Image Source:

Image Source:

The results of Japan’s Lower House elections have led to a significant defeat for the Liberal Democrat-Komeito coalition. This is likely to contribute to ongoing volatility in the USDJPY exchange rate as political uncertainty in Japan is compounded by other macro risks, the benchmark Nikkei225 is trading sharply higher, gaining 1.8%. Mainland China stocks recovered from initial declines in early trading on Monday, while Hong Kong stocks also flipped from red to green as investors await potential outcomes of pivotal meetings at home and the U.S. presidential election next week. China’s blue-chip index advanced 0.15%, while the Hong Kong benchmark Hang Seng also posted modest gains of 0.15%. China’s top legislative body will meet from Nov. 4-8, with no mention on the agenda of highly anticipated debt and other fiscal measures. Earlier, China’s central bank announced it had activated its open market outright reverse repo operations facility and would use it to trade with primary dealers in open market operations on a monthly basis. Republican former President Donald Trump and Democratic Vice President Kamala Harris are in a tight race in key swing states ahead of the November 5 election. Investors are concerned about a disputed outcome disrupting global markets and triggering renewed geopolitical uncertainty.With important events like the Bank of Japan’s policy meeting, the October jobs report from the United States, the UK budget, and the aftermath of the Japanese election, this week will be busy. Governor Ueda continues to indicate a cautious stance to further tightening, and the Bank of Japan is anticipated to keep its policy rate at 0.25%. Japan will publish a range of economic data, such as retail sales, industrial production, consumer confidence, and unemployment. Stateside Investors will have access to a broad set of economic data, such as consumer confidence, ADP jobs, advance Q3 GDP, the September PCE price index, JOLTS job openings, ISM manufacturing PMI, and the monthly jobs report, even though the U.S. Federal Reserve enters a blackout period prior to its policy meeting on November 6-7. A major event for rates, investors, and sterling is expected to be Wednesday’s release of the UK’s first budget under the new Labour government. China will announce its official and Caixin manufacturing PMIs in the latter part of the week, while the euro zone will release flash Q3 GDP, sentiment indices, final October consumer confidence, and flash HICP. Additionally, 41% of S&P market cap is scheduled to report next week, which is the busiest week of the 3Q earnings season. Some of the key highlights include:Tuesday – , Wednesday – , Thursday – ,

Overnight Newswire Updates of Note

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut (1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

CFTC Data As Of 25/10/24

Technical & Trade ViewsSP500 Bullish Above Bearish Below 5775

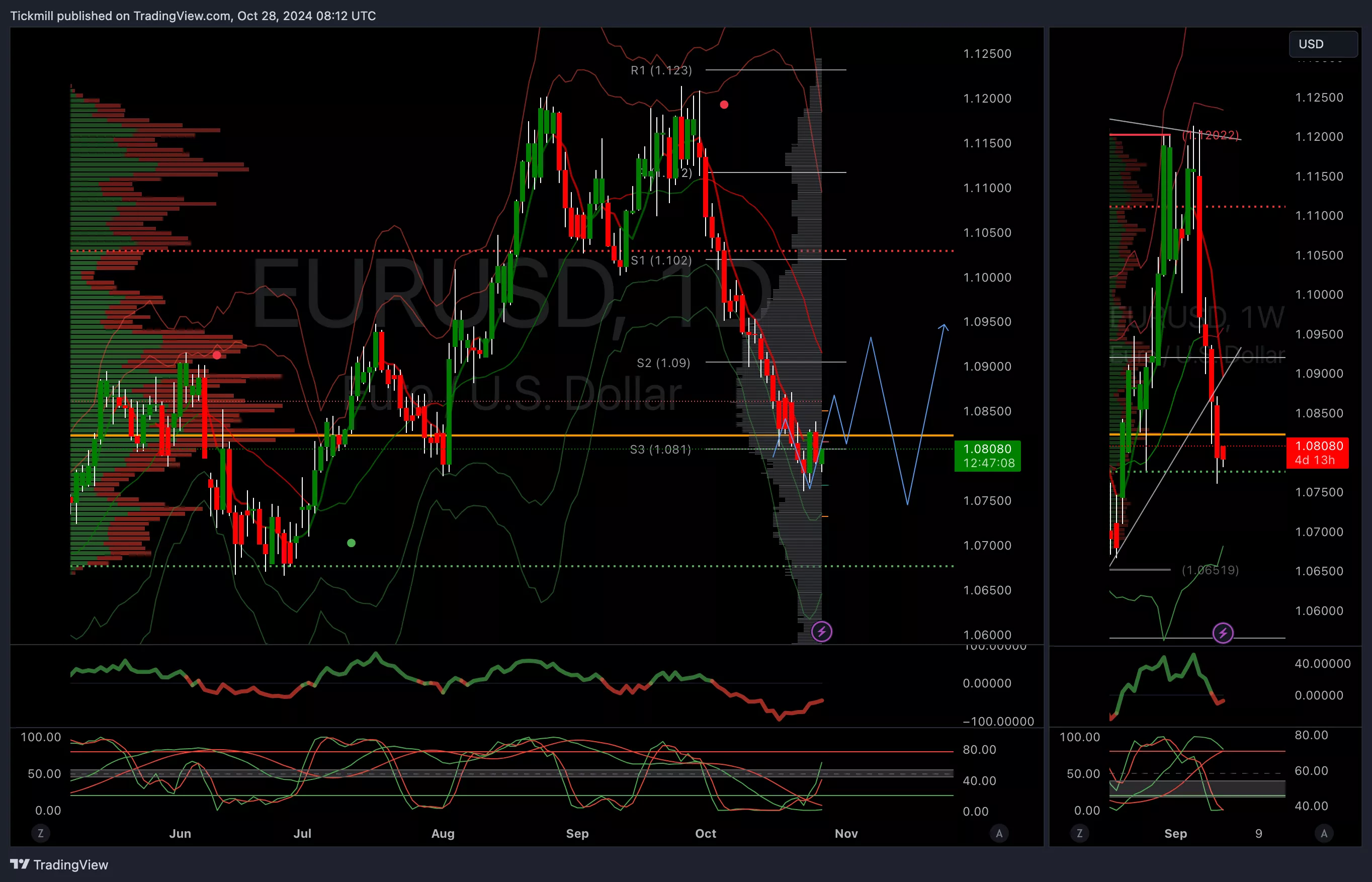

(Click on image to enlarge) EURUSD Bullish Above Bearish Below 1.0950

EURUSD Bullish Above Bearish Below 1.0950

(Click on image to enlarge) GBPUSD Bullish Above Bearish Below 1.31

GBPUSD Bullish Above Bearish Below 1.31

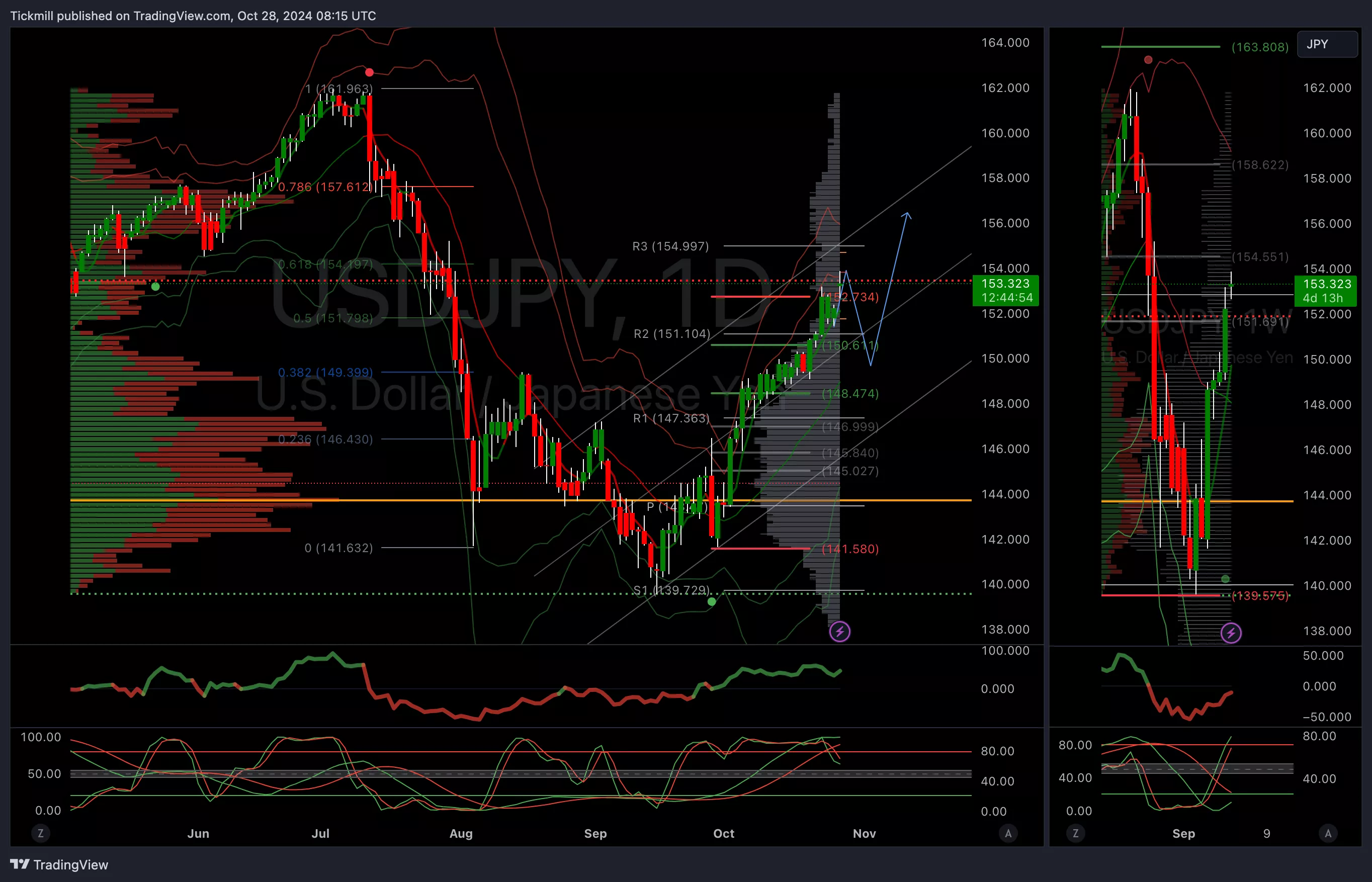

(Click on image to enlarge) USDJPY Bullish Above Bearish Below 148

USDJPY Bullish Above Bearish Below 148

(Click on image to enlarge) XAUUSD Bullish Above Bearish Below 2680

XAUUSD Bullish Above Bearish Below 2680

(Click on image to enlarge) BTCUSD Bullish Above Bearish Below 64000

BTCUSD Bullish Above Bearish Below 64000

(Click on image to enlarge) More By This Author:

More By This Author: