Hotter-than-expected inflation statistics dampened expectations for swift interest rate drops and overshadowed optimism surrounding software company Sage’s positive quarterly profit, which caused the UK’s FTSE indices to remain muted on Wednesday. The technology sector surged 6.9% to reach a record high, while the export-focused FTSE 100 edged lower by 0.07%. Nvidia’s quarterly earnings announcement, which is coming late Wednesday, is being keenly awaited by investors worldwide. However, data revealed that inflation increased more than anticipated in October, above the Bank of England’s 2% target, primarily due to a rise in regulated domestic energy tariffs. As a result, the FTSE 250 index, which is more sensitive to domestic issues, fell. While traders anticipate borrowing costs to be lowered by little over 50 basis points by December of next year, expectations were reinforced that the Bank of England will err on the side of caution and leave interest rates constant in December.

Single Stock Stories:

UK housebuilders’ index declines over 3% after British inflation jumped by more than expected last month, rising back above the Bank of England’s 2% target; underlying price growth also gathered speed, showing why the central bank is moving cautiously on interest rate cuts. Vistry, a top performer on the housing index, fell around 8%, leading losses in the blue-chip FTSE 100 index. Other FTSE 100 homebuilders, including Berkeley, Persimmon, Barratt, Redrow, and Taylor Wimpey, also declined between 2% and 3.6%.

British multinational enterprise software company Sage sees its stock price rise 16.2%, the highest level since March 28. The stock is the top gainer on the FTSE 100 index, which is up 0.2%. Sage reports a better-than-expected 21% increase in fiscal year 2024 operating profit to 529 million pounds, with revenue growing 9%. The company launches a 400 million pound share buyback program and increases its fiscal year 2024 dividend by 6%. Sage expects its fiscal year 2025 organic revenue to grow by 9% or more. The stock is down 8.1% year-to-date as of the last close.

Shares of British Land, a commercial property firm, declined by 2.7% to 374.4 pence. The stock is among the top losers on the FTSE 100 index. The company’s EPRA Net Tangible Assets, a key measure reflecting the value of its buildings, rose 0.2% to 567 pence as of September 30. However, the valuation of the company’s campus portfolio fell 1.7% in the first half. Analysts at Panmure Liberum remain concerned about office yields, despite being very bullish on rents and how the combination will impact shareholder returns. The company reiterated its expectation of 3-5% annual growth in estimated rental value across its portfolio. British Land’s stock has lost around 6% year-to-date.

Broker Updates:

Shares of British motor and home insurer Admiral Group have declined by 3.2% to 2,423 pence, making it one of the top losers on the FTSE 100 index. Jefferies has reduced its price target for the company to 2,550 pence from 3,025 pence, stating that Admiral’s valuation remains closely tied to an irrational market, and the company’s attempts to diversify its business have yet to pay off. The UK motor financing market is facing scrutiny due to a significant Court of Appeal judgement that impacts credit brokers and lenders. Including the current session’s losses, the stock is down 8.6% year-to-date.

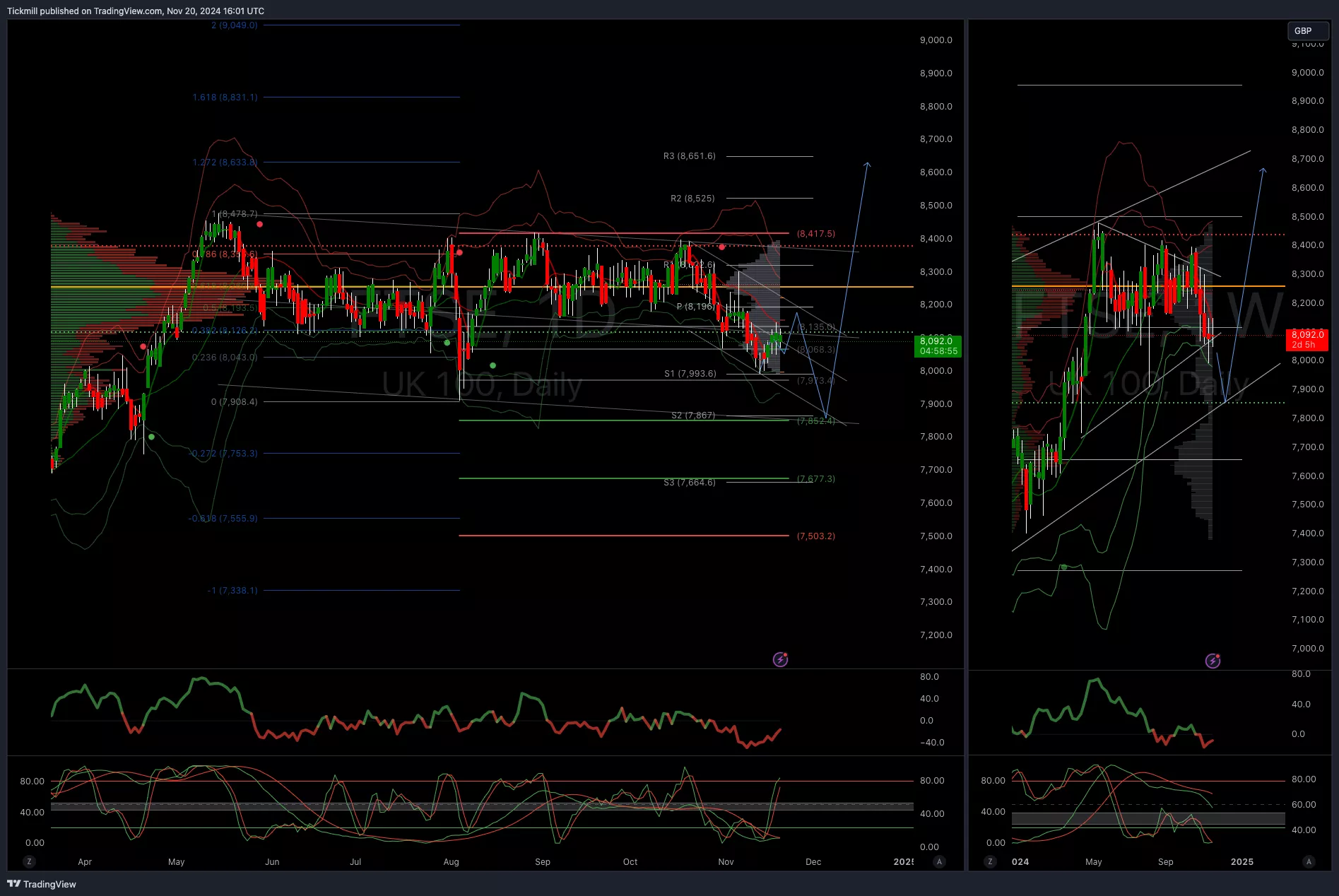

Technical & Trade ViewFTSE Bias: Bullish Above Bearish below 8225

(Click on image to enlarge) More By This Author:Daily Market Outlook – Wednesday, Nov. 20FTSE Softens As Geopolitical Tensions SoarDXY, EURUSD & GBPUSD Structural & Seasonal Trade Setups

More By This Author:Daily Market Outlook – Wednesday, Nov. 20FTSE Softens As Geopolitical Tensions SoarDXY, EURUSD & GBPUSD Structural & Seasonal Trade Setups