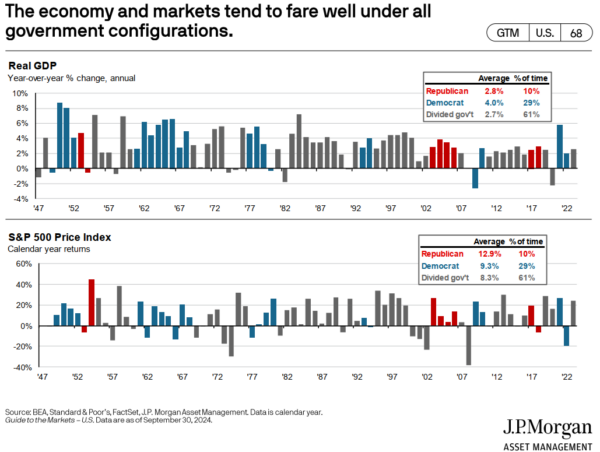

In a few short days/hours there will be a new President of the United States. Between now and then and long after you will hear biased stories about how the world is going to be transformed by political agendas. Some of it will be true, but most of it will be noise inside a system that is much larger and more complex than politics. As an example of this, consider this data point from :“Exhibit 4 highlights real GDP growth and S&P 500 returns during Republican, Democratic, and divided governments (when one party does not control the White House and both chambers of Congress). Since 1947, real GDP has grown on average 2.8% under Republican rule and 4.0% under Democratic rule. The S&P 500 has returned 12.9% under Republicans and 9.3% under Democrats.”

This is really important. The USA is very specifically structured to have checks and balances. No party is intended to be in total control most of the time. And in the post-WW2 era the government has been divided 61% of the time. Republicans have had total control just 10% of the time and Democrats have had total control just 29% of the time. During periods where Democrats were in total control the economy performed better, but the markets performed worse. And during periods of total Republican control the economy did worse and the markets performed better.Consider also that much of this is just random data in a relatively small dataset. For example, Congress was divided in the 1990s during the tech boom. Some might look at the President and say “Clinton caused a mess that the Republicans had to clean up”. Or consider the GFC. You might look at the post-GFC recovery and say “thankfully Obama was in office to clean up that Republican mess”. You can make up whatever narrative you want about this stuff, but the truth is that there is no clear party that’s better or worse for the economy. In fact, I’d argue that the one of the things that makes the US economy work so well is that it’s never controlled by one group for too long. There’s consistent turnover in the political agendas that forces compromise. Despite this you will consistently hear narratives about how the stock market or economy perform better under certain types of regimes. None of it is supported by meaningful data!More importantly, the economy and markets aren’t driven by politics in an economy like the USA where the government is so intentionally decentralized across different branches, states and local entities. No one has enough control to drive the economic car in a single direction. And while politicians will often take credit for certain outcomes the reality is that the US economic vehicle is being driven by hardworking people who wake up every day and strive to be a little bit better. We spend so much talking about things like the Fed and government spending that it can be hard to remember that these are tangential factors in a system so large and complex that it’s usually other macro factors that matter the most.The point here is that the markets and the economy don’t really care about politics. This is not to say that politics don’t matter. But in an economy as large and complex as the US economy the most important driving factors are going to be things that the government doesn’t control with a dial.1 So get out there and vote. But don’t vote with your portfolio as your portfolio is going to be agnostic to politics in the long-run.1 – I think it would be fair to say that politics has an asymmetric impact at specific times. For example, the economic impact of policies in 2008 and 2009 have a much bigger impact than policies enacted in 2012. During a recession or crisis policy has a huge multiplier effect whereas during more benign environments the engine of the economy is consumers, innovators and corporations.More By This Author:The Employment Report And Future Inflation Three Things – Early Weekend ReadingNvidia, Rising Rates And Recession Risk

Chart Of The Day – Ignoring Political Noise