Image Source:

Image Source:

The market’s response to fund manager Scott Bessent’s selection as the next U.S. Treasury Secretary has dominated Asian trade. Asian markets are trading mostly higher on Monday, buoyed by the positive performance on Wall Street on Friday, with significant gains in Japan, Indonesia, and South Korea. The general investor sentiment is satisfaction that Bessant is a well-known candidate rather than an unknown one. Bessent’s fiscally conservative rhetoric has pushed 10-year Treasury yields lower, but it is unclear if he will be able to reduce deficits while extending tax cuts that are about to expire. He has mentioned reducing spending and boosting economic growth in order to address the massive amount of U.S. debt and bring the budget deficit down to 3% of GDP. Critics would point out that the United States has seen robust growth for a long time and that the deficit has only become bigger, and that the amount of discretionary spending that may be reduced is insignificant when compared to necessities like Medicare and defence. Though the tariff levels stated, like 60% on Chinese goods, were “maximalist” stances that might be softened, Bessent has advocated for tariffs and suggested that they be “layered in gradually.” In an apparent attempt to counter President-elect Donald Trump’s prior experiment with devaluation as a means of reducing trade deficits, he has also expressed support for a strong dollar. With markets fully priced for a quarter-point cut from the ECB next month and implying a nearly 58% possibility that it will loosen by a full 50 basis points on December 12, the dollar has been supported by the difference in economic performance between the U.S. and Europe. The likelihood of a rate cut in December has decreased from 70% a month ago to 52%, indicating that bets on the Fed have shifted in the opposite direction. By the end of 2025, the market has only factored in 65 basis points of Fed easing, whereas the ECB has factored in 154 basis points.This week’s key events include U.S. inflation data that will further shape Federal Reserve rate expectations and China’s official PMIs. While trading may slow ahead of the Thanksgiving holiday, there is a busy U.S. data calendar, including consumer confidence, new home sales, and the FOMC minutes. Significant releases also include GDP, personal income, and the Fed’s preferred inflation gauge, the core PCE price index. Reactions to President-elect Trump’s Treasury secretary nomination will be monitored. The RBNZ is widely expected to cut rates, and China’s central bank is likely to hold its medium-term lending facility rate. Japanese data will provide a broad snapshot of the economy, while the euro zone and UK have a relatively light schedule. Australia’s CPI and Canada’s GDP are also due.

Overnight Newswire Updates of Note

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut (1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

CFTC Data As Of 22/11/24

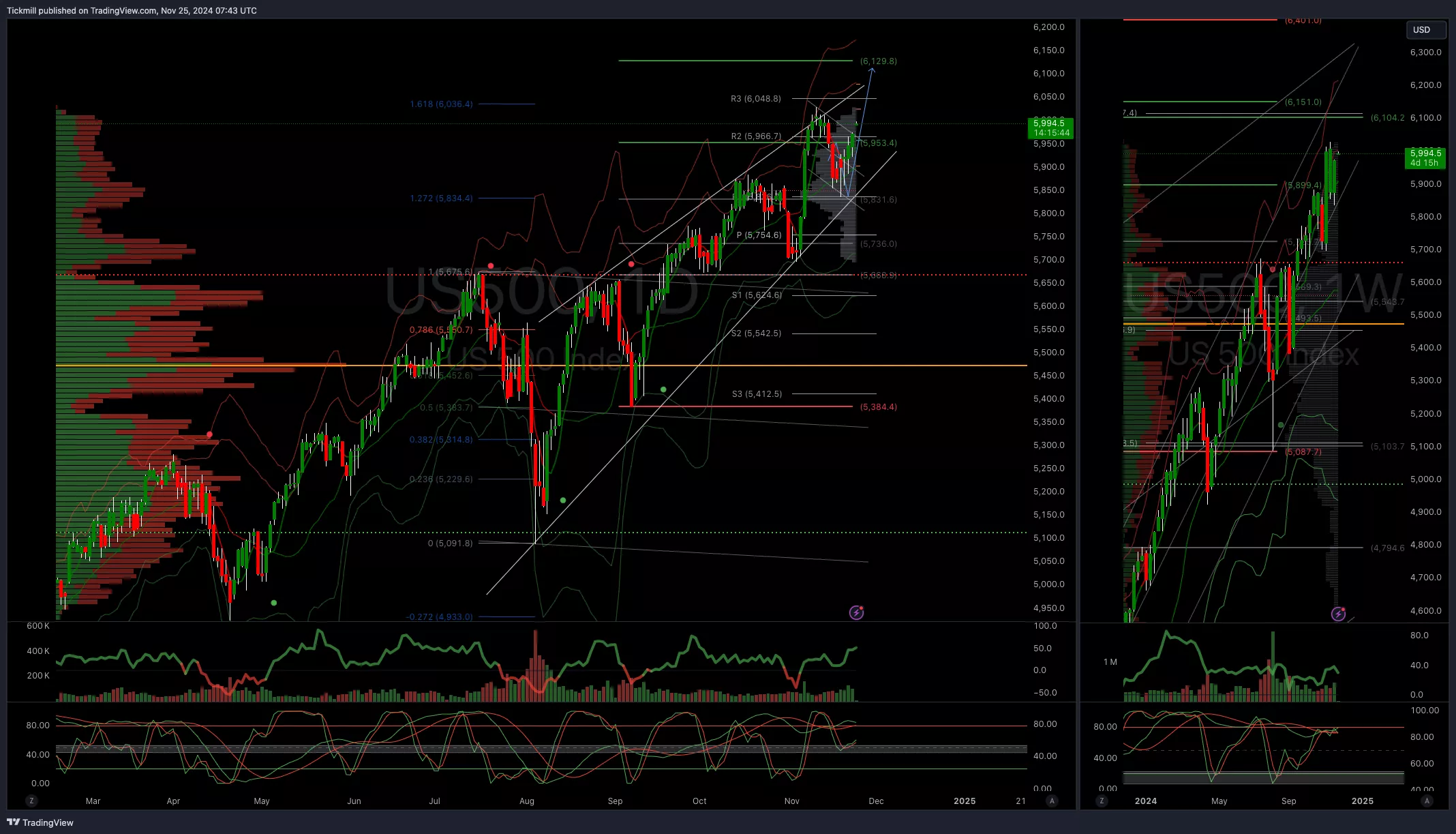

Technical & Trade ViewsSP500 Bullish Above Bearish Below 5960

(Click on image to enlarge) EURUSD Bullish Above Bearish Below 1.05

EURUSD Bullish Above Bearish Below 1.05

(Click on image to enlarge) GBPUSD Bullish Above Bearish Below 1.2750

GBPUSD Bullish Above Bearish Below 1.2750

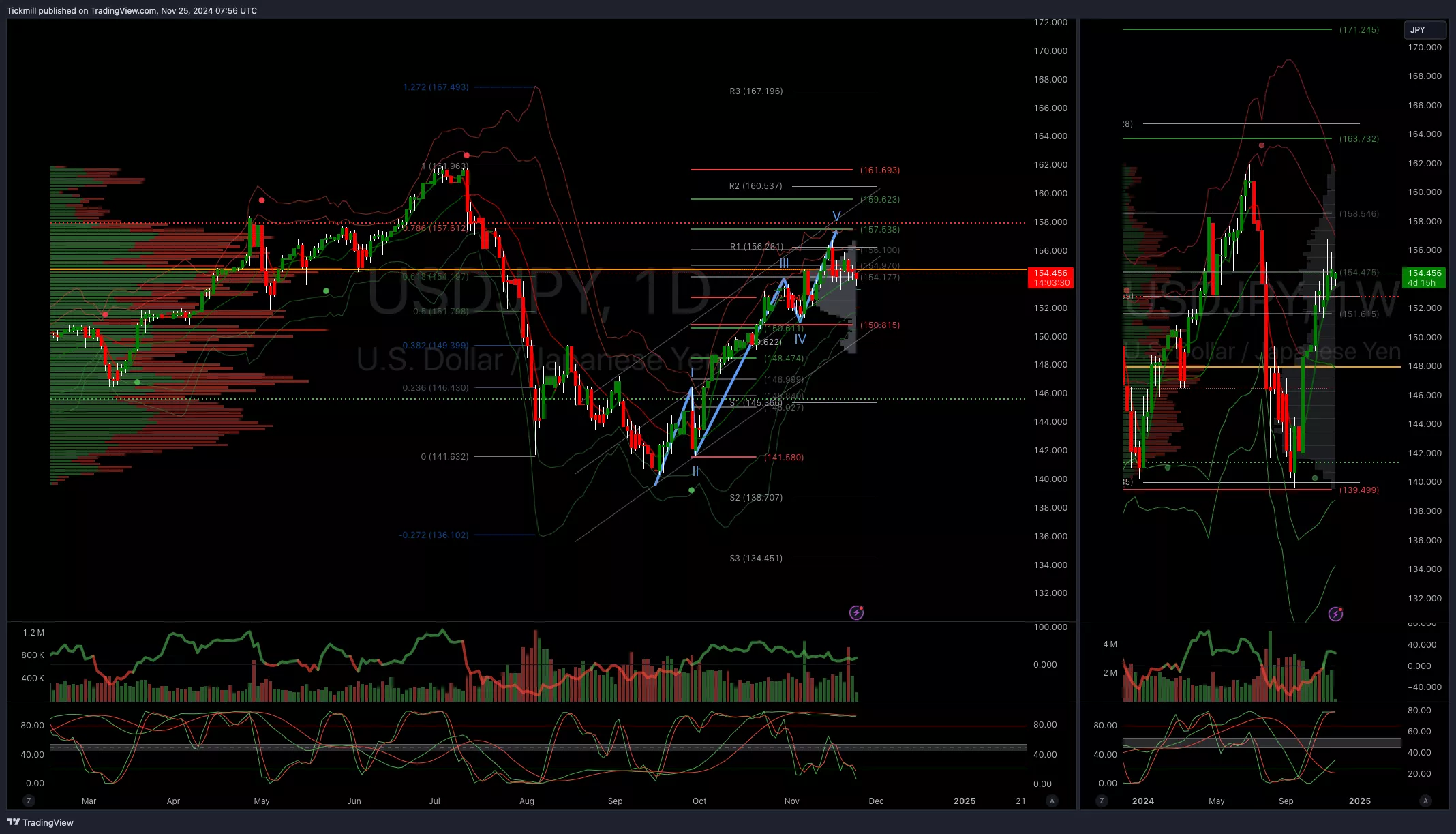

(Click on image to enlarge) USDJPY Bullish Above Bearish Below 154

USDJPY Bullish Above Bearish Below 154

(Click on image to enlarge) XAUUSD Bullish Above Bearish Below 2600

XAUUSD Bullish Above Bearish Below 2600

(Click on image to enlarge) BTCUSD Bullish Above Bearish Below 93000

BTCUSD Bullish Above Bearish Below 93000

(Click on image to enlarge) More By This Author:FTSE Bid On Downbeat Data As Traders Bet On BoE Rate CutsDaily Market Outlook – Friday, Nov. 22FTSE Posts Gains As Manufacturer Outlook Points To Green Shoots

More By This Author:FTSE Bid On Downbeat Data As Traders Bet On BoE Rate CutsDaily Market Outlook – Friday, Nov. 22FTSE Posts Gains As Manufacturer Outlook Points To Green Shoots