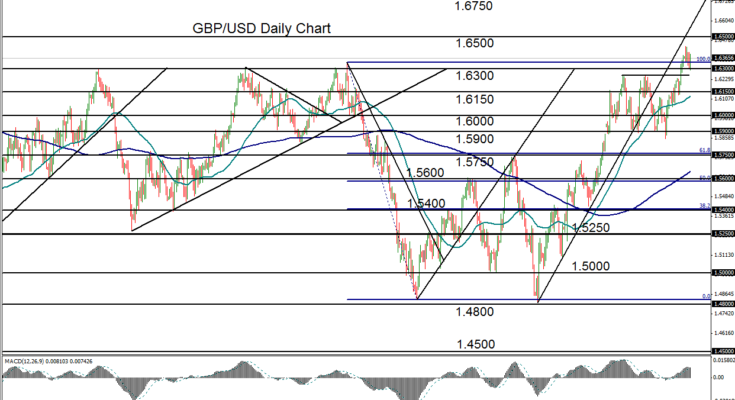

December 6, 2013 – GBP/USD (daily chart) has thus far sustained its recent gains after having made a major breakout in late November above several key resistance levels, including 1.6260 and the major 1.6300 level, disrupting the trading range that had been in place since mid-September. That trading range resided roughly between 1.6260 resistance to the upside and 1.5900-area support to the downside, and occurred in the midst of a long and steep bullish trend extending back to July’s 1.4800-area low.

The recent range breakout above the 1.6260-1.6300 resistance zone tentatively confirmed a continuation of the bullish trend and put the pair on track to target the 1.6500 and 1.6750 resistance levels to the upside. The latter part of this past week saw the pair pullback in a flag-like pattern down to key support around the 1.6300 level after hitting a high of 1.6441 early in the week. Major support should continue to reside around the 1.6260-1.6300 prior resistance zone as the pair consolidates further within the flag pattern and potentially prepares for a pattern breakout towards the noted resistance objectives.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.