American Q3 Results

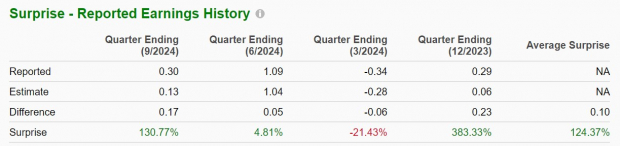

Attributed to what it called an aggressive shift in its sales and distribution strategy, American raised its profit guidance after posting Q3 EPS of $0.30 which crushed the Zacks Consensus of $0.13 a share. Year over year, Q3 earnings were down from $0.38 a share in the comparative quarter with CEO Robert Isom stating American is looking for ways to reengage the business travel community.Still, Q3 sales rose to a record $13.64 billion which surpassed year-ago metrics and estimates of $13.48 billion. Optimistically, the world’s largest airliner in terms of passengers was confident that its strategic initiatives would continue to boost its revenue and performance over time. Even better, American raised its earnings outlook and now expects Q4 EPS at $0.25-$0.30. This came in range of the current Zacks Consensus of $0.26 a share. American now forecasts full-year fiscal 2024 EPS at $1.60 which came in well above current expectations of $1.22 per share. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Southwest Q3 Results

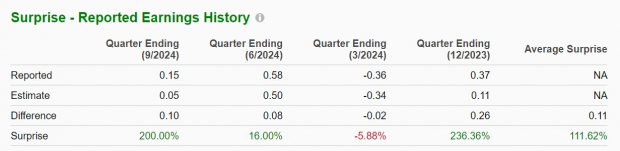

Lower fuel costs helped Southwest post a surprise profit of $0.15 a share compared to Q3 EPS estimates of $0.05. This was despite Southwest’s bottom line dipping from $0.38 per share in the prior-year quarter.Southwest also expects strategic initiatives will help the company get back to a strong financial performance with Q3 sales of $6.87 billion topping estimates of $6.79 billion and rising 5% from $6.52 billion a year ago. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Rising EPS Estimates

Aforementioned and already suggesting more upside in American and Southwest Airlines stock is a trend of rising EPS estimates.In this regard, American’s FY24 earnings estimates have soared 14% in the last month from $1.07 a share to $1.22 per share. Plus, FY25 EPS estimates have risen over 7% in the last 30 days. Image Source: Zacks Investment ResearchAs for Southwest, its FY24 earnings estimates have skyrocketed 133% in the last month from projections of $0.24 a share to $0.56 per share. Furthermore, Southwest’s FY25 EPS estimates have increased more than 15% in the last 30 days.

Image Source: Zacks Investment ResearchAs for Southwest, its FY24 earnings estimates have skyrocketed 133% in the last month from projections of $0.24 a share to $0.56 per share. Furthermore, Southwest’s FY25 EPS estimates have increased more than 15% in the last 30 days. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Following their favorable Q3 results now may be a good time to buy American and Southwest Airlines stock.To that point, their trend of positive earnings estimate revisions should continue. Notably, this comes ahead of the busy holiday travel season during Q4, and both airliners are expecting a sharp rebound on their bottom lines in FY25.More By This Author:INTC Stock Before Q3 Earnings Release: To Buy Or Not To Buy? American Airlines Surpasses Q3 Earnings And Revenue Estimates IBM Tops Q3 Earnings Estimates

Top Airline Stocks To Buy After Q3 Earnings: AAL & LUV