Image Source:

Image Source:

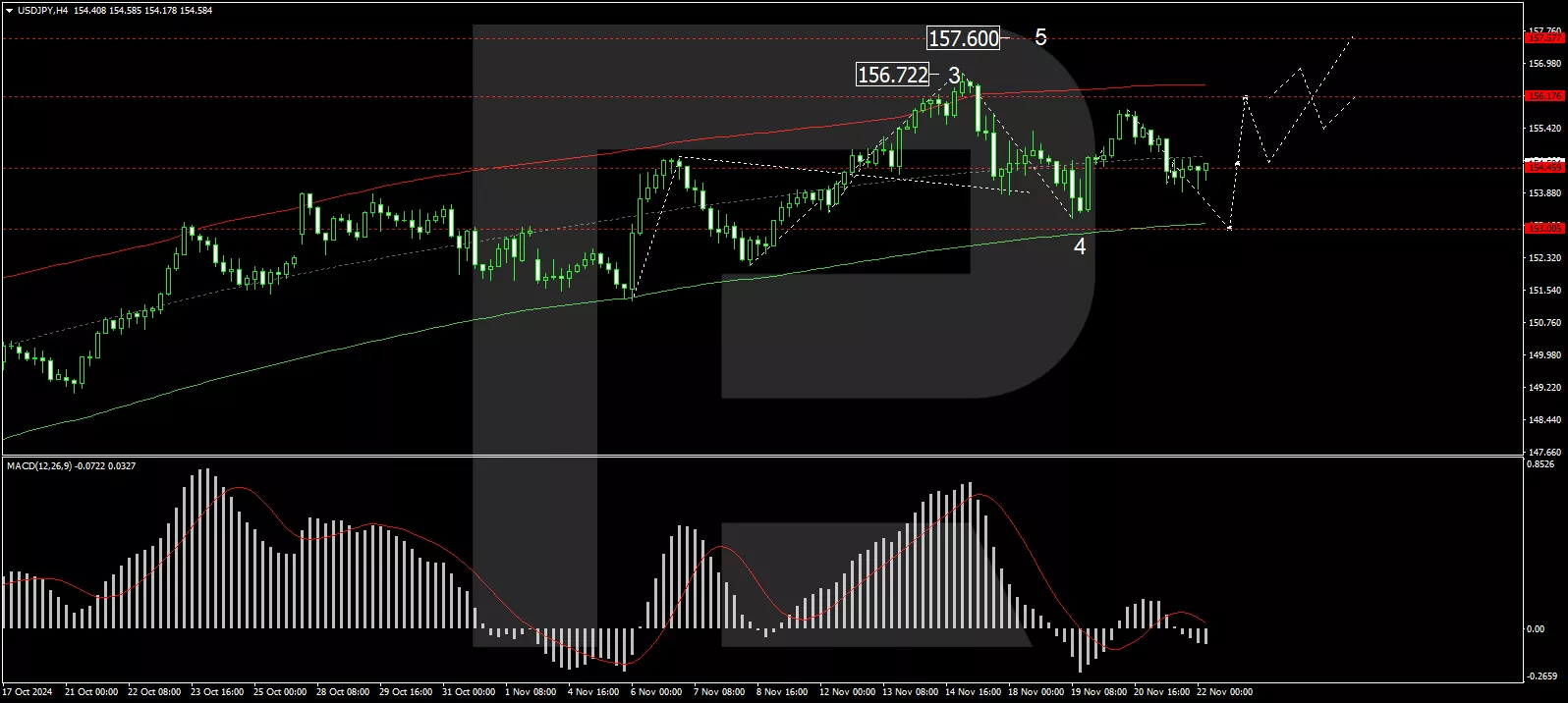

The USD/JPY pair remains stable at approximately 154.30 amid global economic fluctuations and expectations of potential Japanese stimulus measures.Japan’s latest inflation data for October revealed a decline to 2.3%, marking the lowest level in nine months and potentially easing pressure on the Bank of Japan (BoJ) for immediate rate hikes. However, BoJ Governor Kazuo Ueda has hinted at a possible rate increase in December due to the yen’s prolonged weakness.Japan’s manufacturing sector contracted more than anticipated in November, while the service sector showed expansion, highlighting a mixed economic outlook.Reports suggest the Japanese government may introduce a significant stimulus package worth 90 billion USD to mitigate the impact of inflation on households. While details remain undisclosed, the possibility of such measures has generated some optimism around the yen.Technical analysis of USD/JPY(Click on image to enlarge) H4 Chart: the USD/JPY is forming a consolidation pattern around 154.45. A downward breakout could lead to further movement towards 153.00, while an upward breakout might pave the way to 156.20, potentially extending to 157.60. The MACD indicator supports this , with its signal line positioned above zero but trending downwards, suggesting the pair is approaching a critical decision point.(Click on image to enlarge)

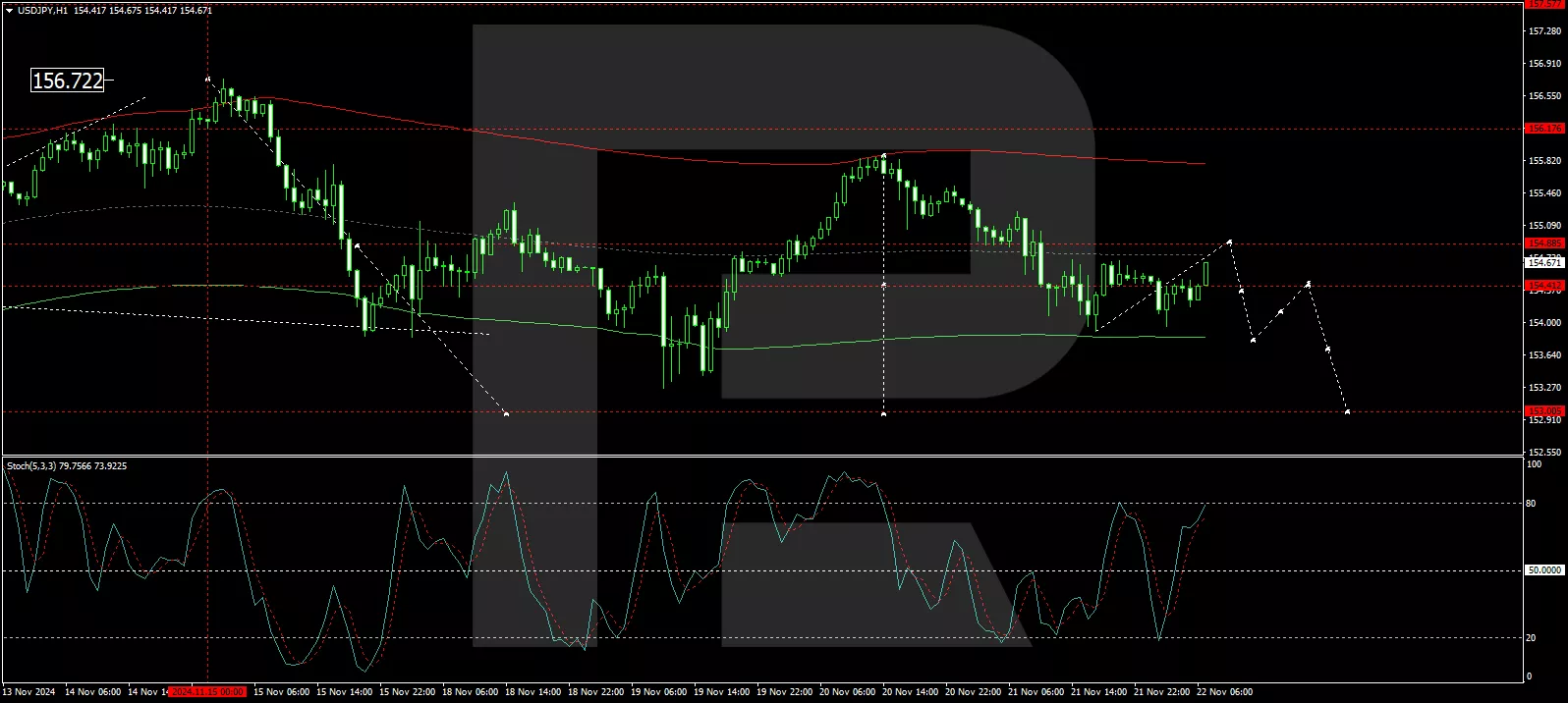

H4 Chart: the USD/JPY is forming a consolidation pattern around 154.45. A downward breakout could lead to further movement towards 153.00, while an upward breakout might pave the way to 156.20, potentially extending to 157.60. The MACD indicator supports this , with its signal line positioned above zero but trending downwards, suggesting the pair is approaching a critical decision point.(Click on image to enlarge) H1 Chart: a consolidation around 154.45, potentially extending to 154.88, sets the stage for possible corrective movements towards 153.00. A subsequent recovery could push the pair to 156.20, marking a new growth phase. The Stochastic oscillator, currently above 80, indicates overbought conditions, signalling a likely retraction to lower levels, aligning with the potential for a near-term correction.More By This Author:

H1 Chart: a consolidation around 154.45, potentially extending to 154.88, sets the stage for possible corrective movements towards 153.00. A subsequent recovery could push the pair to 156.20, marking a new growth phase. The Stochastic oscillator, currently above 80, indicates overbought conditions, signalling a likely retraction to lower levels, aligning with the potential for a near-term correction.More By This Author:

USD/JPY Awaits Potential Stimulus Impact