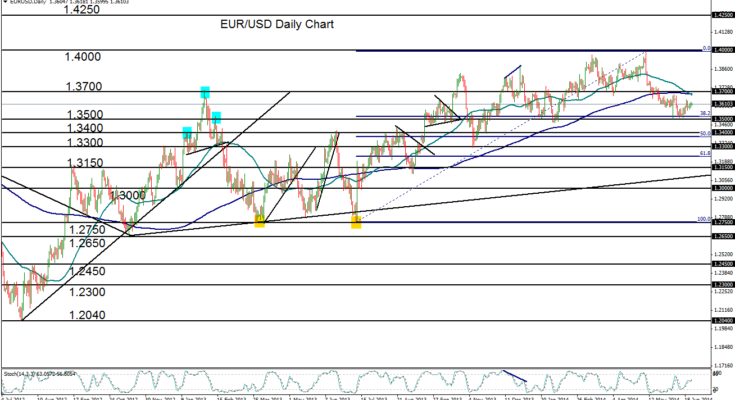

June 25, 2014 – EUR/USD (daily chart) has rebounded from key 1.3500 support after having made a 3.5% downside retracement from its multi-year high of 1.3993 that was reached in early May. The past seven weeks has generally seen the currency pair tumble from that high, breaking down below key prior support at 1.3700 as well as the major 50-day and 200-day moving averages. This decline has significantly interrupted the general uptrend that has been in place since July of 2013.

The past three weeks has seen EUR/USD tentatively bottom out at major 1.3500 support and form the current rebound. While this rebound provides some relief for EUR/USD bulls, the overall technical outlook remains somewhat bearish in light of the recent breakdown. The 50-day moving average has begun to make an initial cross below the 200-day moving average, a condition not seen for more than a year, which adds additional weight to the longer-term bearish bias.

Any upside extension of the current rebound should find major resistance around the nearby 1.3700 level. A significant breach of 1.3700 should reverse the bearish thesis, with a further upside target once again around the 1.4000-area highs. To the downside, the key event to watch for would be a breakdown below 1.3500, in which case the major intermediate downside target resides around the 1.3300 support level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.