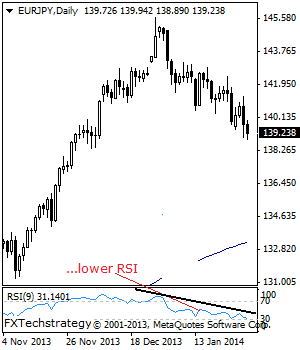

The cross remains weak and vulnerable as long as it holds below the 142.41 level. With a follow through lower on the back of its Wednesday losses seen, further weakness is expected in the days ahead towards the 138.48 level, its .50 Fib Ret (its 131.21-145.68 rally).

Further down, support comes in at the 138.00 level, its psycho level where a violation will aim at the 137.50 level. A cut through that level will open the door for a run at the 137.00 level and then the 136.76 level, its .618 Fib Ret.

Its daily RSI is bearish and pointing lower supporting this view. On the other hand, resistance resides at the 141.27 level, its Jan 29 2014 low followed by the 142.41 level, its Jan 23 2014 low.

A violation if seen will target the 142.90 level, its Jan 16’2014 high and then the 143.50 level. All in all, the cross remains biased to the downside on correction.

Guest post by FX Tech Strategy