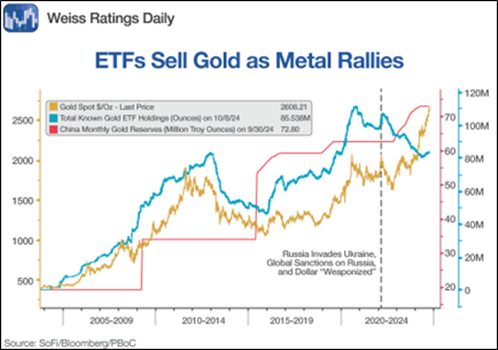

Image Source: Force No. 1: More Rate Cuts Are Coming. It was just a few weeks ago that the Federal Reserve finally, FINALLY began cutting its benchmark interest rate, with the first cut in four years. The Fed slashed its benchmark rate by 50 basis points to a target range of 4.75% to 5%.There should be at least another 50 basis points worth of cuts before the end of the year – and four more 25-basis-point cuts in 2025 – if the Fed’s “dot plot” forecast holds true. The Fed is expecting to lower its benchmark rate to 4.1% by June 2025, and 3.1% by June 2026. This chips away at support for the US dollar against other currencies. Since gold is priced in dollars, as the greenback goes down, the yellow metal usually goes up.Force No. 2: A Bull Flag. A chart of gold showed the metal forming a bull flag recently, one of the most reliable chart patterns. The SPDR Gold Shares ETF () had also been stepping higher along the 20-day moving average, forming its own bull flag. Then both broke out to the upside. The old saying on Wall Street is, “Flags fly at half mast.” So, if gold follows through on the breakout, we should see the metal move another 14% higher in the short term. That would push gold to nearly $3,100 per ounce.In the long term, my research gives me a gold target of $6,902. That will take a few years, and it’s a zigzagging path higher. Pullbacks can be bought.So, what will power gold on that next leg higher?Force No. 3: Gold ETF Buying. As a gold investor, I’ve always viewed physical gold ETFs as a two-sided sword. They help during bull markets as investors pile in and help push gold higher. But in bear markets, physical ETFs make things worse by adding to the selling.We’re in a bull market now. And ETF buyers are just waking up to it. Check out this next chart, showing the price action in gold, buying and selling by physical gold ETFs, and gold purchases by China’s central bank.

Image Source: Force No. 1: More Rate Cuts Are Coming. It was just a few weeks ago that the Federal Reserve finally, FINALLY began cutting its benchmark interest rate, with the first cut in four years. The Fed slashed its benchmark rate by 50 basis points to a target range of 4.75% to 5%.There should be at least another 50 basis points worth of cuts before the end of the year – and four more 25-basis-point cuts in 2025 – if the Fed’s “dot plot” forecast holds true. The Fed is expecting to lower its benchmark rate to 4.1% by June 2025, and 3.1% by June 2026. This chips away at support for the US dollar against other currencies. Since gold is priced in dollars, as the greenback goes down, the yellow metal usually goes up.Force No. 2: A Bull Flag. A chart of gold showed the metal forming a bull flag recently, one of the most reliable chart patterns. The SPDR Gold Shares ETF () had also been stepping higher along the 20-day moving average, forming its own bull flag. Then both broke out to the upside. The old saying on Wall Street is, “Flags fly at half mast.” So, if gold follows through on the breakout, we should see the metal move another 14% higher in the short term. That would push gold to nearly $3,100 per ounce.In the long term, my research gives me a gold target of $6,902. That will take a few years, and it’s a zigzagging path higher. Pullbacks can be bought.So, what will power gold on that next leg higher?Force No. 3: Gold ETF Buying. As a gold investor, I’ve always viewed physical gold ETFs as a two-sided sword. They help during bull markets as investors pile in and help push gold higher. But in bear markets, physical ETFs make things worse by adding to the selling.We’re in a bull market now. And ETF buyers are just waking up to it. Check out this next chart, showing the price action in gold, buying and selling by physical gold ETFs, and gold purchases by China’s central bank. The gold line is the price of gold itself. The blue line is total known gold ETF holdings. Until recently, even as the price of gold went up, gold ETFs were selling into the market. That means those physical ETFs were a drag on the price of gold — but purchases by the world’s central banks overwhelmed that selling. More recently, though, physical ETFs started buying the metal; you can see how the blue line turned higher. In September alone, it amounted to $1.4 billion worth of gold purchases. This adds a force to the gold market that was absent — and opens the way to a big, bold move higher in the yellow metal.Recommended Action: Buy gold.More By This Author:TLT: Bonds Selling Off For These Reasons. So, What Does It Mean For Stocks? XMMO: A Momentum ETF To Buy On The Market’s Rate-Related PullbackAlamos Gold: A Mining Stock To Target As Central Banks Pile Into Gold

The gold line is the price of gold itself. The blue line is total known gold ETF holdings. Until recently, even as the price of gold went up, gold ETFs were selling into the market. That means those physical ETFs were a drag on the price of gold — but purchases by the world’s central banks overwhelmed that selling. More recently, though, physical ETFs started buying the metal; you can see how the blue line turned higher. In September alone, it amounted to $1.4 billion worth of gold purchases. This adds a force to the gold market that was absent — and opens the way to a big, bold move higher in the yellow metal.Recommended Action: Buy gold.More By This Author:TLT: Bonds Selling Off For These Reasons. So, What Does It Mean For Stocks? XMMO: A Momentum ETF To Buy On The Market’s Rate-Related PullbackAlamos Gold: A Mining Stock To Target As Central Banks Pile Into Gold

Gold: Two Past Drivers Pushing It Higher (& One That’s Just Emerging!)