Watch the video above from the WLGC session before the market opens on 12 Nov 2024 to find out the following:

Video Length: 00:04:23

Market Environment

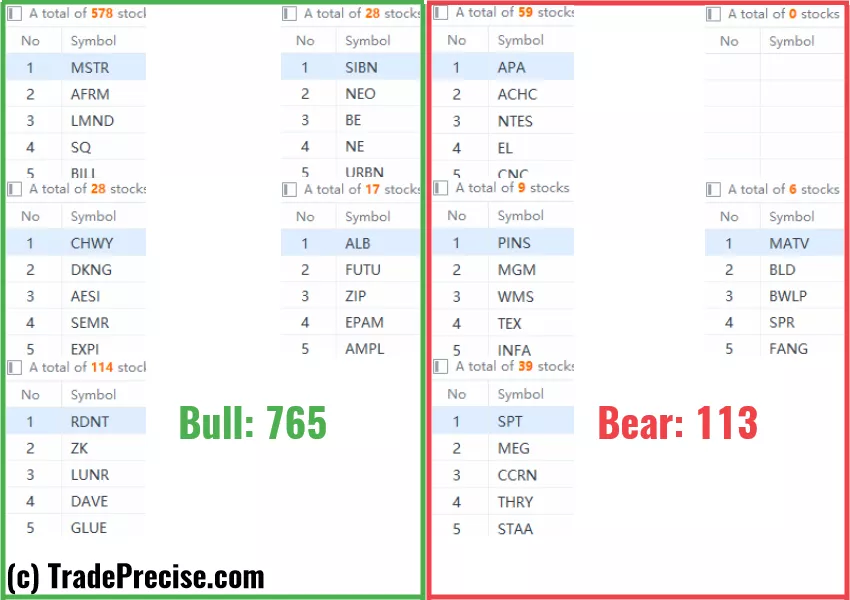

The bullish vs. bearish setup is 765 to 113 from the screenshot of my stock screener below.

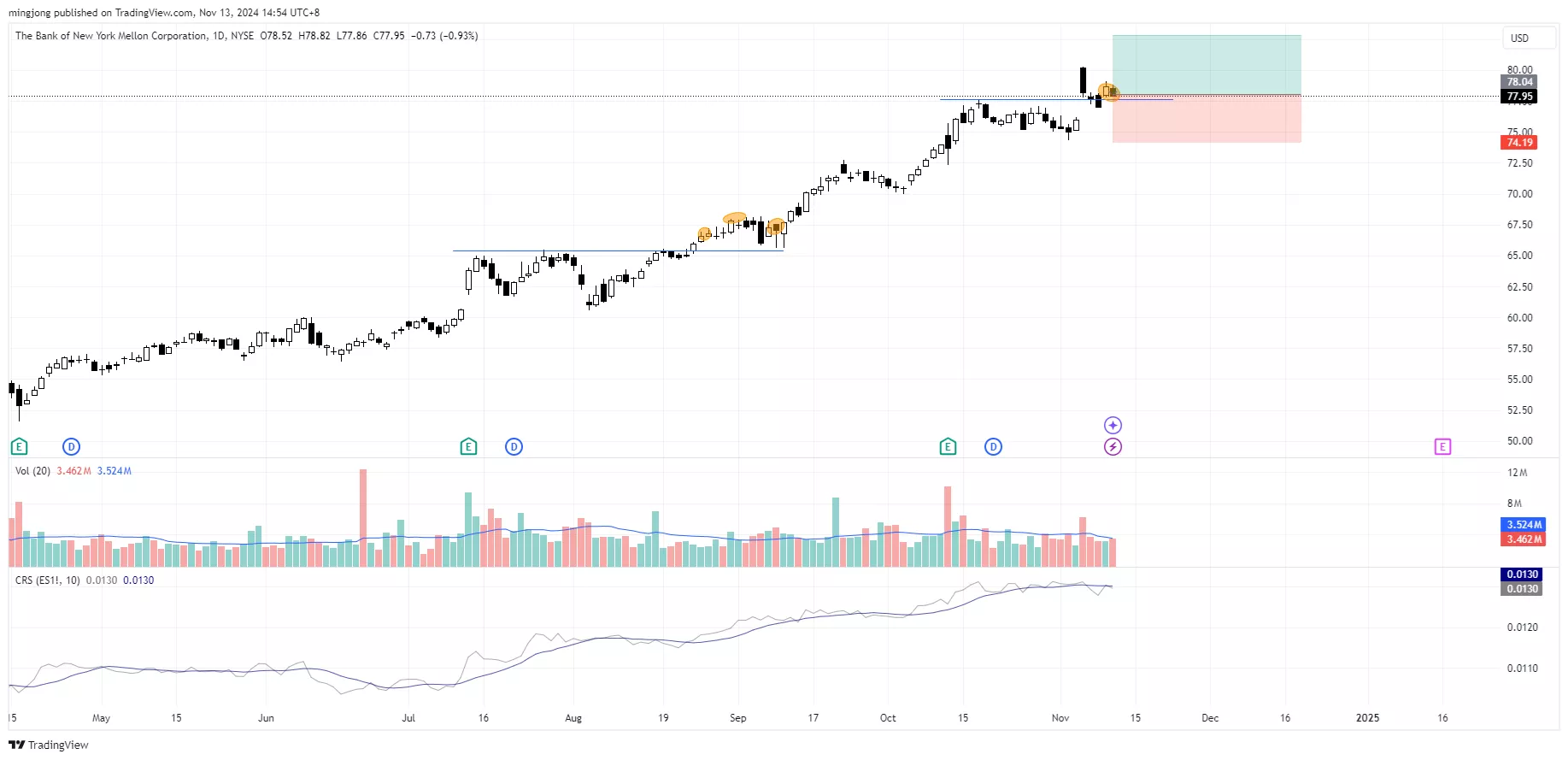

3 Stocks Ready To Soar21 actionable setups such as , , , were discussed during the live session before the market open (BMO).Many stocks are overbought and over-extended since last Tuesday’s discussion, yet the long-term weekly charts show the early uptrend phase as many stocks just had the first strong impulsive up wave from the accumulation structures.There are plenty of opportunities to participate in those bottoming stocks based on the price action as discussed in the with the post-election pattern as a strong tailwind.(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

More By This Author: