Image Source: As part of an ongoing series, each week we typically conduct an analysis on one of the companies in our screens. This week, however, we will take a closer look at a stock that is not currently in our screens: Caterpillar Inc. ().

Image Source: As part of an ongoing series, each week we typically conduct an analysis on one of the companies in our screens. This week, however, we will take a closer look at a stock that is not currently in our screens: Caterpillar Inc. ().

Profile

Caterpillar is the top manufacturer of heavy equipment, power solutions, and locomotives. It is currently the world’s largest manufacturer of heavy equipment. The company is divided into four reportable segments: construction industries, resource industries, energy and transportation, and Cat Financial.Its products are available through a dealer network that covers the globe with about 2,700 branches maintained by 160 dealers. Cat Financial provides retail financing for machinery and engines to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Caterpillar product sales.

Recent Performance

Over the past 12 months, the share price has moved up approximately 46.50%. Please note that the numbers provided are as of Oct. 10, 2024.Source: Google Finance

Inputs

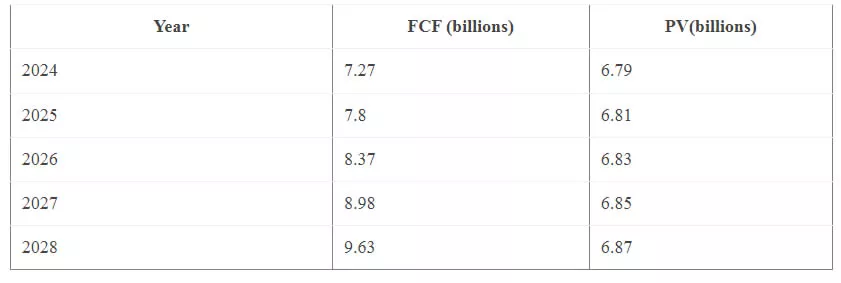

Forecasted Free Cash Flows (FCFs)

Terminal Value

Present Value of Terminal Value

Present Value of Free Cash Flows

Enterprise Value

Net Debt

Equity Value

Per-Share DCF Value

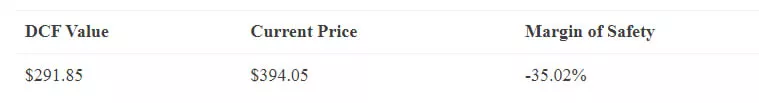

Conclusion

Based on the DCF valuation, the stock seems to be overvalued. The DCF value of $291.85 per share is lower than the recent market price of $394.05. The margin of safety is around -35.02%.More By This Author:TotalEnergies SE: Is It A Buy?Exxon Mobil Corp. DCF Valuation: Is The Stock Undervalued?Eli Lilly And Co DCF Valuation: Is The Stock Undervalued?

Based on the DCF valuation, the stock seems to be overvalued. The DCF value of $291.85 per share is lower than the recent market price of $394.05. The margin of safety is around -35.02%.More By This Author:TotalEnergies SE: Is It A Buy?Exxon Mobil Corp. DCF Valuation: Is The Stock Undervalued?Eli Lilly And Co DCF Valuation: Is The Stock Undervalued?