Image Source:

Image Source:

Tesla’s better-than-expected profits gave investors some last minute relief overnight. After reporting strong third-quarter earnings and surprising analysts with a forecast for a 20–30% increase in sales next year, Tesla’s stock surged 12% in after-hours trade. Futures on the S&P 500 increased by 0.4%, while those on the Nasdaq increased by 0.7%. The so-called Magnificent Seven tech firms saw significant losses ahead of their quarterly reporting, and U.S. markets had been down for three days in a row before the overnight recovery. Asian stocks fell on Thursday, the dollar stayed close to three-month highs, and U.S. rates increased as market anxiety persisted due to the outcome of the U.S. election. Higher U.S. Treasury rates, the uncertainty surrounding the U.S. election, and mounting anticipation of a more cautious Federal Reserve easing tempo all combined to limit risk sentiment. Market anxiety is exacerbated by growing expectations of Donald Trump’s potential return to the White House. In Asia, the Nikkei in Tokyo recovered from previous losses to gain 0.2%. Declines in Chinese equities put pressure on MSCI’s broadest index of Asia-Pacific stocks outside of Japan, which fell 0.3%. The Hang Seng index in Hong Kong lost 1.2%, while the blue chips in China slid 0.5%. The yen weakened across the board after Bank of Japan Governor Kazuo Ueda stated that it was still taking time to achieve the central bank’s inflation goal. The case for a strong yen remains compelling, but the normalisation process is rarely smooth. The market has repriced expectations for Fed rate cuts, and the US economy continues to grow at a solid pace. The translation of the US/Japan 2y OIS spread to the currency looks exaggerated, and factors like potential Trump tariffs may be influencing price action. Carry might seem appealing, but the sustainability of swap spread levels is questionable. A cautious approach to the USD/JPY rally seems prudent at current levels.Markets in Europe on Thursday will focus on preliminary Purchasing Managers’ Index (PMI) readings, particularly from the euro zone, where growth prospects have become a concern. Business activity in the bloc is expected to remain in contractionary territory, keeping pressure on the European Central Bank (ECB) to cut rates sooner. ECB President Lagarde said the bank would need to be cautious in further easing, although sources indicate policymakers are debating whether rates need to go below neutral to stimulate the economy. Futures pricing shows traders expect rates to fall below 2% by June next year. This has weighed on the euro, which is down over 3% this month and on track for its steepest monthly decline since April 2022. PMI figures for the UK and US will also be released, with growth likely to fare better than in the euro zone.

Overnight Newswire Updates of Note

FX Options Expiries For 10am New York Cut (1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

CFTC Data As Of 18/10/24

Technical & Trade ViewsSP500 Bullish Above Bearish Below 5750

(Click on image to enlarge) EURUSD Bullish Above Bearish Below 1.0950

EURUSD Bullish Above Bearish Below 1.0950

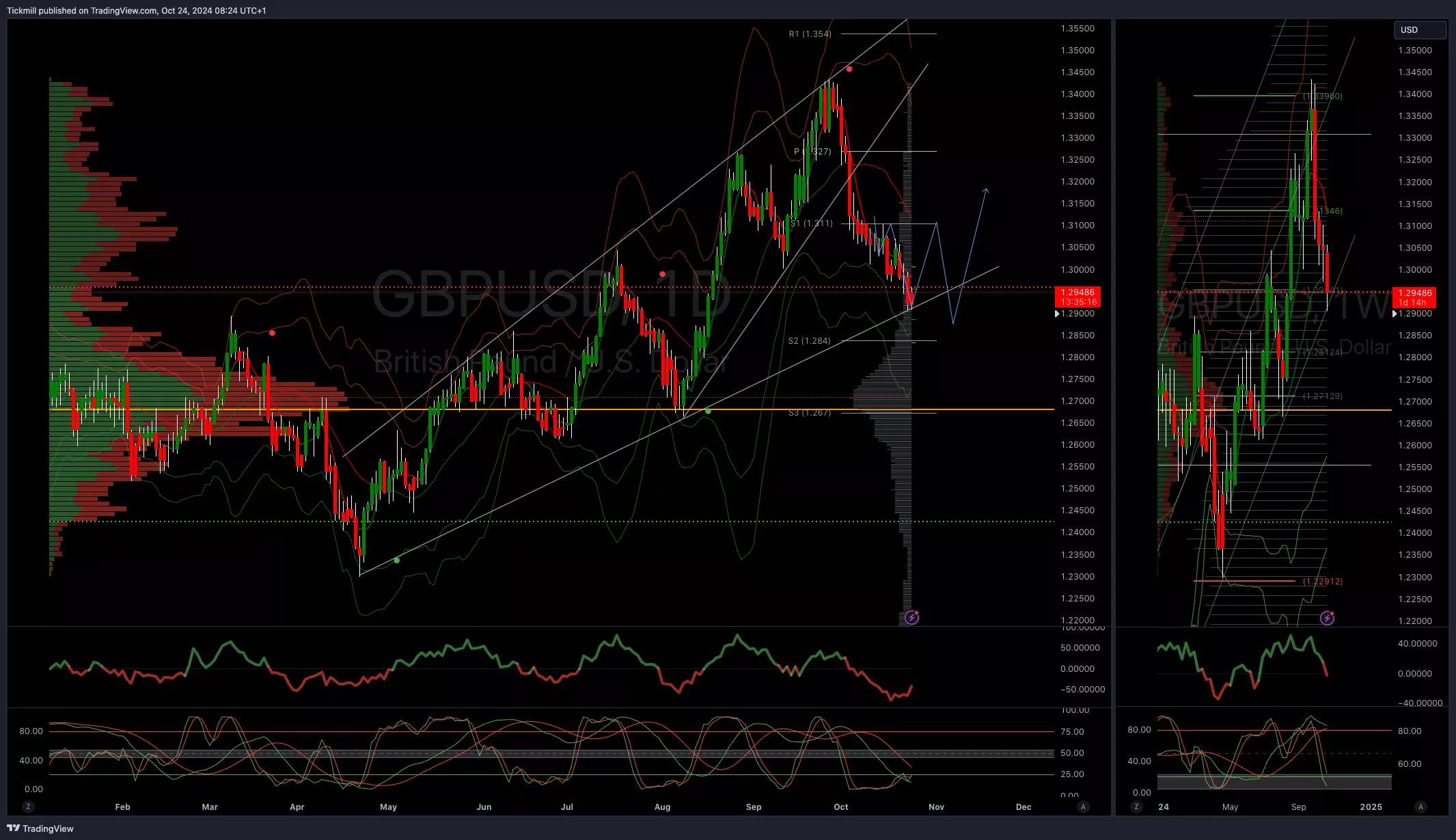

(Click on image to enlarge) GBPUSD Bullish Above Bearish Below 1.31

GBPUSD Bullish Above Bearish Below 1.31

(Click on image to enlarge) USDJPY Bullish Above Bearish Below 148

USDJPY Bullish Above Bearish Below 148

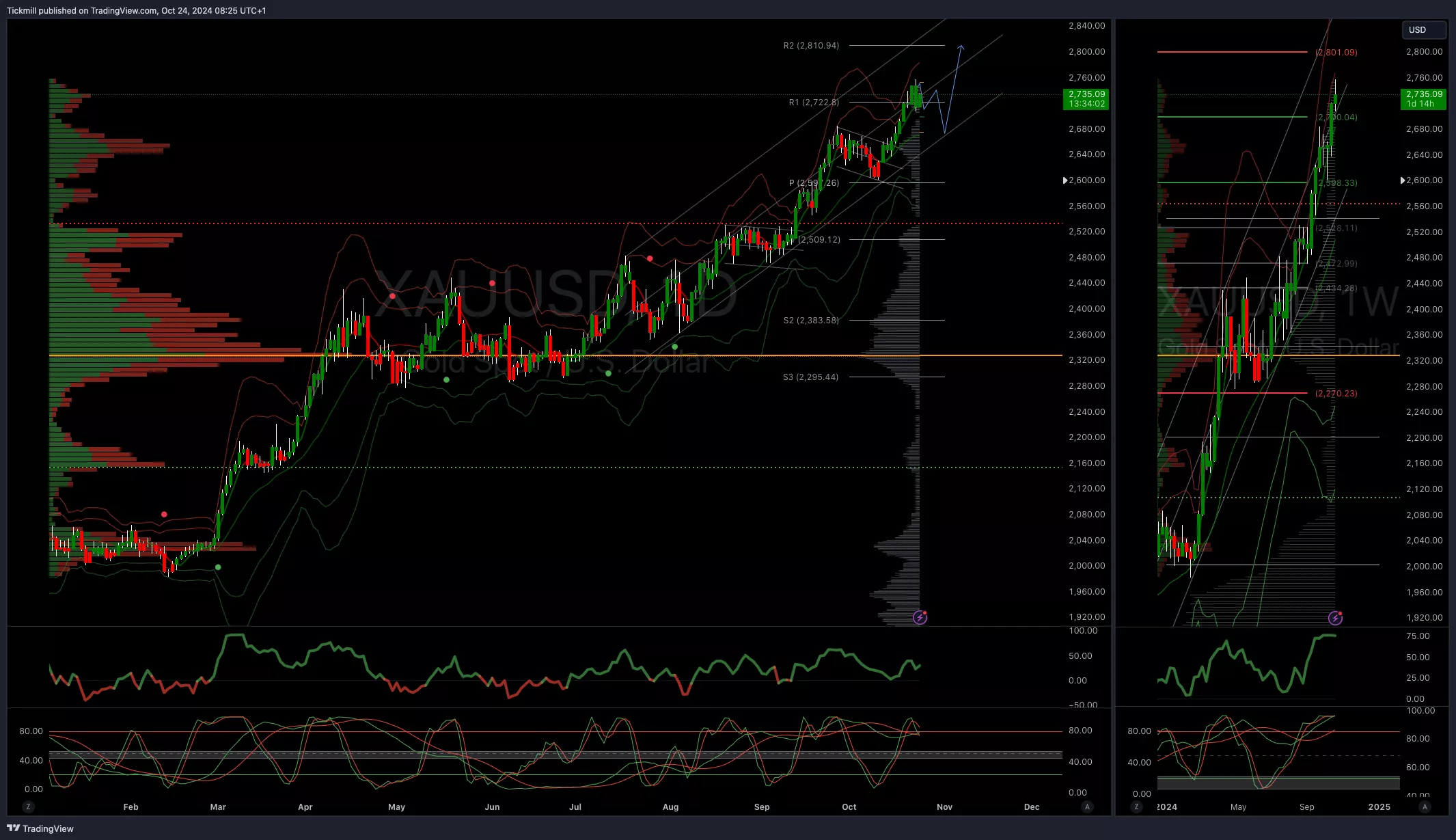

(Click on image to enlarge) XAUUSD Bullish Above Bearish Below 2680

XAUUSD Bullish Above Bearish Below 2680

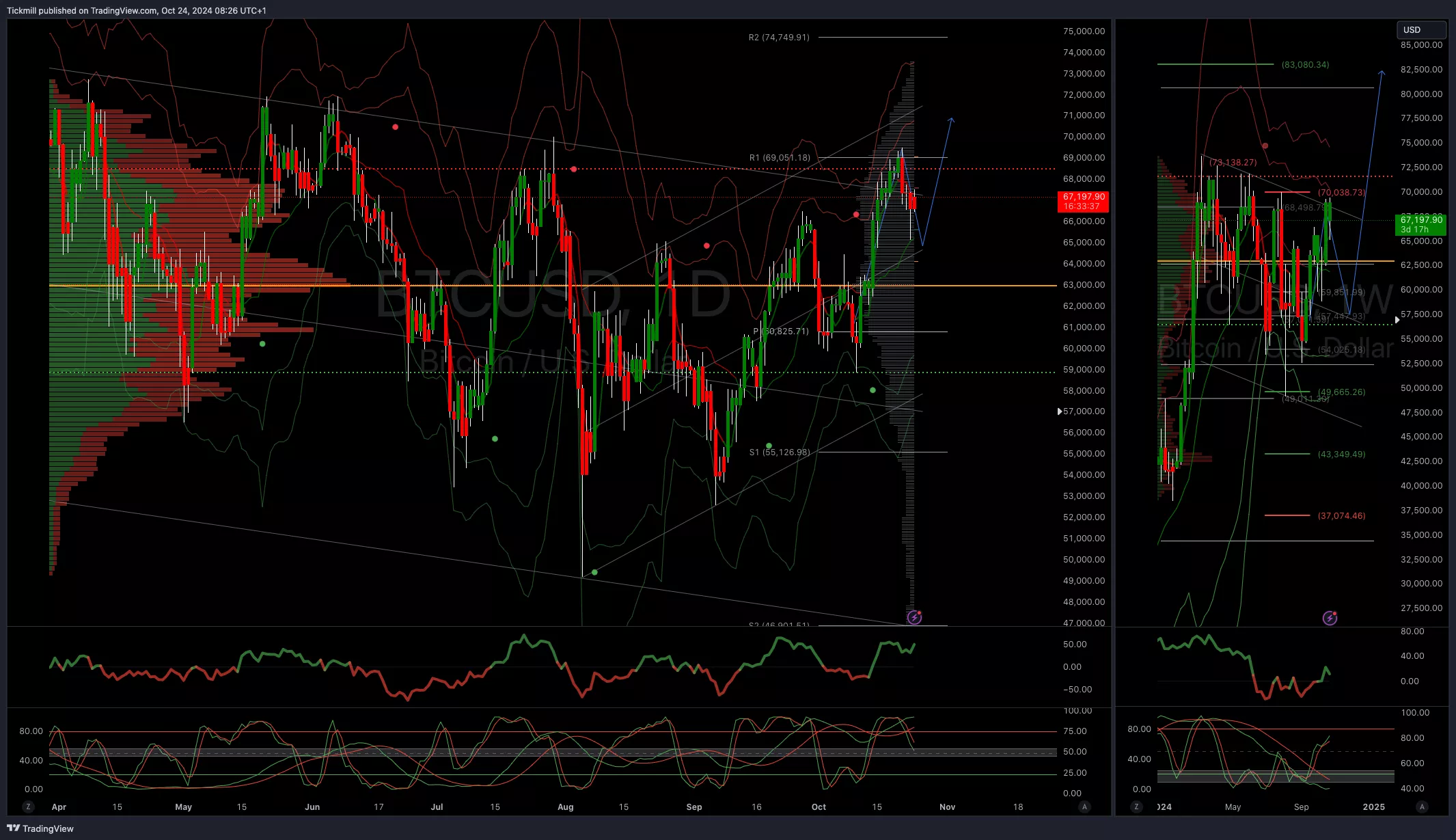

(Click on image to enlarge) BTCUSD Bullish Above Bearish Below 63000

BTCUSD Bullish Above Bearish Below 63000

(Click on image to enlarge) More By This Author:

More By This Author: