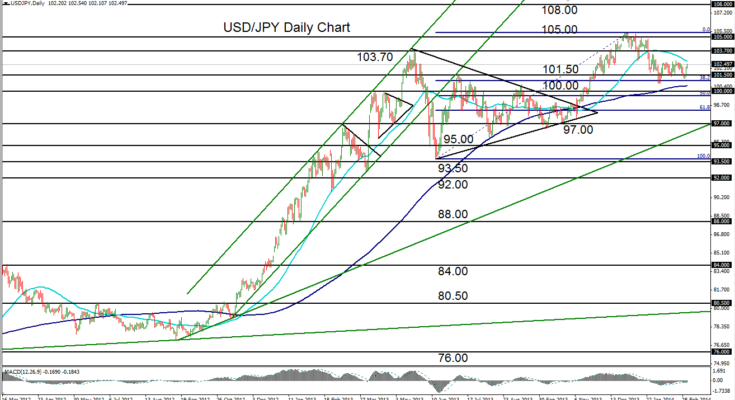

March 5, 2014 – USD/JPY (daily chart) has advanced during the first half of this week but continues to consolidate within a tight trading range that has been in place for the past month. This consolidation is highlighted by the fact that the currency pair has been oscillating squarely between its 50-day and 200-day moving averages since late January, suggesting a non-trending, directional indecision. The current trading range occurs after the pair hit a five-year high of 105.43 in the very beginning of the year to cap off a steep bullish trend, before pulling back to a low of 100.75 in early February.

Since that pullback to 100.75, the pair has been struggling to find direction. Currently having risen to approach both its range high around 102.80 as well as the noted 50-day moving average to the upside, USD/JPY could soon rebound and emerge from the trading range to seek its recent highs once again. A breakout above 102.80 would provide indication of this rebound, with further upside resistance targets around 103.70 and then 105.00. Downside support continues to reside around the noted 100.75 range low and the 200-day moving average to the downside.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.