Image Source:

Image Source:

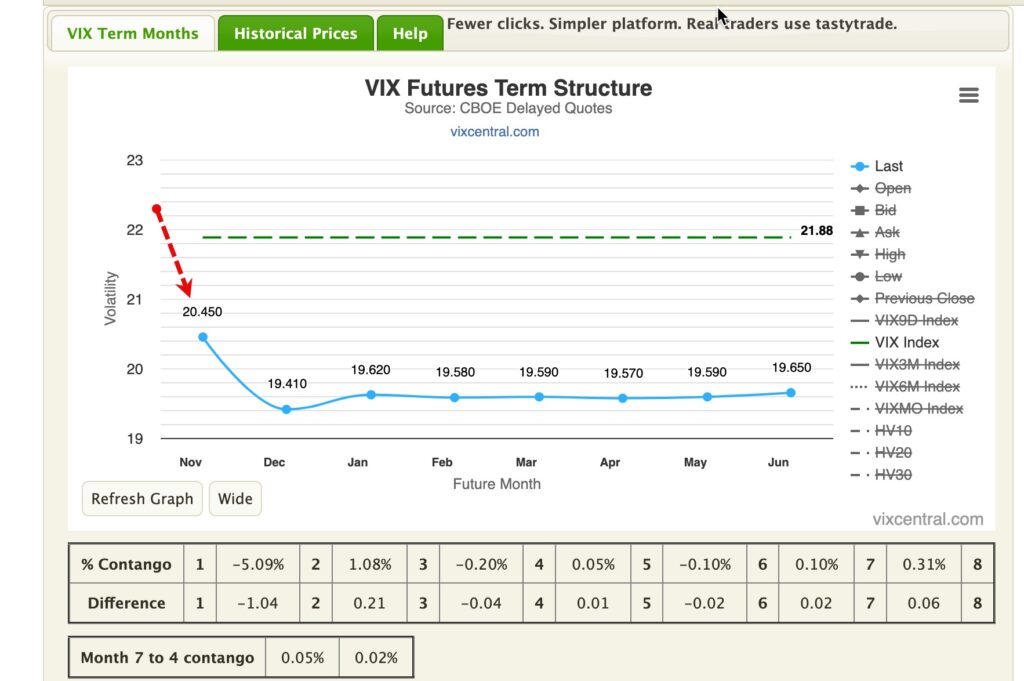

Market volatility for the October and November futures has been elevated for over a year. Will it drop suddenly this week? Or stay high? Here’s what to expect with the stock market and the election this week.Volatility was driven up a year ago!About a year ago, volatility buyers had a plan. They believed that this presidential election would sow chaos and uncertainty. “We’ll get in early when volatility is low, follow the playbook of the last two elections, and protect ourselves before anyone else has the chance.” As a result, uncertainty (volatility) was getting priced into futures.

The stock market and the election: what happens on Nov. 6

On November 6, the election will be over. The result may be in doubt and that may have some people pulling their hair out. But this big event will be over and the market will simply move forward. There is so much more to worry about after the election: the next Fed meeting and maybe more interest rate cuts, earnings season, inflation, and the holidays.So, what happens to that elevated volatility (see below) in November futures after the election?(Click on image to enlarge)

It’s going to sell off of course, because the event that was being priced has concluded.We often see equity futures move higher when volatility comes down. Just look at what happens after an inflation, jobs, or earnings report is released. The tension and stress over the uncertainty is gone, and the markets move forward.But what if the volatility does not move down and the stock market does not move up?Well, that is why you buy index put protection. Puts balance out volatility. Nothing is ever guaranteed (especially not in trading), so you always have to try to lower the temperature of high volatility in your portfolio, even for a short time. If the market rises, you can unload those puts.More By This Author:

The Stock Market And The Election: What To Expect This Week