The dollar was the main loser on the back of the Fed’s decision to maintain the current pace of asset purchases, wanting to see further evidence of a sustainable recovery before tapering. We’ve seen more than our fair share of false dawns since the Fed started quantitative easing late 2008 and the statement made clear that they want to be sure that the recovery is on a solid footing before they start to step back.

The main winner on the majors was the kiwi, helped by better  data, but up nearly 8% over the past 2 weeks. Emerging market currencies have also pushed ahead, including the Indonesian Rupiah and the India Rupee. For the dollar, this means that we are again set for a period of greater sensitivity to data, as the market continues in the vein of trying to determine when the Fed will move.

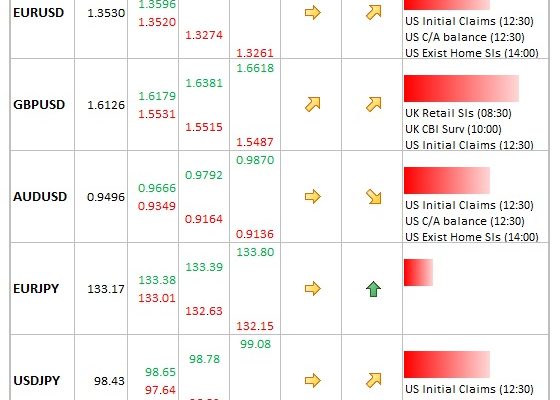

Data/Event Risks

USD: Bernanke made it clear that tapering remains dependent on the flow of incoming data and the underlying resilience of the economy. Today’s data is not major for the dollar, unless we see an outlier in the claims release. Last week saw a dip to 292k, but one-off factors appeared to be pushing the data artificially lower.

GBP:Â Retail sales data of key interest, with sales seen at 0.0% after 1.1% gain in the previous month. Sterling already feeling confident and stronger sales data would add to the perception that the Bank of England will have to raise rates earlier than they anticipated in the August inflation report and implied by their forward guidance.

Latest FX News

JPY:Â On the majors, the smallest move post-Fed has been seen on USDJPY, just 0.4% lower since the Fed decision. The yen has weakened during the Asia session, back above the 98.40 level towards the European open. The trade data was better than expected; the adjusted balance at JPY -791 bln.

GBP:Â Pushing through the 1.60 level in the wake of the Fed decision, following through the more bullish tone seen in the wake of the MPC minutes earlier in the day.

NZD:Â The kiwi has been the star performer in the wake of the Fed decision, helped by slightly better than expected GDP data, which showed the headline rate rising 2.5%, with the previous quarter also revised higher. Kiwi has risen 9 of the past 10 sessions, pushing above 0.84 in late Asia trade.

Further reading:

EUR/USD at 7 month high, above uptrend resistance after Fed surprise – can it continue?

Fed’s decision