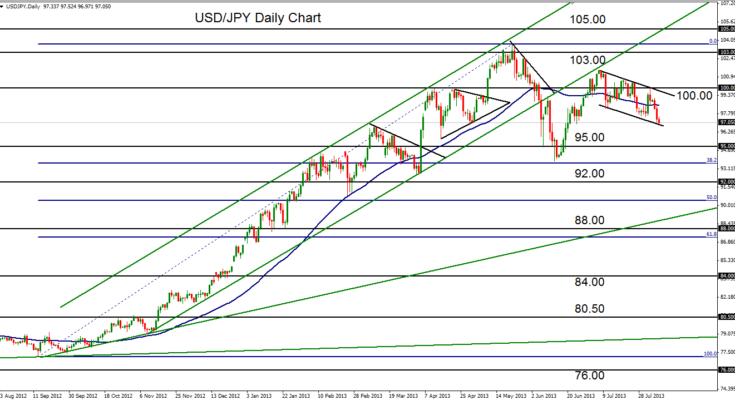

August 7, 2013 – USD/JPY (daily chart) has continued its gradual downside correction within a clear parallel descending channel. This extended channel has currently brought the pair down below the 97.00 level, significantly lower than the intermediate high around 101.50 that was established one month ago. This corrective decline has formed a trading range consolidation that follows a steep and prolonged trend of dollar strength and yen weakness that extended from a low around 77.00 in September 2012 to a high at 103.70 in May of this year.

The current bearish leg could soon breakdown below the channel, extending and accelerating the correction, and reach down towards key support levels around 95.00 and then towards a retest of June’s 93.77 low. With the longer-term directional bias still to the upside, however, the major bullish event to watch for would be a breakout above the upper border of the channel and the key 100.00 level, which would potentially target a bullish trend continuation and upside objectives once again around 103.00 and 105.00.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.