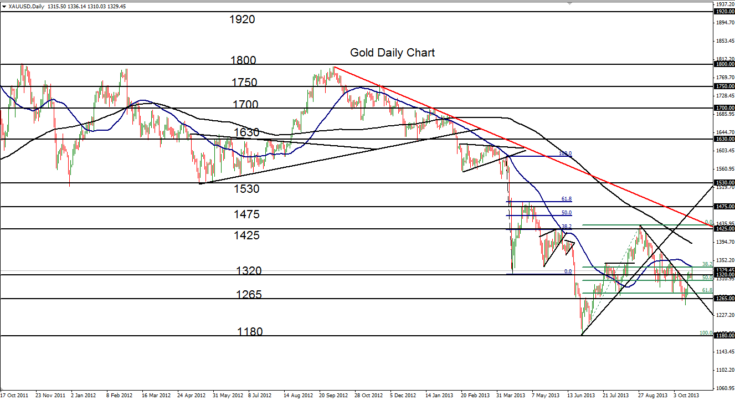

October 22, 2013 – Gold (daily chart) pushed higher on the delayed release of the U.S. non-farm payrolls report released on Tuesday morning. This advance furthers the climb from the 1250-1265 support area last week that broke out above a key downtrend resistance line extending from the late August 1433 high. This price action occurs within the context of a 1-year plunging downtrend that has been in place since the October 2012 highs near 1800. A large upside correction of this downtrend occurred in July and August from the long-term low at 1180, but failed in late August at the noted 1433 high and began to fall once again.

Currently, having broken out above the downtrend resistance line and reached up to the 50-day moving average, gold could be poised to stage another recovery attempt. Further upside momentum that moves price above the 50-day moving average could target a key upside resistance objective at 1425. Downside support continues to reside around the 1265 level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.