Photo by on The 2024 Q3 earnings cycle is slowly wrapping up, with the bulk of S&P 500 companies already revealing quarterly results. The reporting docket remains busy, however, with plenty of results still to come in the weeks ahead.So far, several high-growth companies, including e.l.f. Beauty ( – ) and Palantir ( – ) , have posted results that caused shares to see bullish action post-earnings, with each raising guidance in one way or another.Let’s take a closer look at the results.

Photo by on The 2024 Q3 earnings cycle is slowly wrapping up, with the bulk of S&P 500 companies already revealing quarterly results. The reporting docket remains busy, however, with plenty of results still to come in the weeks ahead.So far, several high-growth companies, including e.l.f. Beauty ( – ) and Palantir ( – ) , have posted results that caused shares to see bullish action post-earnings, with each raising guidance in one way or another.Let’s take a closer look at the results.

Palantir Enjoys Robust AI Demand

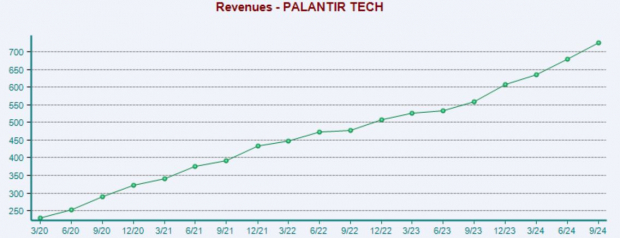

Palantir builds software that empowers organizations toeffectively integrate their data, decisions, and operations. Shares reflect a strong play on the artificial intelligence frenzy, gaining 250% in just 2024 alone thanks to strong quarterly results.The company’s sales have snowballed thanks to strong AI demand, with sales of $726 million throughout its latest period growing 30% year-over-year and 7% sequentially. As shown below, PLTR’s sales have consistently grown sequentially over the years.

Image Source: Zacks Investment ResearchCEO Alexander Karp provided a bullish statement following the results, saying:‘We absolutely eviscerated this quarter, driven by unrelenting AI demand that won’t slow down. This is a U.S.-driven AI revolution that has taken full hold. The world will be divided between AI haves and have-nots. At Palantir, we plan to power the winners.’Notably, Palantir’s customer count continued to expand rapidly again throughout the period, seeing 39% year-over-year growth and a 6% sequential improvement. And the company continues to ink significant deals, closing 104 contracts over $1 million throughout the period.The company raised its FY24 revenue, adjusted income from operations, and adjusted free cash flow outlook following the robust results. Unsurprisingly, positive earnings estimate revisions followed the release, with the stock carrying a favorable Zacks Rank #2 (Buy).Growth is expected to continue in a big way, with our consensus expectations suggesting 53% Y/Y EPS growth on 27% higher sales. Image Source: Zacks Investment ResearchThe stock overall remains a prime pick for those seeking artificial intelligence exposure, underpinned by unrelenting demand and continued customer growth that has led to accelerating sales growth over recent periods.

Image Source: Zacks Investment ResearchThe stock overall remains a prime pick for those seeking artificial intelligence exposure, underpinned by unrelenting demand and continued customer growth that has led to accelerating sales growth over recent periods.

e.l.f. Beauty Bounces Back

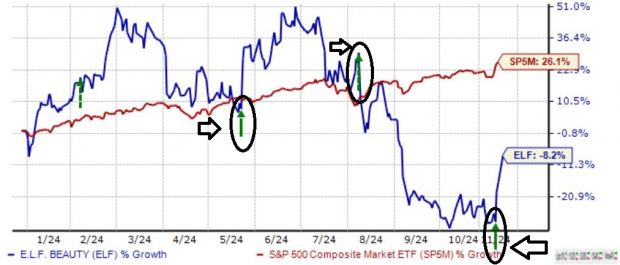

ELF shares have cooled in a big way this year, down 9% in 2024 overall after a big run that stretched across several years. Still, its recent set of quarterly results finally perked shares back up, with ELF posting a 70% beat relative to the Zacks Consensus EPS estimate and reporting sales 4% ahead of expectations. As shown below, the stock has been sensitive to recent quarterly releases.

Image Source: Zacks Investment ResearchThe recent plunge in shares in 2024 can be attributed to a growth cooldown, with the company’s Y/Y sales growth rate cooling significantly over recent periods. Please note that the chart below tracks the percentage Y/Y change in sales, not actual sales figures.

Image Source: Zacks Investment ResearchIn addition, favorable cost-cutting measures and controls have allowed the company to enjoy consistent margin expansion, with a reported gross margin of 71% throughout its latest period expanding 40bp year-over-year. Please note the margin chart below is calculated on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Bottom Line

The 2024 Q3 earnings season is slowly winding down, with just a small chunk of the S&P 500 yet to report. The period has been positive, underpinned again by a strong showing from technology.And concerning positivity, that’s precisely what Palantir and e.l.f. Beauty delivered, with each exceeding consensus expectations, raising guidance, and enjoying bullish reactions post-earnings.Palantir shares overall reflect a very bullish play on the AI frenzy, and it’s certainly a prime selection for those seeking AI exposure. Strong quarterly results driven by snowballing demand provide a notably bullish long-term outlook for the stock, with its current Zacks Rank #2 (Buy) rating also supportive of near-term gains.Slowing sales growth has been a thorn in the side of e.l.f. Beauty, though it’s worth noting that the company continues to gain market share and enjoy margin expansion. While shares have bounced nicely, it looks worthwhile to wait until positive earnings estimate revisions begin hitting the tape and we see continued top line improvement.More By This Author:This Former Pandemic Stock Is Quietly Crushing The MarketDividend Watch: Three Companies Boosting Quarterly PayoutsAre These AI Stocks A Buy Before Earnings?

This Top AI Stock Crushed Quarterly Expectations