Olin Corporation is a vertically-integrated producer and distributor of chemical solutions. The company operates in several regions including Latin America, Europe, Asia-Pacific, and North America. Olin produces and sells a wide variety of products such as chlorine, caustic soda, methyl chloride, hydrochloric acid, potassium hydroxide, and bleach products.The company is one of the largest marketers of caustic soda in Brazil. Additionally, Olin provides epoxy-related chemicals such as liquid and solid resins, allyl chloride, glycerin, and additives. A global producer, Olin also offers sporting ammunition products for hunters and recreational shooters, law enforcement agencies, and industrial applications.Soft global economic conditions are adversely affecting the company’s chemical business. Its Epoxy segment is facing weak demand in China and Europe. The company’s high level of debt is another concern, resulting in the reduction of its financial flexibility. The Zacks RundownA Zacks Rank #5 (Strong Sell) stock, Olin () is a component of the Zacks Chemical – Diversified industry group, which currently ranks in the bottom 19% out of approximately 250 Zacks Ranked Industries. As such, we expect this industry group as a whole to underperform the market over the next 3 to 6 months, just as it has throughout the year:

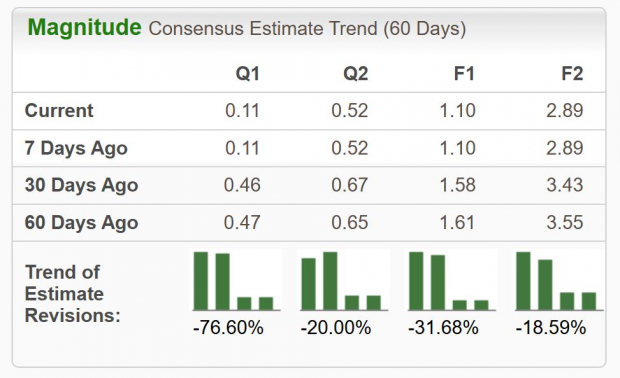

Image Source: Zacks Investment ResearchStocks in the bottom tiers of industries can often be intriguing short candidates. While individual stocks have the ability to outperform even when they’re part of a lagging industry, the inclusion in a weaker group serves as a headwind for any potential rallies and the journey forward is that much more difficult.Along with many other diversified chemical stocks, OLN shares have been underperforming this year while the general market returned to new heights. The stock is hitting a series of lower lows and represents a compelling short opportunity as we head deeper into the fourth quarter. Recent Earnings Misses & Deteriorating OutlookOlin has fallen short of earnings estimates in two of the past three quarters. Just last month, the company reported a third-quarter loss of -$0.21/share, missing the $0.03/share Zacks Consensus Estimate by -800%.The chemical product distributor has posted a negative trailing four-quarter earnings surprise of -187.6%. Consistently falling short of earnings estimates is a recipe for underperformance, and OLN is no exception.The company has been on the receiving end of negative earnings estimate revisions as of late. Looking at the current quarter, analysts have slashed estimates by a whopping -76.6% in the past 60 days. The Q4 Zacks Consensus EPS Estimate is now $0.11/share, reflecting negative growth of -63.3% relative to the year-ago period. Image Source: Zacks Investment ResearchFalling earnings estimates are a huge red flag and need to be respected. Negative growth year-over-year is the type of trend that bears like to see. Technical OutlookAs illustrated below, OLN stock is in a sustained downtrend. Notice how the stock has made a series of lower lows, widely underperforming the major indices. Also note that shares are trading below a downward-sloping 200-day (red line) moving average – another good sign for the bears.

Image Source: Zacks Investment ResearchFalling earnings estimates are a huge red flag and need to be respected. Negative growth year-over-year is the type of trend that bears like to see. Technical OutlookAs illustrated below, OLN stock is in a sustained downtrend. Notice how the stock has made a series of lower lows, widely underperforming the major indices. Also note that shares are trading below a downward-sloping 200-day (red line) moving average – another good sign for the bears.

Image Source: StockChartsOLN stock has experienced what is known as a “death cross,” whereby the stock’s 50-day moving average (blue line) crosses below its 200-day moving average. Shares would have to make an outsized move to the upside and show increasing earnings estimate revisions to warrant taking any long positions. The stock has fallen more than 20% this year alone. Final ThoughtsA deteriorating fundamental and technical backdrop show that this stock is not set to make its way to new highs anytime soon. The fact that OLN is included in one of the worst-performing industry groups provides yet another headwind to a long list of concerns. A history of earnings misses and falling future earnings estimates will likely serve as a ceiling to any potential rallies, nurturing the stock’s downtrend.Potential investors may want to give this stock the cold shoulder, or perhaps include it as part of a short or hedge strategy. Bulls will want to steer clear of OLN until the situation shows major signs of improvement.More By This Author:Time To Buy Walmart Or Target Stock As Q3 Earnings Approach? Bull Of The Day: Tactile Systems TechnologyEnphase Energy’s Software Now Offers AI Upgrade: Time To Buy The Stock?

Bear Of The Day: Olin