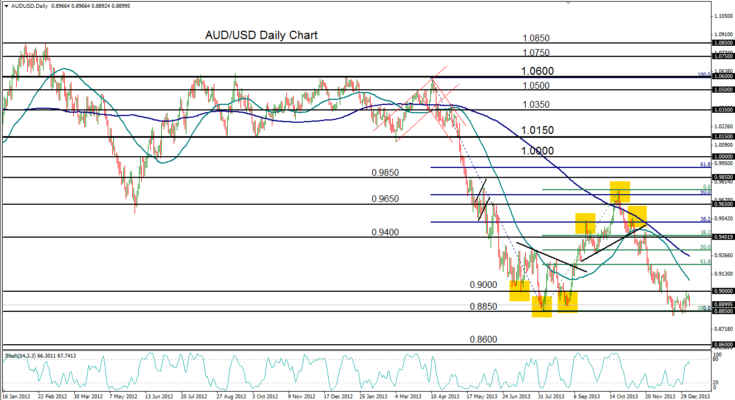

January 7, 2014 – AUD/USD (daily chart) has maintained its bearish bias into 2014 as the currency pair sits close to its three-year low of 0.8818 that was established just weeks ago in mid-December. That long-term low was less than 30 points below the previous multi-year low of 0.8846 that was established recently, in August of 2013. Since the December low, price action has stalled in a tight consolidation. A slight rebound attempt to move above key resistance at 0.9000 in the very beginning of the year failed to follow through.

The current chart pattern, which closely resembles an inverted flag formation, is showing indications of potentially becoming a downside continuation pattern. In the event that this role is fulfilled, a breakdown below the noted 0.8818 three-year low would confirm a continuation of the sharp bearish trend that has been in place since April of 2013. The next major downside price target in this case resides around the 0.8600 support level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.