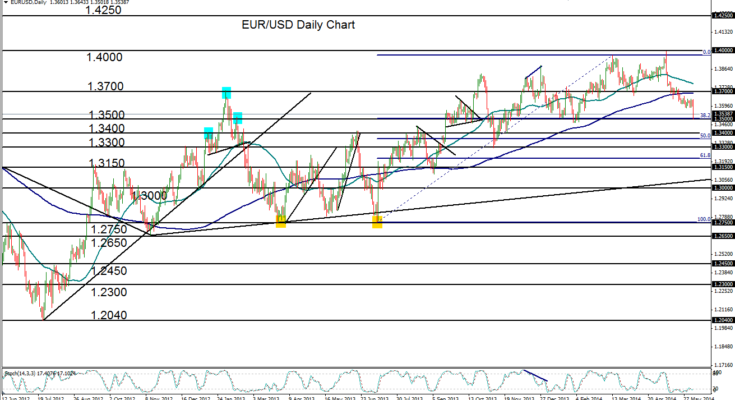

June 5, 2014 – EUR/USD (daily chart) has continued its recent plunge on Thursday by dropping swiftly to its key support target at 1.3500, as mentioned in our previous analysis. This plunge is an extension of the major decline within the past four weeks that brought the currency pair down from its two-and-a-half-year high of 1.3993 in early May. In the process of this decline, EUR/USD broke down below its 50-day and 200-day moving averages, as well as the 1.3700 support level, substantially disrupting the bullish trend that had been in place for the prior 10 months.

Having dropped by around 3.5% within a month down to major support at 1.3500, which is also around the 38% Fibonacci retracement of the noted 10-month uptrend, EUR/USD has reached down to a critical juncture. In the event of a further breakdown below 1.3500, a lower downside support target resides around the 1.3300 level, last hit in November 2013. With any rebound and recovery from the current support, the key bullish objective remains at the noted 1.4000 level for a potential uptrend resumption.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.