While Hungary’s inflation accelerated in October, it caused a significant downside surprise. Services prices fell at a historical rate on a monthly basis, a one-off phenomenon. Despite the seemingly benign picture, it is FX instability rather than inflation data that will drive monetary policy decisions moving forward. The yearly-based inflation rate in Hungary is being driven by two key factors: higher services prices and higher food prices

Headline inflation (YoY)

ING estimate 3.6% / Previous 3.0%

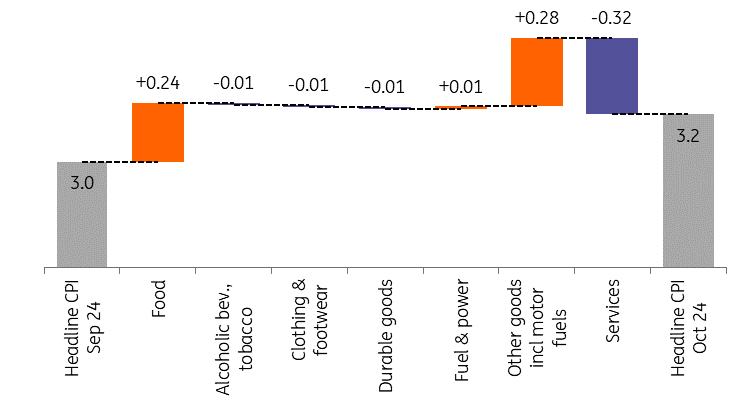

Low base slightly accelerated inflationHungarian inflation picked up slightly in October, but this was well below expectations. The latest data therefore surprised to the downside relative to market consensus. Year-on-year inflation rose from 3.0% to 3.2%, with the modest acceleration owing to a combination of a low monthly increase in the average price level of just 0.1% and a low base from a year ago. Main drivers of the change in headline CPI (%)(Click on image to enlarge) Source: HCSO, ING The details

Source: HCSO, ING The details

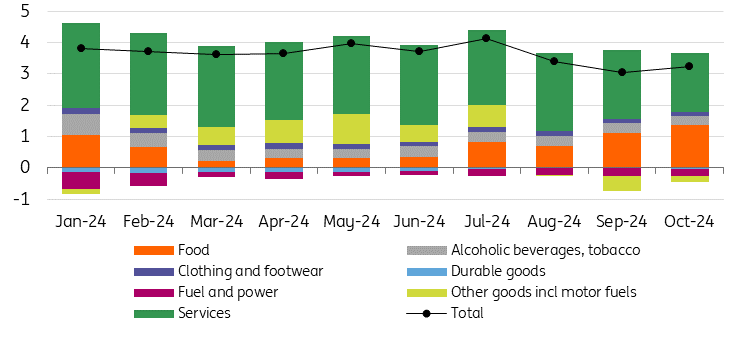

The composition of headline inflation (ppt)(Click on image to enlarge) Source: HCSO, ING Services and food prices drive inflationThe year-on-year inflation accelerated by only 0.2ppt in October compared with the previous month. There are two factors behind this pick-up in inflation. The first is the rise in food prices, which at 4.5% on an annual basis are well above average, and the highest food inflation seen so far this year.Due to the low base, we still see an upward impact from fuel prices on an annual basis. Together, these two items alone would have added 0.5ppt to the inflation rate (bringing inflation to 3.5% YoY, exactly in line with market expectations), but this was offset by a large surprise fall in services prices. The year-on-year change in services prices is now ‘only’ 7.2%. In very simple terms, then, we can say that the yearly-based inflation rate is being driven by two factors: higher services prices and higher food prices. Headline and underlying inflation measures (% YoY)(Click on image to enlarge)

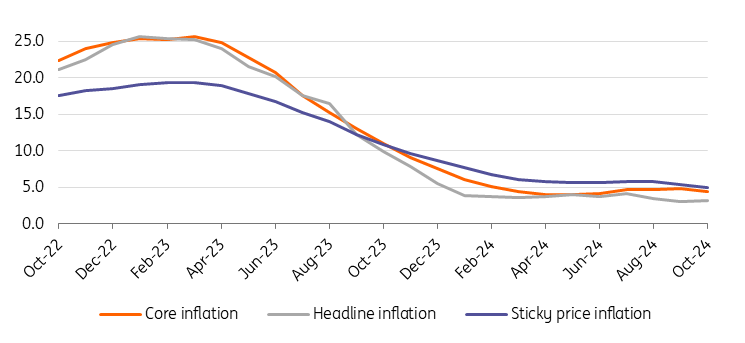

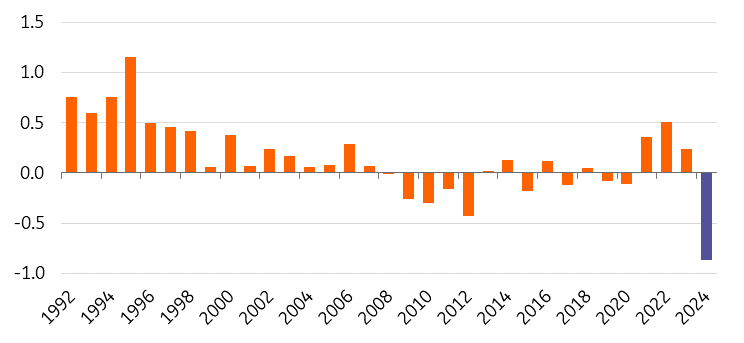

Source: HCSO, ING Services and food prices drive inflationThe year-on-year inflation accelerated by only 0.2ppt in October compared with the previous month. There are two factors behind this pick-up in inflation. The first is the rise in food prices, which at 4.5% on an annual basis are well above average, and the highest food inflation seen so far this year.Due to the low base, we still see an upward impact from fuel prices on an annual basis. Together, these two items alone would have added 0.5ppt to the inflation rate (bringing inflation to 3.5% YoY, exactly in line with market expectations), but this was offset by a large surprise fall in services prices. The year-on-year change in services prices is now ‘only’ 7.2%. In very simple terms, then, we can say that the yearly-based inflation rate is being driven by two factors: higher services prices and higher food prices. Headline and underlying inflation measures (% YoY)(Click on image to enlarge) Source: HCSO, NBH, ING Inflation to accelerate temporarilyLooking ahead, inflation is expected to rise further in the next two months. On one hand, this is due to the low base – and on the other, monthly reassessments are likely to become more pronounced again. In the coming months, we are unlikely to see a similar drop in the prices of, for example, telecommunications or health services.It may well be that the sharp fall in recorded prices for telephone and internet services reflects the impact of the free data packages offered during the September floods, which may have been recorded by the Statistical Office (HCSO) in October (the billing period). If this is indeed the reason, the HCSO is expected to record a significant increase in this item in the coming period (probably in November), which could push up the monthly inflation rate by 0.2ppt. Monthly price changes for services in October (%)(Click on image to enlarge)

Source: HCSO, NBH, ING Inflation to accelerate temporarilyLooking ahead, inflation is expected to rise further in the next two months. On one hand, this is due to the low base – and on the other, monthly reassessments are likely to become more pronounced again. In the coming months, we are unlikely to see a similar drop in the prices of, for example, telecommunications or health services.It may well be that the sharp fall in recorded prices for telephone and internet services reflects the impact of the free data packages offered during the September floods, which may have been recorded by the Statistical Office (HCSO) in October (the billing period). If this is indeed the reason, the HCSO is expected to record a significant increase in this item in the coming period (probably in November), which could push up the monthly inflation rate by 0.2ppt. Monthly price changes for services in October (%)(Click on image to enlarge) Source: HCSO, ING In addition, fuel prices will push up the general price index in the coming months, the depreciation of the HUF may stimulate imported inflation (mainly via durable consumer goods) and food prices may continue to rise. As the rise in fuel and food prices is an important amplifier of perceived inflation, the favourable official statistics will not help to dampen households’ cautionary motives and fears of inflation towards the end of the year. Inflation expectations may therefore start to rise again, creating further headwinds for the Hungarian National Bank.For the year as a whole, headline inflation could average 3.6%, while we expect slightly higher inflation next year (around 3.6-4.0%, according to our preliminary estimates). How much inflation will eventually pick up will depend to a large extent on the HUF exchange rate, wage growth and the repricing power of corporates. The latter will also be an important factor in next year’s tax increases.More By This Author:

Source: HCSO, ING In addition, fuel prices will push up the general price index in the coming months, the depreciation of the HUF may stimulate imported inflation (mainly via durable consumer goods) and food prices may continue to rise. As the rise in fuel and food prices is an important amplifier of perceived inflation, the favourable official statistics will not help to dampen households’ cautionary motives and fears of inflation towards the end of the year. Inflation expectations may therefore start to rise again, creating further headwinds for the Hungarian National Bank.For the year as a whole, headline inflation could average 3.6%, while we expect slightly higher inflation next year (around 3.6-4.0%, according to our preliminary estimates). How much inflation will eventually pick up will depend to a large extent on the HUF exchange rate, wage growth and the repricing power of corporates. The latter will also be an important factor in next year’s tax increases.More By This Author: