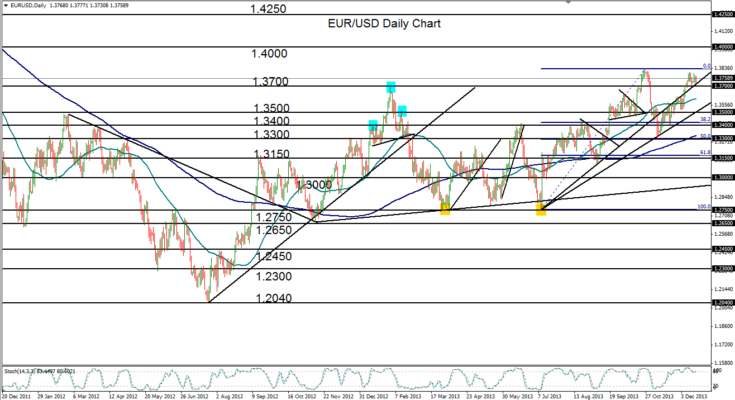

December 18, 2013 – EUR/USD (daily chart) has maintained its month-long ascent that has approached 1.3830, which was close to a two-year high established in late October.

The pair has spent the better part of 2013 within a general trading range consolidation between 1.2750 support to the downside and 1.3700 resistance to the upside. For much of the first half of the year, the currency pair wallowed in the lower half of this range. Only in July did it begin a substantial climb that was to hit the noted long-term high at 1.3830 by late October. From that high, the pair plunged down to a low around the 1.3300 support level in early November, which also happened to be the key 50% Fibonacci retracement level of the bullish run from 1.2750 up to 1.3830. The pair then abruptly rebounded from 1.3300 to begin gradually grinding its way higher. Early December saw a re-break above the 1.3700 level to target the noted 1.3830 high once again.

Currently, EUR/USD has approached year-end having maintained its gains thus far and continues to carry a significant bullish bias, pullbacks notwithstanding. Price is currently well above its 50-day moving average which is, in turn, well above its 200-day moving average – a significant bullish indication. To the upside, the major price objective resides at the 1.4000 psychological resistance level. Any move above that level should begin targeting 1.4250, a key historical support/resistance level. On any further pullback of the current uptrend, short-term support within the bullish trend resides around 1.3700 and 1.3600.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.