Image Source: I like to assess the performance of the most important sectors and asset classes relative to each other. That helps me interpret what underlying market dynamics may be signaling about the future direction of risk-taking by investors. Here is a look at what three sector ETFs are saying, highlights Michael Gayed, editor of .My charts are all price ratios, showing the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

Image Source: I like to assess the performance of the most important sectors and asset classes relative to each other. That helps me interpret what underlying market dynamics may be signaling about the future direction of risk-taking by investors. Here is a look at what three sector ETFs are saying, highlights Michael Gayed, editor of .My charts are all price ratios, showing the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

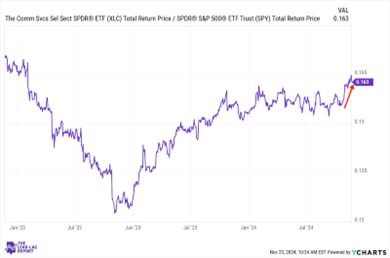

Communication Services Select Sector SPDR Fund (XLC): A Potential Landing Spot

The breakout in this sector continues, and it continues to happen outside the margins of just Meta Platforms Inc. () and Alphabet Inc. (). Traditional telecoms and names such as Netflix Inc. () are trying to follow the lead of utilities in providing leadership in a market where tech is falling behind and cyclicals are turning mixed.If inflation is going to become a future concern, this might end up being a nice landing spot for more conservative investors.

Financials Select Sector SPDR Fund (XLF): Optimism Giving Way to Inflation Concerns

Financials continue to be the standard bearer among the S&P 500 sectors, but the action is starting to turn a little more choppy. Improving lending conditions, an uptick in mergers and acquisitions, and the deregulation theme have all worked in this sector’s favor.However, I believe the possibility of higher inflation in 2025 is starting to weigh on that optimism. Higher-for-longer interest rates and the threat of higher costs will weigh on consumers, and that will spill over to this sector as well.

Energy Select Sector SPDR Fund (XLE): Geopolitics Take Center Stage

Energy sector stocks always provide a balance between global demand and supply/demand dynamics. Currently, however, geopolitical risks are pushing this ratio higher.These often tend to be temporary in nature (and could be this time as well). But there are so many daily flare-ups happening in so many different locations that this could keep crude oil prices elevated for longer.

About the Author

Michael A. Gayed is a portfolio manager and author of five award-winning research papers on market anomalies and investing. He has a BS with a double major in finance and management from NYU Stern School of Business and is a CFA charterholder.Mr. Gayed is the publisher of The Lead-Lag Report, focused on helping investors outperform in all market conditions. It offers a tactical, data-driven approach to investing to achieve long-term success even in the face of uncertainty. With increasing market volatility, it’s essential to understand risk-on/risk-off signals, seize high-yield opportunities, and leverage award-winning research to maximize returns. More By This Author:Technicals, Strong Earnings Still Supportive Of This Bull Run NVDA: In Wake Of Earnings, Keep This Long-Term Trend In MindVertiv: A Data Center Play With Market-Beating Profit Growth

Three Sector ETFs, Three Different Market Stories