Image Source: James Smith has something to shout about this week as he tackles the biggest economic questions for 2025: is inflation merely lagging the surveys, or should we be far more worried? That, and next week’s economic news today, in this week’s THINK Quietly. Sorry, THINK Aloud.As an economist, it’s always a bit of a relief when another profession takes the heat for dodgy predictions. Forgive me for feeling a little bit of schadenfreude after the US pollsters were claiming the presidential election was on a knife-edge. But I can sympathise. We often face the same issue in economics. People – or companies – often say one thing and end up doing quite another. Pollsters have the ‘Quiet Trump voters’; we have the ‘Quiet Price Hikers’.Let me explain. Back in 2022, surveys suggested 60% of eurozone retailers were raising prices. Now it’s less than 20%, similar to pre-Covid averages. It’s a very similar picture in the service sector. The Inflation problem solved? Not exactly. The official numbers show services inflation has been stuck at 4% for a year now. And remember, services are the bit of the inflation basket that central bankers supposedly have the most control over. Likewise, data this week showed that negotiated wage growth hit a new high of 5.4%. It wasn’t that long ago that the ECB was citing those figures as critical to the decision-making process. It’s the same story in the US. Surveys have, for some time, suggested firms are becoming more chilled about raising prices. The recent uptick in the monthly core inflation figures says otherwise. As James Knightley explains below, next week’s core PCE deflator – the Fed’s preferred measure of inflation – looks set to come in hotter than officials would like.Here in the UK, our Quiet Price Hikers aren’t even that quiet. Check out the Bank of England’s monthly survey of CFOs. Asked how quickly they expect to hike wages over coming months, the answer has been 4% for some time, a fair bit below what the official figures are telling us. That same survey also asks them for their realised wage growth or what they’re actually doing in practice, and the answer is typically much higher. So here’s the dilemma for central banks: Is inflation simply lagging what the surveys are telling us? Or is there something more worrisome going on? This is perhaps one of the biggest economic questions for 2025.The conundrum isn’t exactly new, nor is it straightforward. As is often the case, the answer is probably somewhere in between. Here in Europe, those stubborn services inflation figures look less troubling when the more volatile stuff like airfares or holidays is taken out. In the US, rents are still doing a lot of the heavy lifting, something the Federal Reserve has signalled it’s less bothered about in the past.Even so, the discrepancy between the surveys and the official data has got central bankers scratching their heads. The Bank of England talks about three inflation scenarios: one where inflation drops naturally, another where firms and consumers clash over incomes, needing higher unemployment to gain full control of inflation, and a worst-case where price and wage behaviours change permanently.The ECB, it seems, has concluded it sits in the first of those categories. Yes, wage growth has jumped again, but volatility was anticipated and most people expect it to trend down from here. And anyway, mounting growth concerns have become more important for the ECB outlook. As for next week’s flash inflation figures, Bert Colijn expects 2.3%. Base effects are pushing inflation up towards year-end before it is expected to move lower again.Over in Fed Towers in Washington, the jury’s out, though maybe the recent uptick in those monthly inflation figures isn’t totally unhelpful. US officials have bigger fish to fry right now, after all. President-elect Trump’s policy proposals are universally seen as hawkish for the Fed.James Knightley thinks that means a pause in the Fed’s cutting cycle is coming; Chair Powell’s recent commentary suggests that too. James expects a cut in December but a slower pace of rate cuts in the new year. And those stickier inflation numbers might just give the Fed the cover it needs to do so without having to discuss the thornier subjects of migration, tariffs and tax cuts.

Image Source: James Smith has something to shout about this week as he tackles the biggest economic questions for 2025: is inflation merely lagging the surveys, or should we be far more worried? That, and next week’s economic news today, in this week’s THINK Quietly. Sorry, THINK Aloud.As an economist, it’s always a bit of a relief when another profession takes the heat for dodgy predictions. Forgive me for feeling a little bit of schadenfreude after the US pollsters were claiming the presidential election was on a knife-edge. But I can sympathise. We often face the same issue in economics. People – or companies – often say one thing and end up doing quite another. Pollsters have the ‘Quiet Trump voters’; we have the ‘Quiet Price Hikers’.Let me explain. Back in 2022, surveys suggested 60% of eurozone retailers were raising prices. Now it’s less than 20%, similar to pre-Covid averages. It’s a very similar picture in the service sector. The Inflation problem solved? Not exactly. The official numbers show services inflation has been stuck at 4% for a year now. And remember, services are the bit of the inflation basket that central bankers supposedly have the most control over. Likewise, data this week showed that negotiated wage growth hit a new high of 5.4%. It wasn’t that long ago that the ECB was citing those figures as critical to the decision-making process. It’s the same story in the US. Surveys have, for some time, suggested firms are becoming more chilled about raising prices. The recent uptick in the monthly core inflation figures says otherwise. As James Knightley explains below, next week’s core PCE deflator – the Fed’s preferred measure of inflation – looks set to come in hotter than officials would like.Here in the UK, our Quiet Price Hikers aren’t even that quiet. Check out the Bank of England’s monthly survey of CFOs. Asked how quickly they expect to hike wages over coming months, the answer has been 4% for some time, a fair bit below what the official figures are telling us. That same survey also asks them for their realised wage growth or what they’re actually doing in practice, and the answer is typically much higher. So here’s the dilemma for central banks: Is inflation simply lagging what the surveys are telling us? Or is there something more worrisome going on? This is perhaps one of the biggest economic questions for 2025.The conundrum isn’t exactly new, nor is it straightforward. As is often the case, the answer is probably somewhere in between. Here in Europe, those stubborn services inflation figures look less troubling when the more volatile stuff like airfares or holidays is taken out. In the US, rents are still doing a lot of the heavy lifting, something the Federal Reserve has signalled it’s less bothered about in the past.Even so, the discrepancy between the surveys and the official data has got central bankers scratching their heads. The Bank of England talks about three inflation scenarios: one where inflation drops naturally, another where firms and consumers clash over incomes, needing higher unemployment to gain full control of inflation, and a worst-case where price and wage behaviours change permanently.The ECB, it seems, has concluded it sits in the first of those categories. Yes, wage growth has jumped again, but volatility was anticipated and most people expect it to trend down from here. And anyway, mounting growth concerns have become more important for the ECB outlook. As for next week’s flash inflation figures, Bert Colijn expects 2.3%. Base effects are pushing inflation up towards year-end before it is expected to move lower again.Over in Fed Towers in Washington, the jury’s out, though maybe the recent uptick in those monthly inflation figures isn’t totally unhelpful. US officials have bigger fish to fry right now, after all. President-elect Trump’s policy proposals are universally seen as hawkish for the Fed.James Knightley thinks that means a pause in the Fed’s cutting cycle is coming; Chair Powell’s recent commentary suggests that too. James expects a cut in December but a slower pace of rate cuts in the new year. And those stickier inflation numbers might just give the Fed the cover it needs to do so without having to discuss the thornier subjects of migration, tariffs and tax cuts.

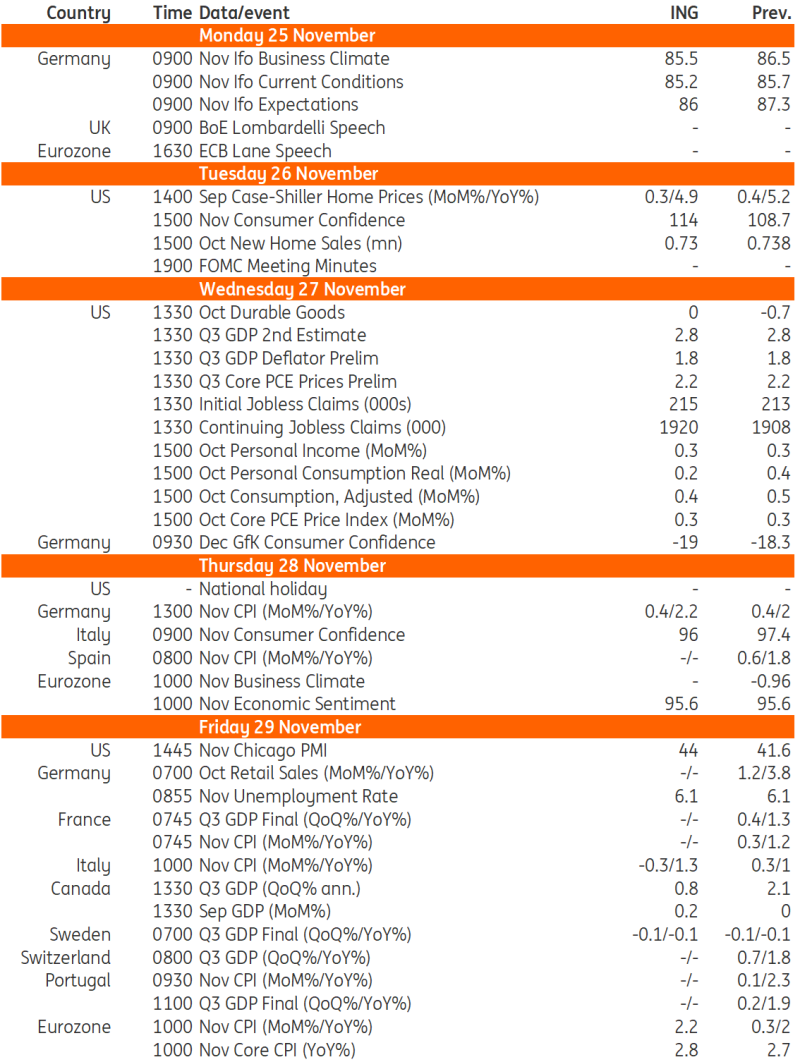

THINK Ahead in developed markets

United States (James Knightley)

Eurozone (Bert Colijn)

Canada (James Knightley)

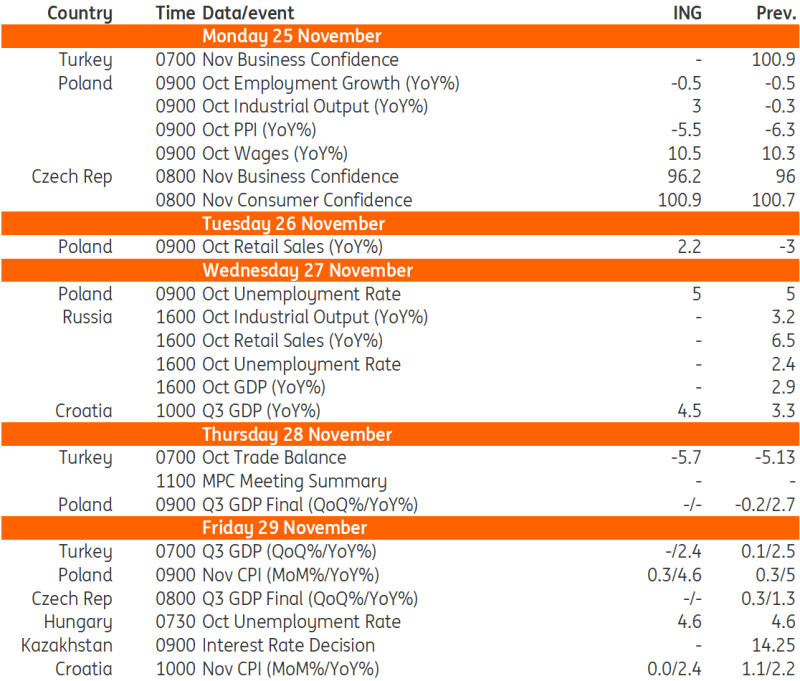

THINK Ahead for Central and Eastern Europe

Poland (Adam Antoniak)

Czech Republic (David Havrlant)

Turkey (Muhammet Mercan)

Key events in developed markets next week

Source: Refinitiv, ING

Source: Refinitiv, ING

Key events in EMEA next week

Source: Refinitiv, INGMore By This Author:Hungarian Wage Growth Moderates But Remains Strong Eurozone PMI Sounds The Alarm About Growth Once More FX Daily: Big PMI Day For The Euro

Source: Refinitiv, INGMore By This Author:Hungarian Wage Growth Moderates But Remains Strong Eurozone PMI Sounds The Alarm About Growth Once More FX Daily: Big PMI Day For The Euro