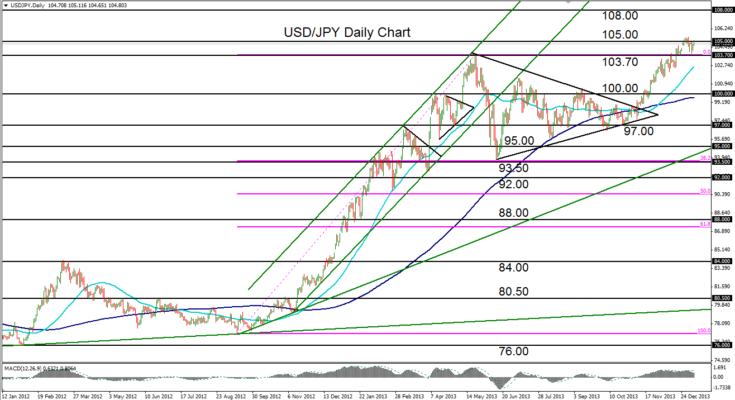

January 8, 2014 – USD/JPY (daily chart) is currently advancing very close to its new 5-year high of 105.43, which was just established a few days ago, in the very beginning of the year. That high occurred in the midst of a strong and steady bullish trend that has been in place since the currency pair broke out above its previous triangle consolidation in November, extending the sharp uptrend that has been in place since September 2012.

The past few months of this yen-weakening run have seen USD/JPY advance to break out above several key price levels, including the 100.00 psychological level and the 103.70 previous long-term high (May 2013). 105.00 had been the former upside price target, and was just reached in late December. After having just made a shallow pullback, the pair appears poised to advance even further. On a breakout above the noted 105.43 high, a major upside resistance target resides around the important 108.00 level. Downside support tentatively continues to reside around the 103.70 price region.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.