Image source:

Image source:

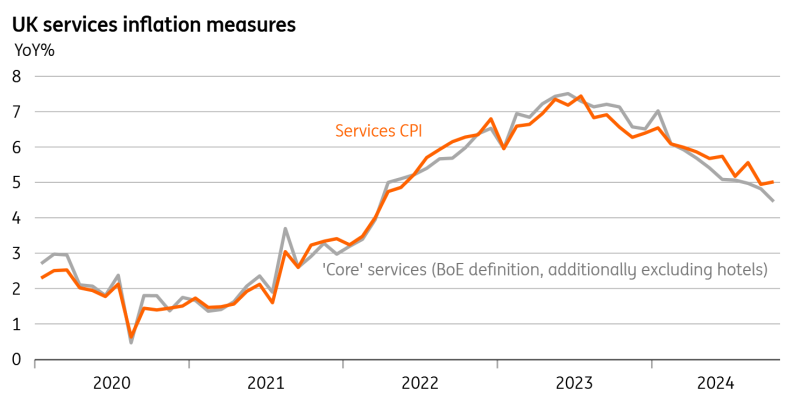

Services inflation is set to bounce around 5% into the winter, while headline CPI could get close to 3% in January. That reduces the chance of a rate cut in December, but in the spring, we think there is still a good chance the Bank of England will accelerate its easing cycle.UK services inflation was a tad hotter than the economist consensus had expected in October. But at 5%, it’s only fractionally higher than in September and in line with the Bank of England’s (and our own) forecast. Interestingly though, when we drill down into the details, you discover that much of the recent stickiness is in categories that the Bank seems to deem less important/less indicative of inflation “persistence”.That’s things like rents, which were particularly strong on a month-on-month basis in October, though this could feasibly be related to social rents, which are only updated quarterly. Airfares and package holidays, notoriously volatile categories, also explain some of the latest pick-up in services inflation.The Bank of England likes to strip those things out and focus on so-called “core services” inflation. There’s no single definition, but our favored measure in the chart below, emulating work the BoE has done previously, fell from 4.8% to 4.5%. That’s quite a different story from what the headline services number is telling us.‘Core services’ inflation is falling faster than the headline number Core services based on a measure used in the May 2024 Monetary Policy Report Source: Macrobond, ING calculationsDoes this make any difference to the December Bank of England decision? We doubt it, though remember we do still have another reading before then. We, like the BoE, expect services inflation to bounce around 5% for the next four months or so before turning more noticeably lower in the second quarter. At the same time, headline inflation could get pretty close to 3% in January, albeit mainly because of energy. All of that means the Bank will most likely continue its “gradual” rate-cutting path for now, which is widely taken to mean one cut per quarter. We expect a pause at next month’s meeting.But that nuance about core services inflation is important. We think that the downtrend will continue, albeit maybe not in the next couple of months. Assuming it does, we think that means the Bank of England can in time become more aggressive on cuts. Timing that isn’t easy, but we think a rate cut in February, followed by another in March (and back-to-back cuts thereafter) is still a reasonable base case.More By This Author:FX Daily: FX Market Looking Through Geopolitical Risk Asia Morning Bites For Wednesday, Nov 20U.S. State Payrolls Numbers Confirm The Cooling Jobs Narrative

Core services based on a measure used in the May 2024 Monetary Policy Report Source: Macrobond, ING calculationsDoes this make any difference to the December Bank of England decision? We doubt it, though remember we do still have another reading before then. We, like the BoE, expect services inflation to bounce around 5% for the next four months or so before turning more noticeably lower in the second quarter. At the same time, headline inflation could get pretty close to 3% in January, albeit mainly because of energy. All of that means the Bank will most likely continue its “gradual” rate-cutting path for now, which is widely taken to mean one cut per quarter. We expect a pause at next month’s meeting.But that nuance about core services inflation is important. We think that the downtrend will continue, albeit maybe not in the next couple of months. Assuming it does, we think that means the Bank of England can in time become more aggressive on cuts. Timing that isn’t easy, but we think a rate cut in February, followed by another in March (and back-to-back cuts thereafter) is still a reasonable base case.More By This Author:FX Daily: FX Market Looking Through Geopolitical Risk Asia Morning Bites For Wednesday, Nov 20U.S. State Payrolls Numbers Confirm The Cooling Jobs Narrative

Sticky UK Services Inflation To Keep BoE Cutting Gradually (For Now)