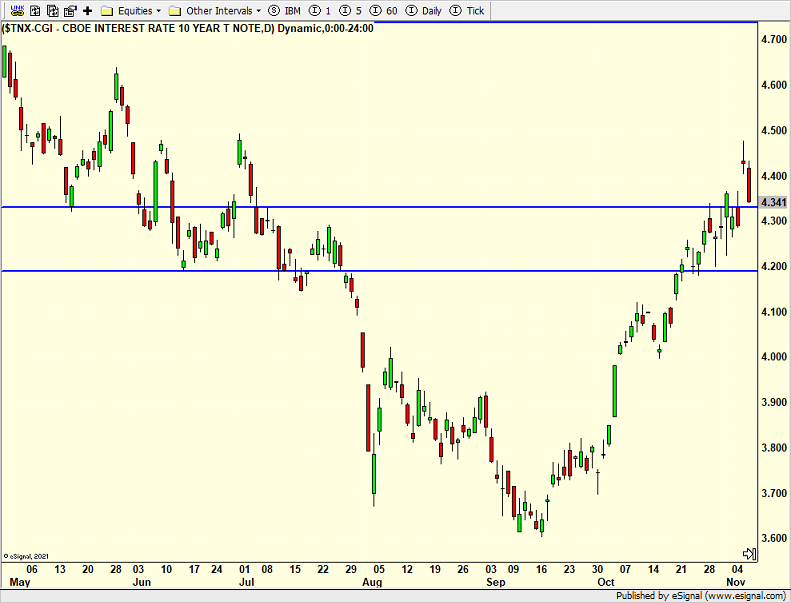

Image Source: Election out of the way. Fed out of the way. Q3 earnings season is mostly over. Not many catalysts for a while. And that’s just the way I like it. Markets need to calm down and digest. Investors’ emotions need to recover. It’s been a whirlwind.As expected the Fed cut interest rates on Thursday and Jay Powell said he would not resign if Trump asked him. Markets didn’t really seem to care. The Fed made a mistake by cutting 0.50% last time. They seem to be front-loading the cuts. I think they are closer to being done.Post-election and Fed reaction has been severe. Lots winners and lots of losers. It has certainly not been a rising tide lifting all ships. And it won’t be ahead either. The bond market has been hit. Although the Fed cut rates by 0.25% intermediate and long-term bond yields have risen.

Image Source: Election out of the way. Fed out of the way. Q3 earnings season is mostly over. Not many catalysts for a while. And that’s just the way I like it. Markets need to calm down and digest. Investors’ emotions need to recover. It’s been a whirlwind.As expected the Fed cut interest rates on Thursday and Jay Powell said he would not resign if Trump asked him. Markets didn’t really seem to care. The Fed made a mistake by cutting 0.50% last time. They seem to be front-loading the cuts. I think they are closer to being done.Post-election and Fed reaction has been severe. Lots winners and lots of losers. It has certainly not been a rising tide lifting all ships. And it won’t be ahead either. The bond market has been hit. Although the Fed cut rates by 0.25% intermediate and long-term bond yields have risen. Stock market sectors sensitive to bonds have fallen. REITs, staples and utilities. Solar stocks are being sold. Homebuilders are under more pressure as is gold. I am looking for a pause or some giveback in both directions from the more extreme moves.Between the election and two trips to UCONN basketball games, I am in need of some catch-up on sleep and couch R&R. Tonight is the annual gala for Friends of Yale Children’s Hospital gala where my wife and son serve on the board. Lots of hard work by a great group for a great cause. And then there’s a social night for the parents for high school baseball. More fun and socializing. And the UCONN teams see more action. I guess it’s another busy weekend waiting for Mother Nature to stop the drought and record warmth. No skiing in sight.On Wednesday we bought more and . We sold some . On Thursday we bought , , , , more , and more MQQQ. We sold , some RSPN, some QQQW, and some .More By This Author:Markets Looking Bullish Post-ElectionElection Model Tightens With Weak Employment And Market SelloffMarkets Firm As Election Draws Closer – Some Model Inputs

Stock market sectors sensitive to bonds have fallen. REITs, staples and utilities. Solar stocks are being sold. Homebuilders are under more pressure as is gold. I am looking for a pause or some giveback in both directions from the more extreme moves.Between the election and two trips to UCONN basketball games, I am in need of some catch-up on sleep and couch R&R. Tonight is the annual gala for Friends of Yale Children’s Hospital gala where my wife and son serve on the board. Lots of hard work by a great group for a great cause. And then there’s a social night for the parents for high school baseball. More fun and socializing. And the UCONN teams see more action. I guess it’s another busy weekend waiting for Mother Nature to stop the drought and record warmth. No skiing in sight.On Wednesday we bought more and . We sold some . On Thursday we bought , , , , more , and more MQQQ. We sold , some RSPN, some QQQW, and some .More By This Author:Markets Looking Bullish Post-ElectionElection Model Tightens With Weak Employment And Market SelloffMarkets Firm As Election Draws Closer – Some Model Inputs

Digesting The Post-Election / Fed Moves