Image Source:

Image Source:

The UK’s benchmark stock indexes declined on Thursday and were poised to end the month with substantial losses as investors lost optimism about more significant rate cuts over the next year, while Shell surged after exceeding profit forecasts. The blue-chip FTSE 100 skidded 0.88% into the close, reaching its lowest point since Aug. 8 and on track for its second consecutive week of losses.In single stock stories Smith & Nephew, a British medical equipment maker, saw its shares fall as much as 12.4% to 961.80p, making it the top percentage loser on the FTSE 100 index. The company has cut its annual underlying revenue growth forecast for 2024, citing weaker-than-expected demand for its surgical products in China. The company now expects annual underlying revenue growth of 4.5%, down from an earlier forecast of 5%-6% and below analysts’ estimate of 5.2%. The company’s Q3 revenue was hit by weak customer demand for its knee implants in China and a lack of volume benefits from the Volume Based Procurement (VBP) programme. The stock is set for its biggest one-day percentage drop since July 2022 and has hit its lowest level since April 25, with year-to-date losses of around 11%.Coca Cola HBC’s shares rise 2.7% to 2,740 pence, leading the FTSE 100 benchmark. The company expects full-year organic revenue growth of 11%-13%, up from the previous forecast of 8%-12%, and organic EBIT growth of 10% to 12%, compared to the prior forecast of 7%-12%. Coca Cola HBC exceeded market estimates for Q3 organic revenue growth, driven by strong demand for energy, coffee, and sparkling drinks. The company’s shares have gained nearly 16% so far this year.Shares in Anglo American rose 1.2%, ranking second on the FTSE 100. BHP clarified that its pursuit of Anglo American is not off the table. BHP’s chair had earlier stated that the Australian miner was moving on from Anglo and looking for other opportunities, which BHP later clarified did not mean it would not renew its attempt to acquire Anglo American. Anglo American’s shares slid around 4% on Wednesday after BHP’s chair made the remarks, but BHP subsequently clarified those comments. BHP had walked away from a $49 billion bid to acquire Anglo American after it was rejected three times in late May. Under UK takeover rules, BHP can table a new proposal to buy Anglo American from late November, six months after it walked away. Anglo American’s shares are up about 23% so far this year.UK homebuilders down 1.8%. Higher inflation fuelled by Britain’s new big-spending budget plans is likely to prevent the Bank of England from cutting interest rates over the next year by as much as investors had expected. UK homebuilders gained on Wednesday after UK Finance Minister Rachel Reeves announced over 5 bln pounds of housing investment and said it will increase the Affordable Homes Programme to 3.1 bln pounds. The Office for Budget Responsibility says budget plans would raise inflation, adding half a percentage point to the rate of consumer price growth next year. FTSE 100 homebuilders Barratt, Vistry, Taylor Wimpey and Berkeley down 1.8% to 2%. Including session’s losses, sub index up 1.2% YTD.

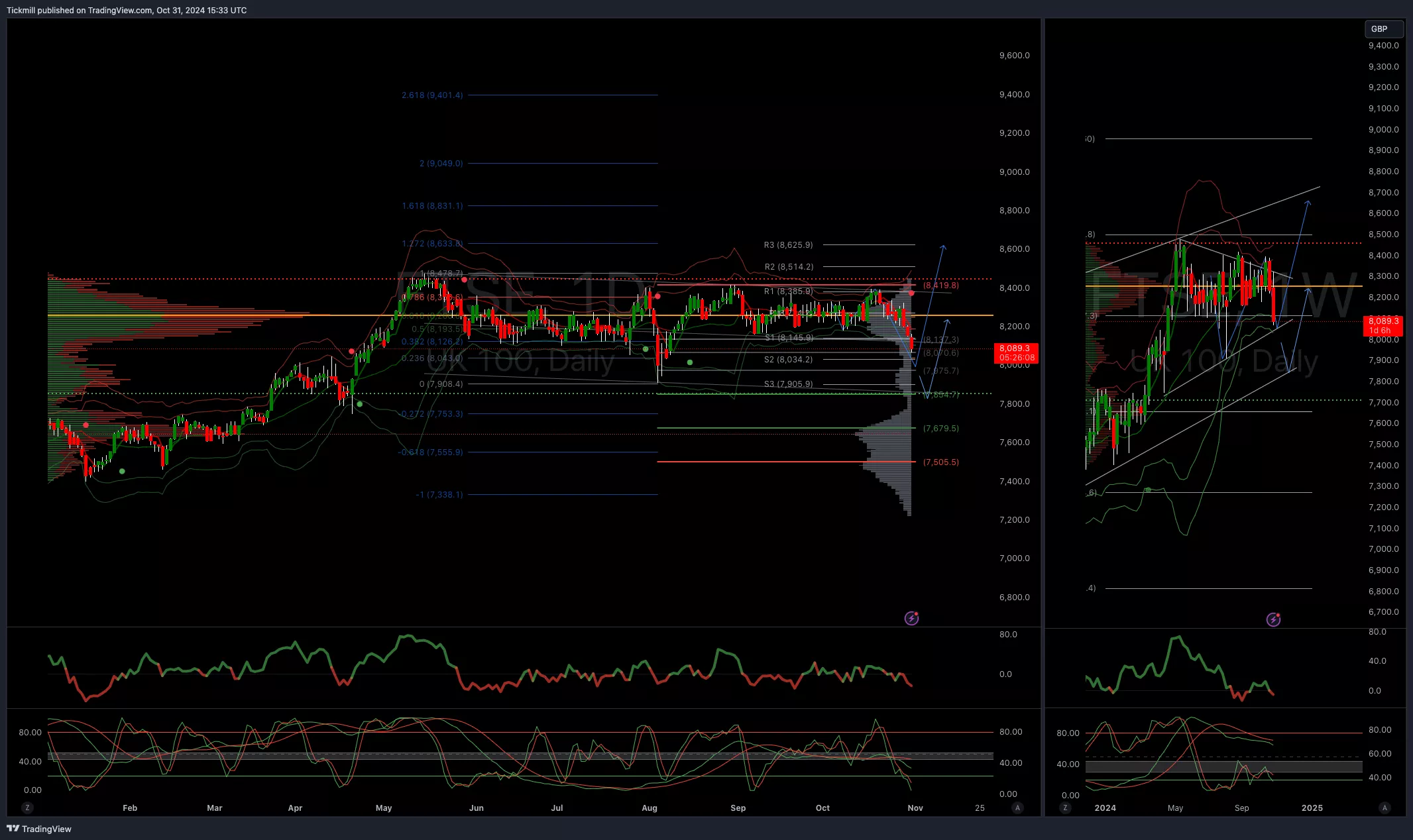

Technical & Trade ViewFTSE Bias: Bullish Above Bearish below 8225

(Click on image to enlarge) More By This Author:

More By This Author: