AbbVie Stock Price Analysis

AbbVie () has long been a dominant player in the pharmaceutical sector, with a strong focus on immunology drugs like Humira, Skyrizi, and Rinvoq. However, with the loss of Humira’s exclusivity and a recent dip in stock value, many are questioning the future trajectory of AbbVie stock. There are multiple growth opportunities ahead. In this post, we’ll explore the current challenges and future prospects of AbbVie, focusing on its drug pipeline and the potential impact of the upcoming U.S. presidential election.1. The Humira Transition: Navigating Post-Blockbuster WatersFor over two decades, Humira was AbbVie’s cash cow, generating approximately $14.4 billion in annual revenue. However, with biosimilars now entering the market and exclusivity coming to an end in 2023, AbbVie is seeing a decline in Humira’s revenue.Despite this, the company’s future is far from bleak, as it has strategically set itself up for growth in immunology with drugs like Skyrizi and Rinvoq.Skyrizi is already poised to take over as AbbVie’s leading drug, with its expansive applications in treating conditions such as psoriasis, Crohn’s disease, and psoriatic arthritis.Thanks to a patent extending through 2033, Skyrizi is likely to be AbbVie’s next big revenue generator.2. AbbVie’s Expanding Pipeline: New Drug Development And PotentialWhile the loss of Humira’s exclusivity has taken a toll, AbbVie is shifting its focus to promising candidates like Skyrizi and Rinvoq to drive future growth. These drugs are leading AbbVie’s push into immunology, offering treatments for a variety of autoimmune conditions that are growing in demand.AbbVie’s broad pipeline, which includes therapies for rheumatoid arthritis, psoriasis, ulcerative colitis, and Crohn’s disease, continues to expand.The company’s commitment to research and development is evident, and with drugs like Skyrizi showing strong potential, AbbVie could see its revenue streams shift from Humira to these next-generation drugs.3. Recent Setbacks: Schizophrenia Drug DisappointsAbbVie’s recent stock dip can be attributed to a failed clinical trial for Emraclidine, a schizophrenia treatment. The drug did not meet its primary endpoint in a late-stage study, leading to investor concerns about the company’s drug pipeline. However, it’s important to remember that the pharmaceutical industry is inherently risky, and setbacks in clinical trials are not uncommon. AbbVie’s broad pipeline, along with other promising candidates, could mitigate this short-term volatility.4. The Trump Election Effect: A Potential Catalyst For Healthcare StocksDespite recent setbacks, there are external catalysts that could work in AbbVie’s favor. The election of Donald Trump as U.S. president in the near future could provide a boost for healthcare stocks like AbbVie. Historically, the healthcare sector has performed well under a Republican administration, driven by deregulation and policies aimed at improving access to healthcare.If the new president maintains a strong stance on deregulation, AbbVie could see further tailwinds in its domestic operations, boosting investor confidence.5. Technical Chart AnalysisIn my analysis of ABBV’s technical chart, at the time of writing, I’ve identified three potential buy limit levels: $161.11, $149.10, $134.17.These levels represent price points where I see potential for favorable entry based on historical price action and key support areas. I personally plan to hold long-term (over 5 years) as ABBV suits my unique risk tolerance and financial goals.Given that the market sentiment is bullish, my strategy is to initiate a position at the current market price (CMP) and to layer in additional buy limit orders at the identified levels.This approach aims to take advantage of any near-term price dips, positioning for potential upside as AbbVie continues its strategic advancements in immunology and oncology.Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals.

6. Risks To Consider: Patent Expirations, Litigation, And Regulatory PressuresAbbVie, like any large pharmaceutical company, faces significant risks that could impact its growth. Patent expirations, such as for Humira, expose AbbVie to competition from generics and biosimilars, leading to reduced revenues.Additionally, AbbVie faces risks from litigation, regulatory pressures, and delays in the approval process for new drugs, which could hinder growth and profitability.The company also competes in a crowded market for autoimmune and oncology drugs. If AbbVie’s treatments like Skyrizi or Rinvoq lose their market position, or if clinical trials fail, it could affect long-term prospects.External risks include geopolitical and economic factors, such as changes in healthcare policies and trade relations, which could impact AbbVie’s global operations and financial performance.7. Conclusion: Abbvie Stock Price Analysis – Is Now The Time To Buy AbbVie Stock?Despite some recent challenges, AbbVie remains a pharmaceutical giant with a strong focus on immunology and an extensive pipeline of promising new drugs.The company’s strategic acquisitions, its strong position in the immunology market, and the potential upside from ongoing innovations suggest that AbbVie is well-positioned for future growth.If you’re an investor willing to ride out the short-term volatility, AbbVie could present a compelling buying opportunity at its current valuation.As with any investment, make sure to conduct your own research and align your decisions with your unique financial goals and risk tolerance.More By This Author:SiriusXM Stock Price Analysis – SiriusXM Strikes Out On Its Own Sparking A New Era For Investors Will “Trump Trade” Continue To Boost Stocks And Bitcoin In 2025? Bitcoin At All-Time High: Should You Sell Or Buy More?

6. Risks To Consider: Patent Expirations, Litigation, And Regulatory PressuresAbbVie, like any large pharmaceutical company, faces significant risks that could impact its growth. Patent expirations, such as for Humira, expose AbbVie to competition from generics and biosimilars, leading to reduced revenues.Additionally, AbbVie faces risks from litigation, regulatory pressures, and delays in the approval process for new drugs, which could hinder growth and profitability.The company also competes in a crowded market for autoimmune and oncology drugs. If AbbVie’s treatments like Skyrizi or Rinvoq lose their market position, or if clinical trials fail, it could affect long-term prospects.External risks include geopolitical and economic factors, such as changes in healthcare policies and trade relations, which could impact AbbVie’s global operations and financial performance.7. Conclusion: Abbvie Stock Price Analysis – Is Now The Time To Buy AbbVie Stock?Despite some recent challenges, AbbVie remains a pharmaceutical giant with a strong focus on immunology and an extensive pipeline of promising new drugs.The company’s strategic acquisitions, its strong position in the immunology market, and the potential upside from ongoing innovations suggest that AbbVie is well-positioned for future growth.If you’re an investor willing to ride out the short-term volatility, AbbVie could present a compelling buying opportunity at its current valuation.As with any investment, make sure to conduct your own research and align your decisions with your unique financial goals and risk tolerance.More By This Author:SiriusXM Stock Price Analysis – SiriusXM Strikes Out On Its Own Sparking A New Era For Investors Will “Trump Trade” Continue To Boost Stocks And Bitcoin In 2025? Bitcoin At All-Time High: Should You Sell Or Buy More?

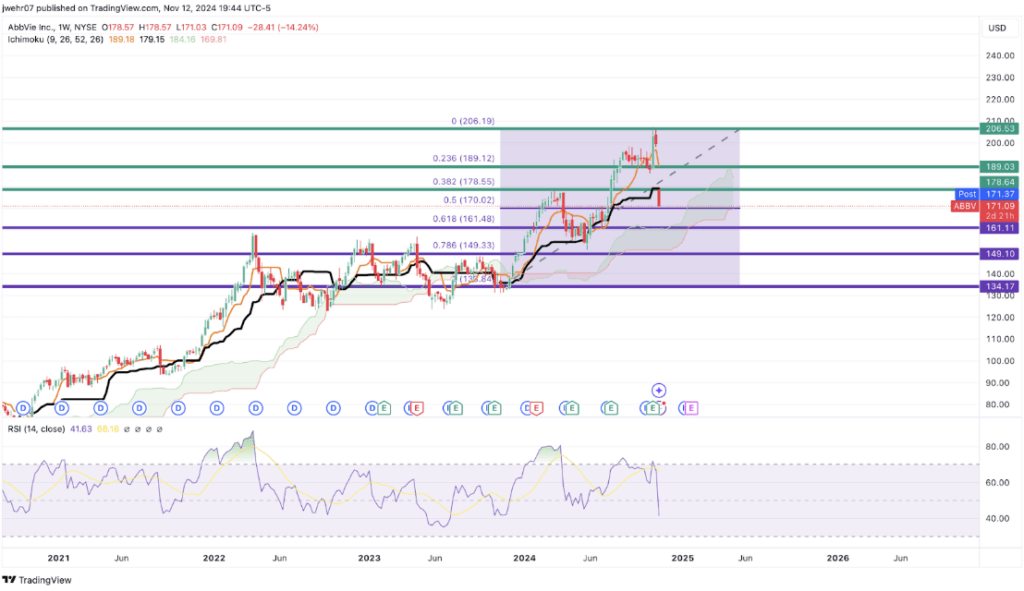

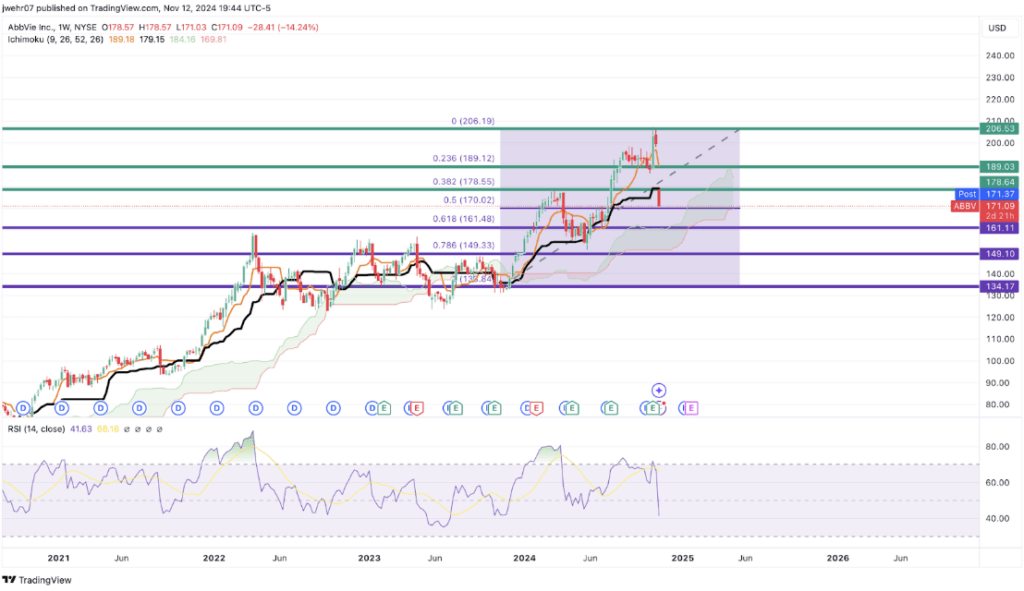

Abbvie Stock Price Analysis – A Post-Humira Dip, New Drug Hopes, And Election Buzz – Is Now The Time To Buy?