(Click on image to enlarge)

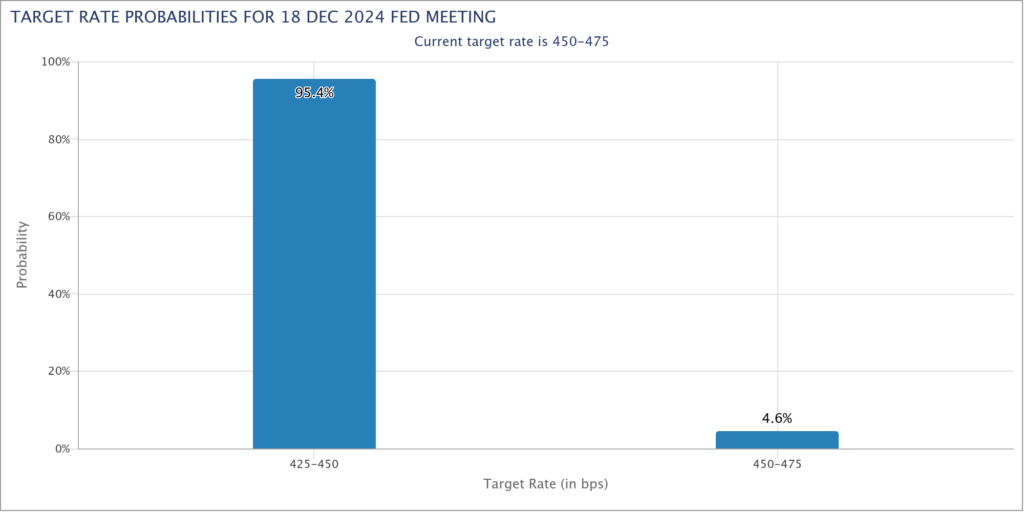

The Fed is going to cut rates a quarter point on Wednesday – but it shouldn’t and it doesn’t seem like it wants to. The stock market is at all time highs, Bitcoin is over $100,000 and inflation remains stubbornly above the Fed’s 2% target. – while correct from a long term perspective IMO – will increase the price of labor and imported goods i.e. are inflationary. [SUBSCRIPTION REQUIRED] thinks cutting would be a mistake because it could ignite a bubble that will later have to be unwound. (Also see Aaron Back, [SUBSCRIPTION REQUIRED], The Wall Street Journal, Friday December 13). Gold and silver as well as their miners seem like obvious plays here and I remain long.(Click on image to enlarge)

The dating app companies – Match () – which owns Tinder and Hinge – and Bumble () – deserve a look here IMO. Tinder has about 10 million paying users and Hinge 1.6 million while Bumble has nearly 3 million. The bottom line is that while all the women on these apps ghost me, this is how many people in the modern world meet members of the opposite sex. The stocks are cheap after being badly beat up over the last three years and I think long term investors will do well buying here. I picked up small positions in both this morning. (Also see Dan Gallagher, [SUBSCRIPTION REQUIRED], The Wall Street Journal, Monday December 16).(Click on image to enlarge)

Lastly, the homebuilders have broken down badly since the beginning of December. I don’t know what the reason is but the charts certainly caught my attention. As a result, I’m quite interested to see what Lennar () has to say when it reports earnings Wednesday afternoon. More By This Author:

More By This Author:

Why Is The Fed Cutting Rates? Value In The Dating App Stocks, Homebuilders Breaking Down