Image Source:

Image Source:

Indian silver demand has spiked, driving the price to record levels in rupee terms.There is a perception that silver has lagged gold despite a price increase of around 35 percent on the year in dollar terms. The fact that silver remains well below its record high, even as gold has in recent months, drives this feeling.But if you look at the trajectory of silver from an Indian perspective, it doesn’t seem like such a laggard. On Oct. 23, silver briefly eclipsed the ₹100,000 per ounce level before settling around a record high of around ₹97,000.Notably, this rally occurred after by more than half, lowering duties from 15 percent to 6 percent. , the market responded favorably to both the import duty cut and its timing right before the festive wedding season.Silverware sales seemed to benefit the most.

“Our discussions with the trade suggested that silverware demand was subdued beforehand, given that these articles are mainly used for gifting and so high prices acted as a deterrent. However, the price correction, post-duty-cut, saw this area of Indian silver demand return quite significantly.”

Improving rural consumption also boosted Indian silver demand. According to Metals Focus, rebounding silver sales in the countryside reflect a general improvement in the rural Indian economy.

“For instance, two-wheeler sales grew by 13 percent y/y in Q3. More importantly, cumulative sales from April to September surpassed 10m units for the first time since 2019, indicating a return to normalcy.”

A good monsoon season is expected to boost crop yields this year, pumping more money into the rural economy. This will likely drive stronger demand for both gold and silver.Rural silver consumption accounts for around two-thirds of total Indian demand.Record gold prices also boosted silver demand in India, particularly silver jewelry sales.

“Anecdotally, several of our contacts have suggested that many low-income consumers have opted for silver, or gold-plated silver jewelry, in response to the record high gold price in India.”

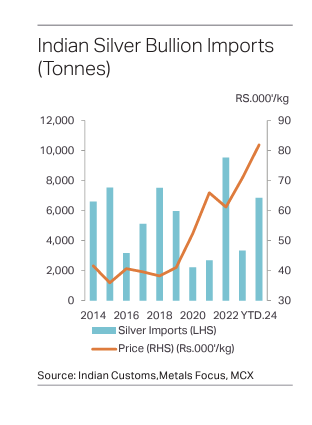

You can see the increase in demand reflected by a spike in silver imports. India received 948 tons of silver in September, and silver imports totaled 2,548 tons in Q3, a 572 percent year-on-year increase. Through the first nine months of 2024, silver imports totaled 7,079 tons, an eightfold increase over last year. The question is how will record prices impact silver demand moving forward. There is some evidence that since the price increase has effectively wiped out the benefit of the lower import duty; silver sales are beginning to cool. However, some bullish demand dynamics remain in play.Diwali (the Hindu festival of lights) falls on Oct. 31 this year. This is an auspicious time to buy metal and an important season for both gold and silver demand. Metals Focus said it remains unclear exactly how record silver prices will impact sales.

The question is how will record prices impact silver demand moving forward. There is some evidence that since the price increase has effectively wiped out the benefit of the lower import duty; silver sales are beginning to cool. However, some bullish demand dynamics remain in play.Diwali (the Hindu festival of lights) falls on Oct. 31 this year. This is an auspicious time to buy metal and an important season for both gold and silver demand. Metals Focus said it remains unclear exactly how record silver prices will impact sales.

“We expect sales volumes to be undermined even as footfall matches that of previous years, due to the price impact as consumers are likely to prefer lighter weight jewelry and silverware. That said, as mentioned earlier, the high gold price could potentially lead to a positive spillover for silver, especially for the gold-plated silver jewelry segment.”

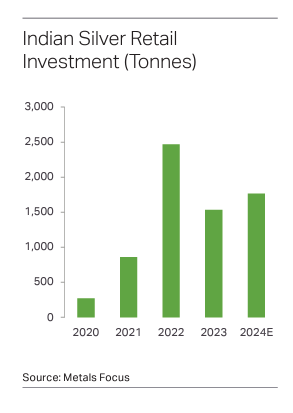

Meanwhile, with prices hitting record levels, investment interest in silver has remained strong.  Over the last decade, investors have accumulated over 17,500 tons of silver in the form of coins and bars. Many analysts thought rising prices would motivate Indian investors to liquidate their extensive silver holdings. However, according to Metals Focus, selling has been “trivial,” even as the price eclipsed ₹100,000.

Over the last decade, investors have accumulated over 17,500 tons of silver in the form of coins and bars. Many analysts thought rising prices would motivate Indian investors to liquidate their extensive silver holdings. However, according to Metals Focus, selling has been “trivial,” even as the price eclipsed ₹100,000.

“Our research suggests that investors are still accumulating physical silver to participate in the bull run. This is primarily driven by still positive price expectations.”

We also see silver investment demand reflected in silver ETFs. Silver holdings by Indian-based funds climbed above 1,000 tons in August. On the other side of the equation, silver supply remains constrained. Globally, silver has charted a market deficit for three straight years, and demand is expected to outstrip supply again in 2024 due to record industrial offtake and lagging silver mine output.And according to Metals Focus, there doesn’t appear to be a strong market for silver scrap to help ease the supply constraints.

“While there has been a rise in the share of jewelry that is exchanged, outright sales of old jewelry are still very low indicating positive consumer price expectations.”

Looking ahead, higher prices will likely create headwinds for silver demand in India, but there are plenty of bullish factors to offset the effect. More By This Author: