After opening the day higher, Indian benchmark indices remained positive as the session progressed and ended the day on firm footing.Domestic benchmark indices Sensex and Nifty edged higher on Friday (22 November) led by index heavyweights. The BSE Sensex zoomed 2,062 points or 2.6% and recorded an intraday high at 79,218.19. While the NSE Nifty was up 606 points or 2.5% above the 23,900 level.At the closing bell, the BSE Sensex stood higher by 1,961 points (up 2.5%).Meanwhile, the NSE Nifty closed higher by 557 points (up 2.4%).SBI, TCS, and ITC are among the top gainers today.Bajaj Auto, on the other hand, was among the top losers today.The GIFT Nifty was trading at 23,882 up by 515 points at the time of writing.The BSE MidCap index ended 1.3% higher and Bthe SE SmallCap index ended 1% higher.Sectoral indices were trading positive with socks in media sector, realty sector and IT sector witnessing most buying speer.Coforge, CRISIL, and KIMS hit their respective 52-week highs today.The rupee is trading at 84.47 against the US$.Gold prices for the latest contract on MCX are trading 1% higher at Rs 77,502 per 10 grams.Meanwhile, silver prices were trading 1.1% higher at Rs 90,887 per 1 kg.Here are the three key factors that drive the market’s momentum.#1 Buying in Adani SharesOne of the reasons for the recovery in the market was gains in Adani Group stocks after Thursday’s sharp fall. Yesterday Adani shares ended with massive losses after the Group chair Gautam Adani was indicted in New York for his role in an alleged multibillion-dollar bribery and fraud scheme.Adani Enterprises shares were up over 3%, Adani Green Energy was up over 0.5%, Adani Ports was up over 3%, Ambuja Cements was up over 4% and Adani Power was up over 0.5%.#2 Positive Global CuesMeanwhile, global markets also boosted confidence. The US markets on Thursday closed higher with the Dow Jones up 1.1%, the S&P 500 up 0.5%, and the Nasdaq Composite flat with a positive bias.Asian markets were also largely trading positive with Japan’s Nikkei up 0.7%. However, China’s indices slipped, with CSI 300 and Shanghai down over 3 per cent. Hong Kong’s Hang Seng was also down 2.1%.#3 Heavyweights RallyBSE Sensex heavyweights ICICI Bank, Reliance Industries, SBI and Infosys were leading the market rally. These 4 index heavyweights collectively contributed nearly 40% of the gains on the BSE benchmark.Among top movers – SBI surged nearly 5% to Rs 818. JSW Steel, UltraTech Cement, Bajaj Finance, Adani Ports, Titan, ITC, Larsen & Toubro, HCL Technologies, TCS and Bharti Airtel traded with gains in excess of 2% each.#4 IT Stocks Trade HigherThe Nifty IT index surged nearly 2% in today’s trading session on the back of strong labour market data from the US, indicating rebound in US job growth in November after last month’s slowdown.Initial jobless claims in the US fell by 6,000 to a seasonally adjusted 213,000 for the week ended November 16, marking a seven-month low. MphasiS, Wipro were trading over 2% higher.

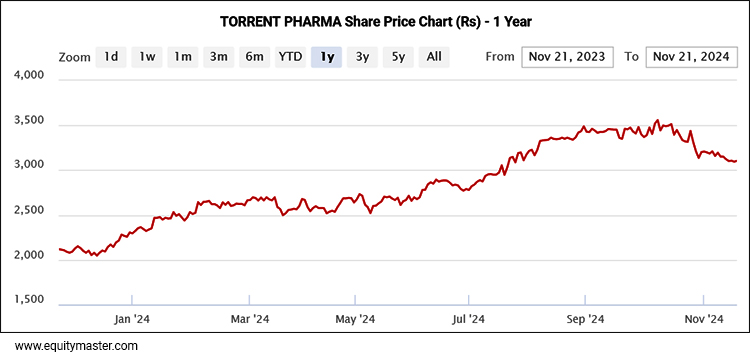

Why Torrent Pharma Share Price is RisingIn news from the pharma sector, shares of Torrent Pharma are higher by over 2.5% in trade on 22 November after the company informed of an Establishment Inspection Report (EIR) by the USFDA for its facility at Pithampur, Madhya Pradesh, stating that the company has initiated voluntary action.The USFDA’s Establishment Inspection Report (EIR) is a report summarizing the findings of an inspection at a facility, mentioning compliance issues if any, and discussions during the visit.The USFDA assigned a Voluntary Action Indicated (VAI) classification, implying the company can voluntarily address the deficiencies without any administrative or regulatory action.The USFDA inspected Torrent’s manufacturing facility at Pithampur in the September quarter and issued a Form 483 with one observation.Torrent Pharma registered constant currency revenue of $32 million, up by 7% on year.Sequentially, Torrent said its US businesses have delivered stable revenue. Torrent has said that it does not expect the US business to ramp up anywhere very fast in the next two years, since most of its filed ANDAs are old, and it expects ‘low single digit approval’ of newer ANDAs.

NLC India Jumps 5%. Here’s Why

Moving on to news from the power sector, shares of NLC India climbed as much as 5% on 22 November after the company announced its emergence as the highest quoted (H1) bidder for the New Patrapara South Coal Mine in Odisha’s Angul district.The designation follows the commercial coal block e-auction conducted by the Ministry of Coal on 21 November.The New Patrapara South Coal Mine boasts a total geological reserve of approximately 720.9 m tonnes, with a peak rated capacity of 12 m tonnes per annum. Official confirmation of NLC India’s successful bid from the Ministry of Coal is awaited.This would mark the company’s third commercial coal mine as it continues to expand its capacity.NLC India is engaged in the business of mining lignite and generation of power by using lignite as well as renewable energy sources.More By This Author:

Sensex Today Rallies 1,961 Points; Nifty Above 23,900