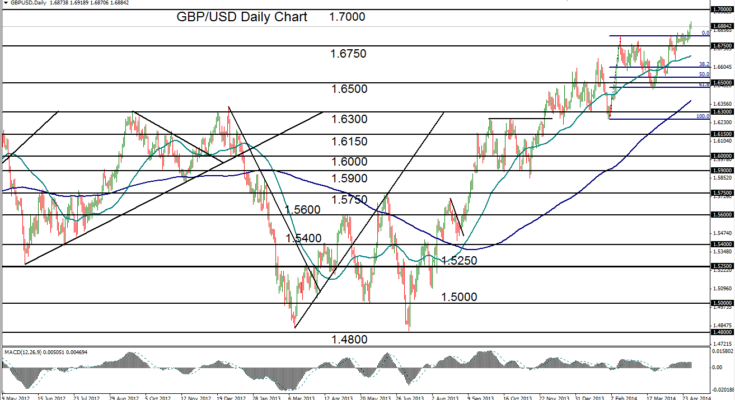

May 1, 2014 – GBP/USD (daily chart) has risen to establish a new four-year high at 1.6919 in early Thursday trading, confirming a continuation of the sharp bullish trend that has been in place for the past nine months since the 1.4800-area low in July of 2013. This steep climb represents a full 14% advance in less than a year, highlighting sterling’s prominent strength in recent months. The last major pullback within this robust uptrend occurred from late February to late March, when the currency pair made a 61.8% retracement of its last bullish run to a level just below 1.6500 support before making a strong rebound.

Currently well above both its key 50-day and 200-day moving averages, GBP/USD’s sharp trajectory has placed it in position for another pullback before a potential resumption of the entrenched bullish trend. Shallow downside support on this potential pullback resides around the 1.6750 level and then the 50-day moving average. To the upside, a continuation of the sharp uptrend should look next to target the nearby 1.7000 resistance level, where the currency pair last peaked in August of 2009.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.