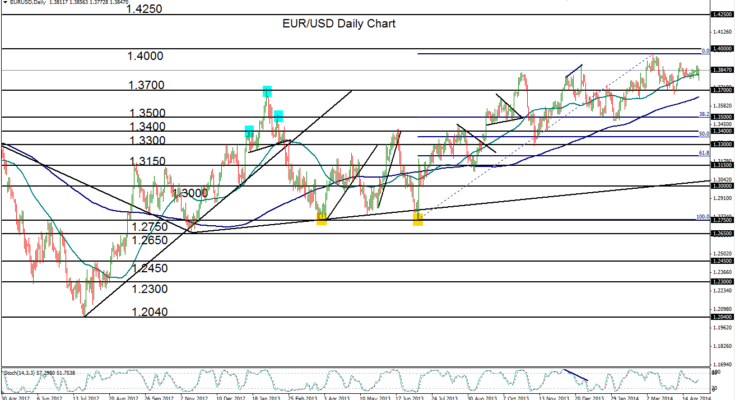

April 30, 2014 – EUR/USD (daily chart) has continued to consolidate around its 50-day moving average, just under its two-year high of 1.3965 that was established only a month-and-a-half ago in mid-March. This consolidation occurs within the context of a nine-month bullish trend extending back to the July 2013 double-bottom low around 1.2750. The course of this bullish trend has seen consistently higher highs and higher lows that have thus far culminated in the noted March 1.3965 high, just short of its original 1.4000 upside target. This nine-month advance represents a rise of close to 10%.

After the 1.3965 high was reached in March, the currency pair pulled back to major support around the 1.3700 level before rebounding into the current consolidation. With the 50-day and 200-day moving averages in clear separation and continuing to rise, the outlook for EUR/USD remains bullish in line with the current uptrend. With strong downside support continuing to reside around the key 1.3700 level, the primary upside target remains at the 1.4000 level. Any break above 1.4000 would confirm a continuation of the entrenched bullish trend, with a key higher target at 1.4250.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.