Image Source: At the moment, the Zacks Internet-Software Industry is currently in the top 14% of nearly 250 Zacks industries.Among the space, several intriguing software stocks are starting to stand out after exceeding their third-quarter top and bottom line expectations earlier in the month. Sporting a Zacks Rank #1 (Strong Buy), here are three of these highly ranked software stocks to consider.

Image Source: At the moment, the Zacks Internet-Software Industry is currently in the top 14% of nearly 250 Zacks industries.Among the space, several intriguing software stocks are starting to stand out after exceeding their third-quarter top and bottom line expectations earlier in the month. Sporting a Zacks Rank #1 (Strong Buy), here are three of these highly ranked software stocks to consider.

Five9 – FIVN

Providing cloud software for contact centers, Five9 ( – ) shares look poised for an extended rebound and are making the argument for being in oversold territory. Trading under $40 a share compared to its 52-week high of $90, FIVN is at a more reasonable 15.7X forward earnings multiple. Plus, Five9’s annual EPS is now expected to increase 15% in fiscal 2024 and is projected to expand another 8% in FY25 to $2.56 per share.Five9 is also expecting sales growth of over 10% in FY24 and FY25 with projections edging north of $1 billion. Reassuringly, Five9 was able to beat Q3 earnings and sales estimates by 15% and 3% respectively with FIVN checking an “A” Zacks Style Scores grade for both Growth and Momentum. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Fortinet – FTNT

Security software provider Fortinet ( – ) has seen its stock rise over +50% in 2024 after recently hitting an all-time high of $100. Notably, FTNT checks a “B” Style Scores grade for Growth and an “A” for Momentum.Fortinet was able to post Q3 earnings and sales surprises of 23% and 2%. Furthermore, Fortinet has been able to achieve record gross margins and operating margins which makes its growth trajectory more compelling. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Toast – TOST

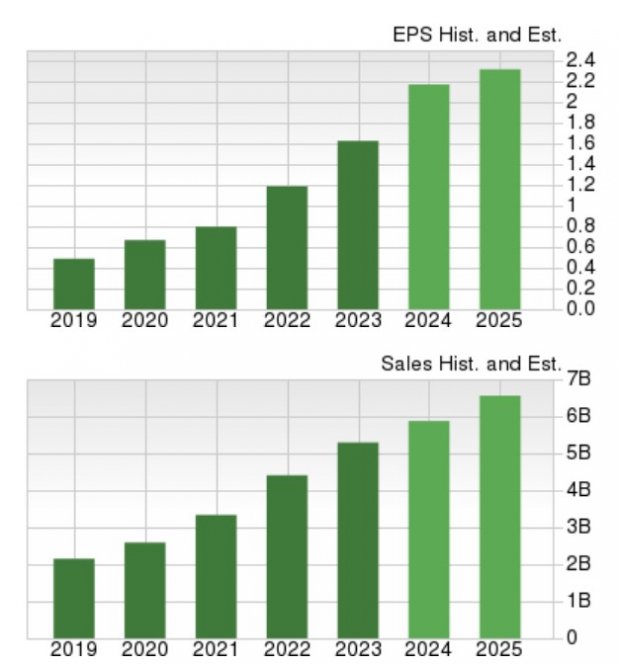

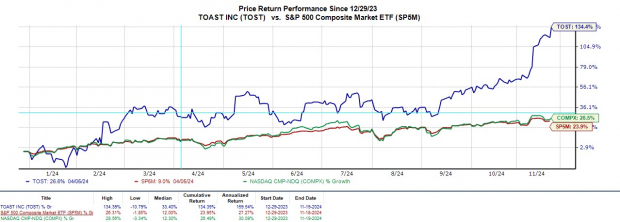

Rounding out the list is Toast ( – ), which provides software that helps restaurants build an on-demand network for online and dine-in orders. Toast has been one of the top-performing stocks in 2024 with TOST skyrocketing over +130% year to date.Sitting at 52-week highs of $42 a share, the rally in TOST could continue after Toast posted a surprise profit of $0.07 a share compared to Q3 estimates of $0.01. Going public in 2021, Toast is expected to cross the profitability line in FY24 and is projected to post stellar EPS growth in FY25 with projections at $0.39.Optimism for Toast’s future earnings potential has been reflected in its rapid top line expansion with total sales projected to increase 27% in FY24 and forecasted to expand another 24% in FY25 to $6.13 billion. TOST has an “A’’ Style Scores grade for Growth and a “B” for Momentum.

Image Source: Zacks Investment Research

Bottom Line

Echoing the momentum in these highly ranked internet software stocks is that their EPS estimates have trended higher in the last 30 days for FY24 and FY25. This further suggests now is a good time to buy Five9, Fortinet, and Toast stock as they continue to carve out a niche in the top-rated Zacks Internet-Software Industry.More By This Author:Bear Of The Day: Olin Time To Buy Walmart Or Target Stock As Q3 Earnings Approach? Bull Of The Day: Tactile Systems Technology

3 Internet Software Stocks To Buy For Growth & Momentum: FIVN, FTNT, TOST