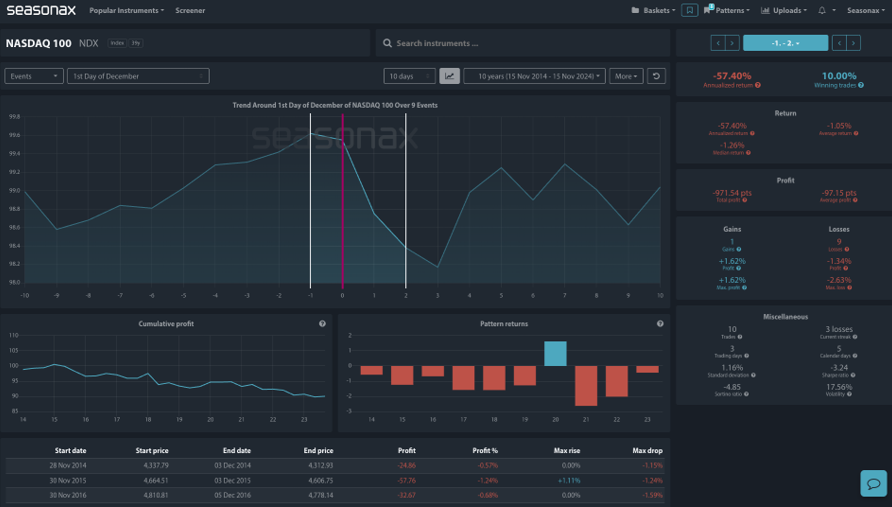

Over the last 10 years the Nasdaq has returned an average of -0.90% over the first 2 days of December. The so called ‘turn on the month effect’ does tend to be positive for stocks, but the Nasdaq bucks this trend around the turn of December showing a 70% losing bias over the last 10 years. Furthermore, if you look at the pattern from the last day of November, you can see that the pattern has an even greater, 90%, losing bias over the last 10 years with an average drop of 1.26%. In 2021, and 2022, the falls were over 2%. So, as we approach the turn of the month at the end of this week will see selling in the Nasdaq as we have done in previous years?

Furthermore, if you look at the pattern from the last day of November, you can see that the pattern has an even greater, 90%, losing bias over the last 10 years with an average drop of 1.26%. In 2021, and 2022, the falls were over 2%. So, as we approach the turn of the month at the end of this week will see selling in the Nasdaq as we have done in previous years? Trade risks

Trade risks

The main risk is from the fact that seasonal patterns, no matter how strong, do not necessarily repeat themselves each and every year. Video Length: 00:02:17More By This Author:

Does The Market Say No To The Nasdaq For The Start Of December?