Asian markets concluded a volatile week on a more stable note, aided by Chinese consumers lifting retail sales above expectations as a slew of governmental support measures buoyed the stock market. Property sales increased slightly, but they are still down 15.8% from a year earlier. A decrease in property investment deepened, and home prices plummeted the most in nine years, which was hardly the rebound investors hoped for. Chinese markets recovered from their losses following the data release, though blue chips fell 0.4%. Nonetheless, it is up 30% from a September low due to Beijing’s stimulus efforts. Globally, the bullish backdrop for share markets is fading as investors, who had revelled in Donald Trump’s U.S. presidential election victory, become increasingly concerned about the scope for U.S. policy easing in the coming year – not surprising given the president-elect’s drastic trade and immigration policies. Short-term Treasury yields rose following Federal Reserve Chair Jerome Powell’s comments that there is no need to hasten interest rate cuts, as the market reduced bets on a December cut to 59% from 82% midweek. Fed fund futures for next year fell by 8 ticks in December, predicting only 71 basis points of easing by the end of 2025, fewer than three standard-sized cuts.This is one reason why Wall Street and European stock futures are in the red.In the UK for Q3, the economy expanded 0.1% q/q but declined 0.1% per capita. The ONS’s first estimate for Q3 economic growth is 0.1% q/q. This was 0.1ppts below consensus and the November MPR BoE estimate. Some turbulence in expenditure components boosted net trade and pulled on gross capital creation, but these partially netted off. Private consumption growth slowed in Q2, but household expenditure rose 0.5% q/q in Q3 after disinflation and tax cuts boosted real wages. However, with overall GDP expanding only 0.1% q/q despite consumer performance being substantially stronger, and GDP per capita falling 0.1% q/q in Q3 and being constant from Q3 last year, this report strengthens the notion that the UK economy is trapped in low growth mode. After inflation bottomed out and tax cuts became tax rises, headwinds grew. Last night at Mansion House, the Governor and Chancellor discussed addressing this structural challenge of low growth, but in the short term, the BoE is likely to remain cautious on easing as fiscal stimulus uses up more economic slack.Later today, the United States will report figures on retail sales. Markets might not see a boost in retail sales as a good thing because producer prices carry an upside risk to the Personal Consumption Expenditures Price Index, the Federal Reserve’s preferred inflation indicator.

Overnight Newswire Updates of Note

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut (1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

CFTC Data As Of 8/11/24

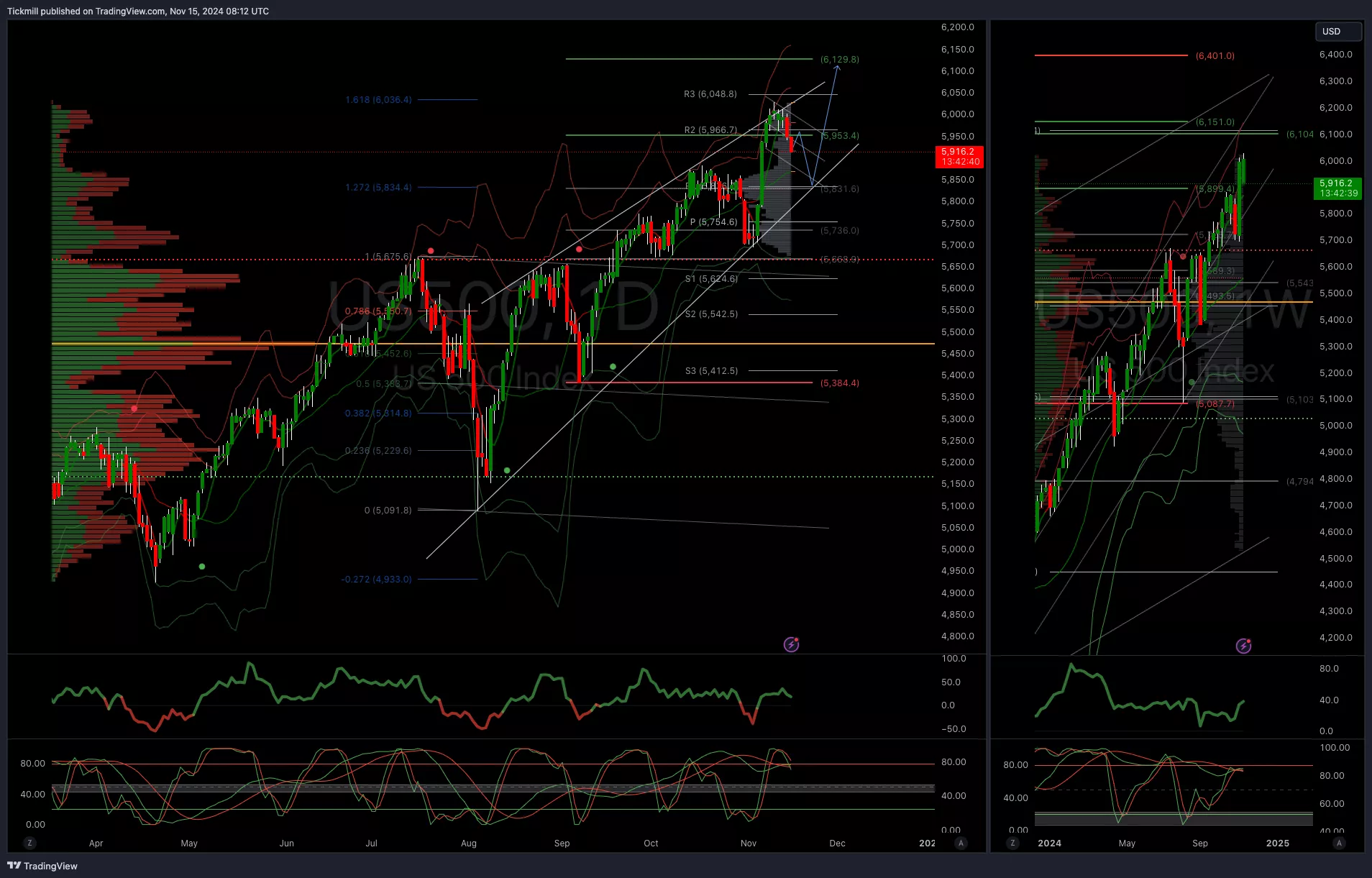

Technical & Trade ViewsSP500 Bullish Above Bearish Below 5960

(Click on image to enlarge) EURUSD Bullish Above Bearish Below 1.0750

EURUSD Bullish Above Bearish Below 1.0750

(Click on image to enlarge) GBPUSD Bullish Above Bearish Below 1.2850

GBPUSD Bullish Above Bearish Below 1.2850

(Click on image to enlarge) USDJPY Bullish Above Bearish Below 154

USDJPY Bullish Above Bearish Below 154

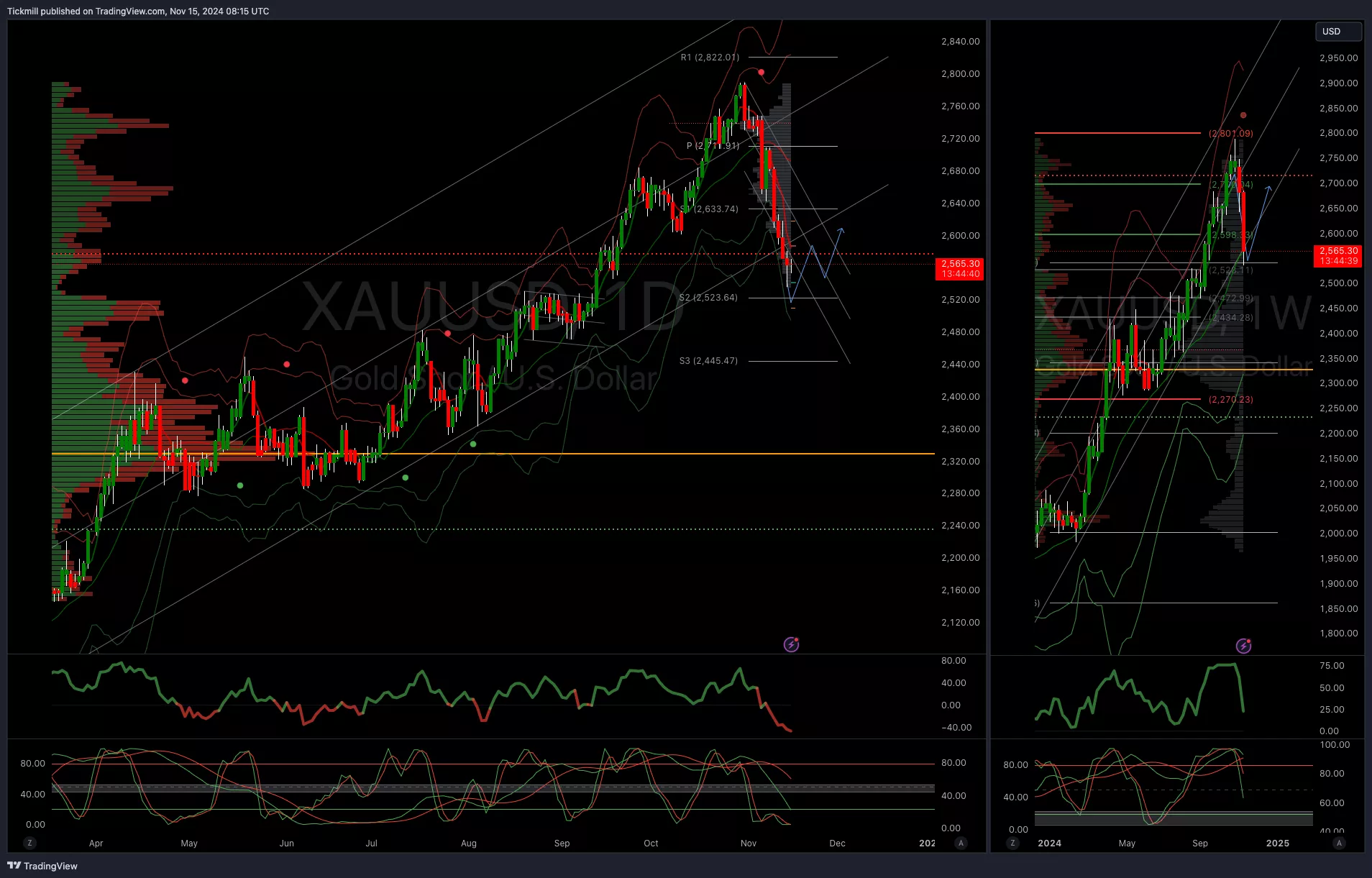

(Click on image to enlarge) XAUUSD Bullish Above Bearish Below 2600

XAUUSD Bullish Above Bearish Below 2600

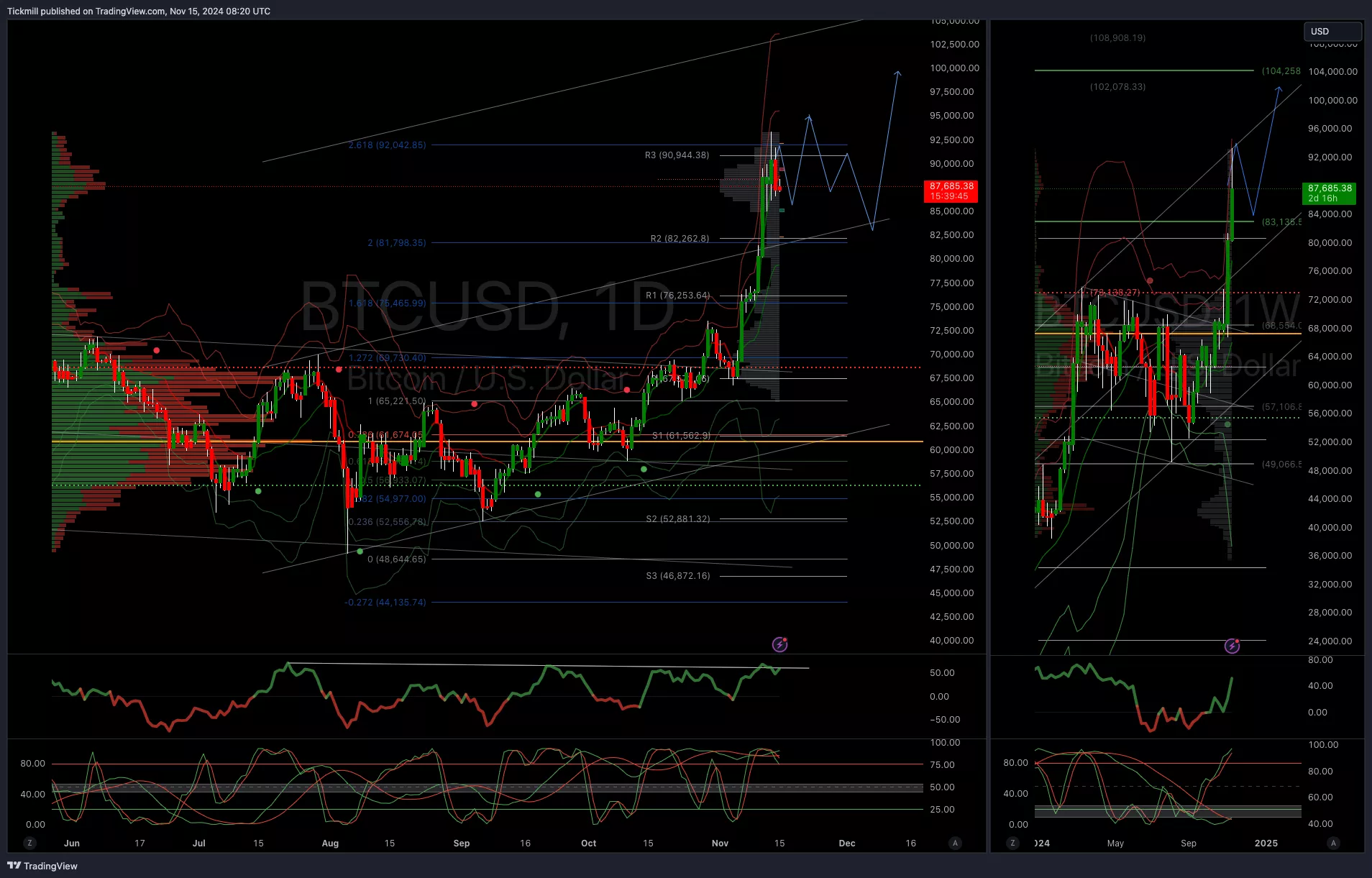

(Click on image to enlarge) BTCUSD Bullish Above Bearish Below 85000

BTCUSD Bullish Above Bearish Below 85000

(Click on image to enlarge) More By This Author:

More By This Author: