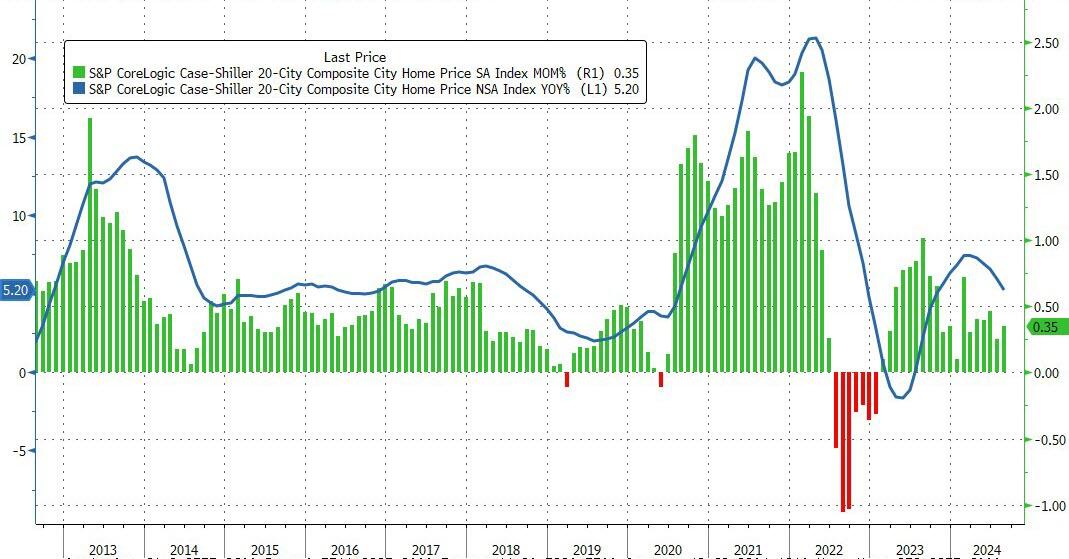

With mortgage rates re-accelerating, the housing market faces another (worsening) affordability crisis – all since The Fed cut rates – and just to add some more pain to that, S&P CoreLogic’s Case Shiller data for August (released today) shows home prices in the top 20 cities in America rising 0.35% MoM (hotter than the 0.20% expected). However, despite the beat, home prices rose just 5.2% YoY (down from 5.93% in July) and the fifth straight monthly slowdown in the YoY growth… Source: BloombergThat is the lowest YoY growth since September 2023… but we note that home prices remain near record highs…

Source: BloombergThat is the lowest YoY growth since September 2023… but we note that home prices remain near record highs… Source: BloombergThe pace of home price appreciation continues to track bank reserves at The Fed (lower on a lag)…

Source: BloombergThe pace of home price appreciation continues to track bank reserves at The Fed (lower on a lag)… Source: BloombergOf course, the funniest thing is that as price appreciation actually begins to slow (a good thing for affordability at the margin), The Fed has slashed interest-rates (which one would expect will juice home prices once again?).But despitye the initial drop in mortgage rates, they have soared recently back above 7.00%…

Source: BloombergOf course, the funniest thing is that as price appreciation actually begins to slow (a good thing for affordability at the margin), The Fed has slashed interest-rates (which one would expect will juice home prices once again?).But despitye the initial drop in mortgage rates, they have soared recently back above 7.00%… Source: BloombergWill The Fed ignite another houosing bubble and re-heat CPI in an Arthur-Burns-esque 1970s redux?More By This Author:

Source: BloombergWill The Fed ignite another houosing bubble and re-heat CPI in an Arthur-Burns-esque 1970s redux?More By This Author:

US Home Prices Remain Near Record Highs… As Mortgage Rates Re-Surge