Hello traders! I hope that you had a great and relaxing weekend as markets can turn up to be very interesting this week after the strong sell-off in US stocks on Friday, after the US jobs report. We see markets in risk-off mode, but interesting.

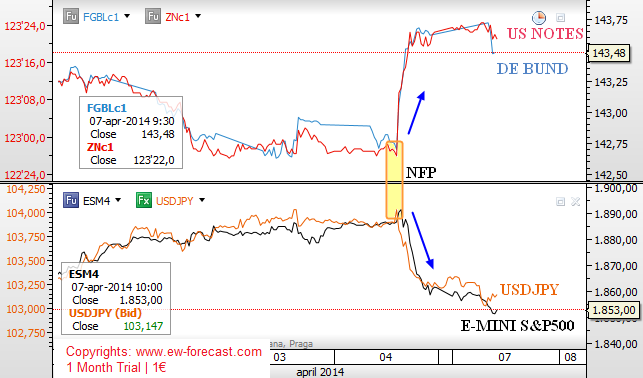

Despite a strong move down in stocks, the USD did not move much to the upside. We have seen a strong upward reaction on US Notes and German Bunds while stocks were falling. This was ideal for lower USDJPY and Yen crosses.

Market Correlation 30min

Now the question going through your head right now is “will this risk-off atmosphere stay here or not?â€

Well, I believe in the technical picture of market swings. So if we take a look at the S&P then we can see five waves to the downside from 1892 down to the Mar 30 gap. The decline is impulsive, thus it’s part of an ongoing weakness, so we will be looking for more weakness after any short-term three wave rally.

This three wave rally may occur soon if we respect gap levels that usual react as reversal zone.

E-mini S&P500 1h

So if we respect the bearish picture of the S&P then we may also consider a bearish continuation on USDJPY and even take advantage of intermarket analysis. A decline there has also unfolded in impulsive fashion, so we may consider shorts with our members in the next 24-48 trading hours.