Image Source: NVIDIA Corporation ( – ) has delivered better-than-expected sales and earnings in its latest quarterly report as it continues to progress banking on the incessant demand for its artificial intelligence (AI) chips. Amid the recent data center success, NVIDIA stock remains attractively priced, exhibits a bullish trend, and is fundamentally strong, making it a good buy for investors. Let’s see in detail –

Image Source: NVIDIA Corporation ( – ) has delivered better-than-expected sales and earnings in its latest quarterly report as it continues to progress banking on the incessant demand for its artificial intelligence (AI) chips. Amid the recent data center success, NVIDIA stock remains attractively priced, exhibits a bullish trend, and is fundamentally strong, making it a good buy for investors. Let’s see in detail –

NVIDIA Stock – Positive Q3 Data Center Result & Outlook

NVIDIA recently reported fiscal third-quarter results, in which its revenues jumped 94% to $35.1 billion from the same period a year ago. Earnings per share (EPS) came in at $0.81, up 103% from a year ago.The company’s revenues exceeded Wall Street expectations due to record gains from the data center business. Third-quarter revenues from the data center came in at $30.8 billion, up 112% from a year ago. CEO Jensen Huang admitted that demand for its Superchips and related hardware was robust, particularly for its present Hopper chips. Huang expects continued high demand for Hopper chips into next year.The advanced H200 chips will be available in several cloud services, such as Azure, Google Cloud and AWS. Beyond big tech cloud operators, Denmark launched its AI supercomputer driven by H100 Tensor Core graphic processing units (GPUs). The government’s demand for Hopper chips, beyond private companies, fuels NVIDIA’s growing data center business in the information arms race.But it’s not all about Hopper chips, Huang clarified that the demand for the much-awaited next-generation Blackwell chips remains “staggering” for the fourth quarter and next year. Companies like Microsoft Corporation ( – ) and Meta Platforms, Inc. ( – ) will likely adopt the Blackwell chips for higher AI throughput than the current Hopper chips. The Blackwell platform can enhance AI training performance and train large language models cost-effectively.According to SoftBank Corp, NVIDIA’s Blackwell platform will build Japan’s most powerful AI supercomputer. Also, NVIDIA’s Blackwell platform may power Taiwan’s fastest AI supercomputer. Therefore, the data center business will drive NVIDIA’s success and increase its share price, making it an enticing buy.

NVIDIA Stock is Less Pricey Than Its Peers

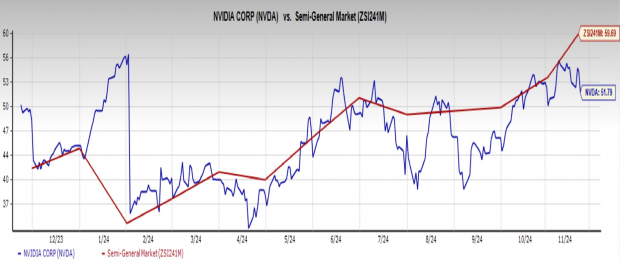

NVIDIA’s strong third-quarter performance comes as no surprise since the company has been delivering promising quarterly results for quite some time. NVIDIA is one of the top performers on the S&P 500 and is the most valuable company.Despite all the success, buying NVIDIA stock as of now will burn a smaller hole in your pocket than its peers. After all, per the price/earnings, the NVDA stock trades at 51.7X forward earnings, less than the industry’s 59.6X forward earnings multiple. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

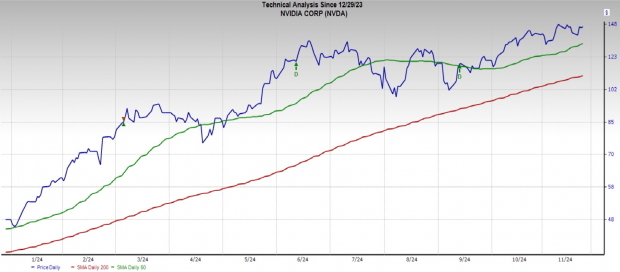

NVIDIA Stock Has Bullish Chart Patterns

Despite NVIDIA’s commendable third-quarter performance, its share price dipped initially as the hype surrounding its earnings results was insane. The stock was in overbought territory and a short-term dip after the earnings release was inevitable.However, the NVIDIA stock is currently trading above the short-term 50-day moving average (DMA) and long-term 200-DMA, a tell-tale bullish trend, making it a sound investment option. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

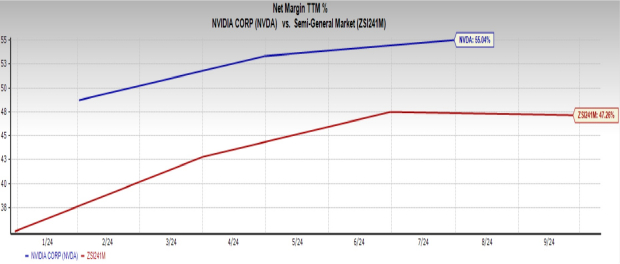

NVIDIA Stock is Fundamentally Solid

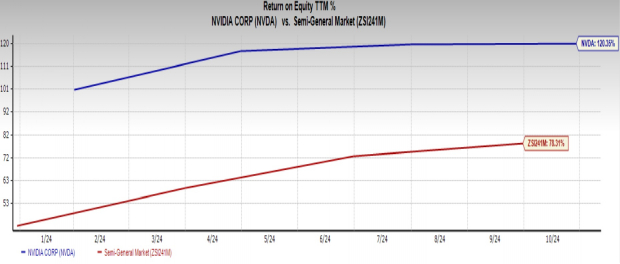

NVIDIA has been able to manage its costs efficiently and generate profits persistently for a somewhat long time, which anyhow makes it the best stock to invest in.NVIDIA’s net profit margin is 55%, higher than the industry’s 47.3%. Any reading greater than 20% indicates a high profit margin. Image Source: Zacks Investment ResearchSimilarly, NVIDIA’s return on equity (ROE) of 120.4% exceeded the industry average of 78.3%, showcasing that the net income surpassed equity.

Image Source: Zacks Investment ResearchSimilarly, NVIDIA’s return on equity (ROE) of 120.4% exceeded the industry average of 78.3%, showcasing that the net income surpassed equity.  Image Source: Zacks Investment ResearchNVIDIA, thus, rightfully has a Zacks Rank #1 (Strong Buy) More By This Author:3 Small-Cap Blend Mutual Funds For Attractive Returns3 Internet Software Stocks To Buy For Growth & Momentum: FIVN, FTNT, TOSTBear Of The Day: Olin

Image Source: Zacks Investment ResearchNVIDIA, thus, rightfully has a Zacks Rank #1 (Strong Buy) More By This Author:3 Small-Cap Blend Mutual Funds For Attractive Returns3 Internet Software Stocks To Buy For Growth & Momentum: FIVN, FTNT, TOSTBear Of The Day: Olin

3 Reasons Besides Q3 Data Center Success To Buy Nvidia Stock