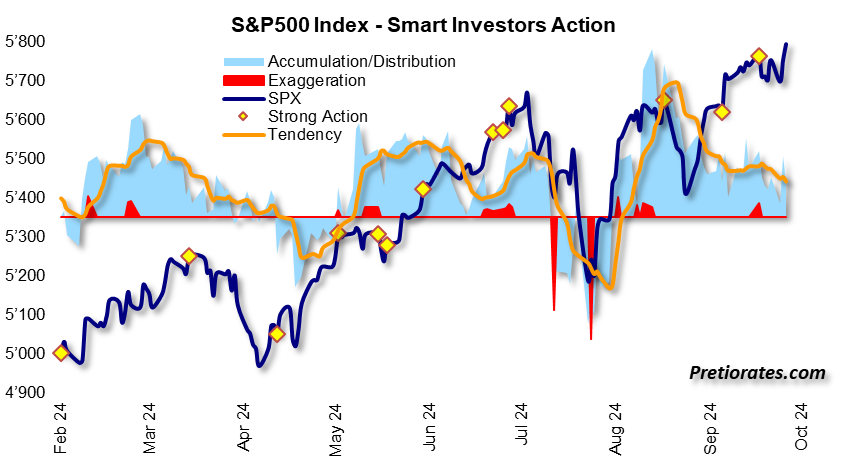

Since last Friday, several monthly economic figures have been published that have a significant impact on the financial markets: the US labor market data, the ISM economic data and, today, the inflation figures (CPI).First, a look at the short-term indicators for the stock markets: these have performed much better than expected since the low at the beginning of August. However, the Smart Investors Action shows that although accumulation is still present, it has recently declined sharply. So we are on shaky ground….(Click on image to enlarge)

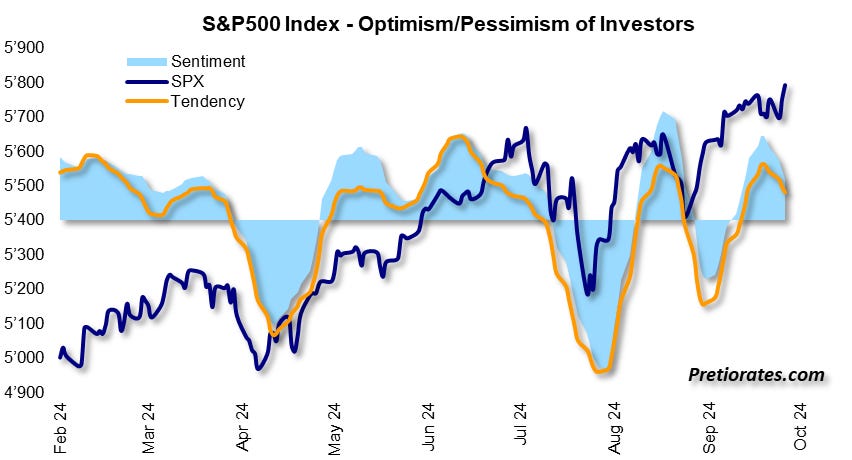

Optimism is also still in the majority, a prerequisite for bullish tendencies. However, the indicator shows that it is declining again…(Click on image to enlarge)

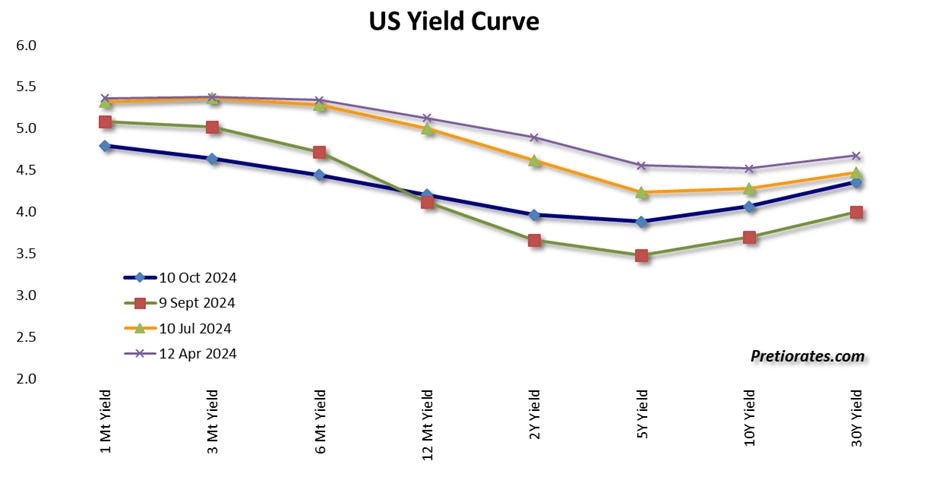

The publication of the US labor market figures also confirmed our view that the potential of interest rate cuts is nowhere near as great as previously expected by the market (see our Thoughts numbers and ). The market has clearly corrected this since last Friday, as can be seen in the yield curve from September 9 (green) and today (blue)…(Click on image to enlarge)

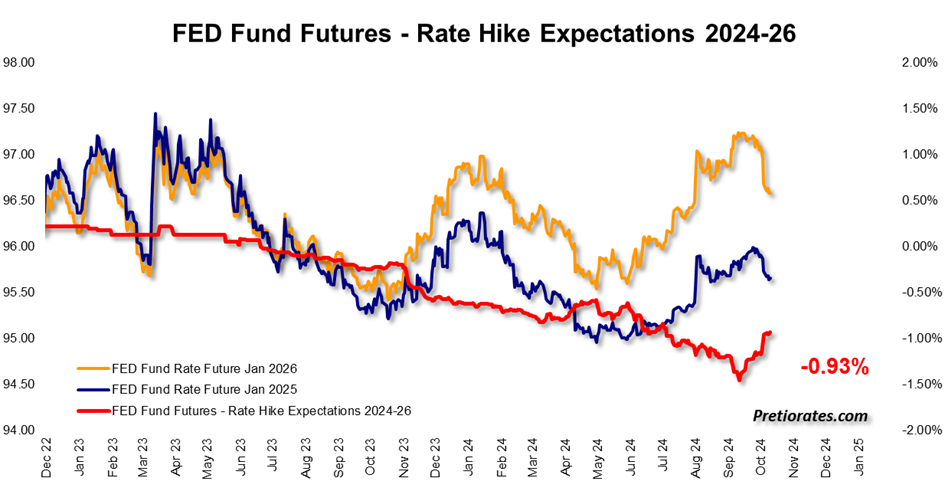

The futures markets have also clearly corrected their hopes for lower interest rates (red line)…(Click on image to enlarge)

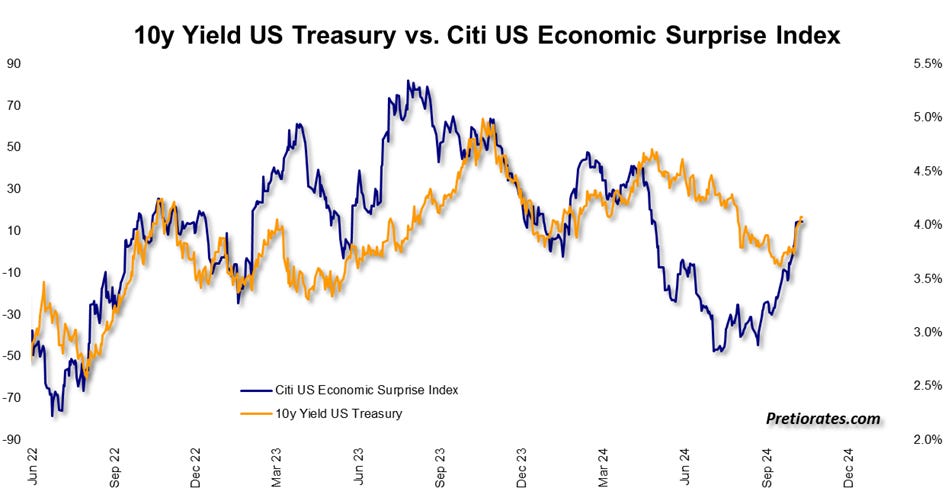

The Citi US Economic Surprise Index shows whether the published figures on the US economy have turned out above or below expectations. The sharp rise in the index (blue line) shows that the US economy is much stronger than the market perceives it to be. A (too) strong economy would tend to be slowed down by higher interest rates. While we do not expect this, it would have to slow down the desire for lower interest rates…(Click on image to enlarge)

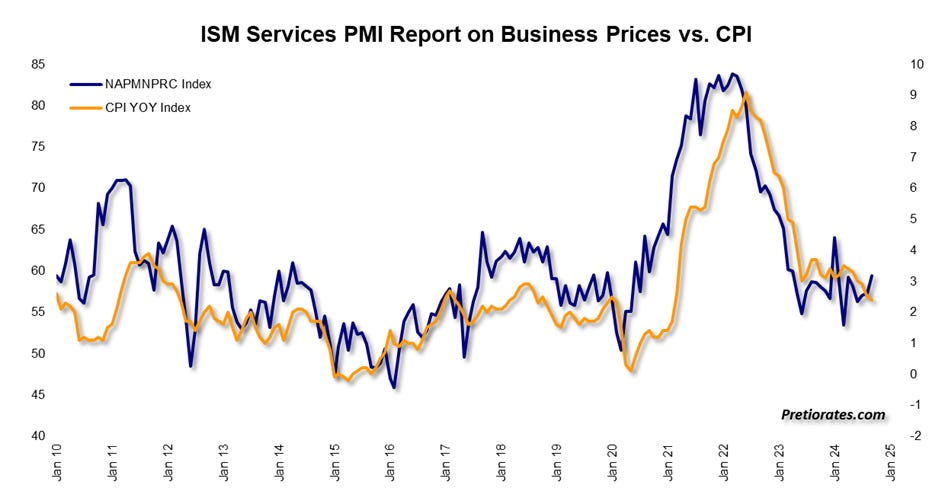

We have already discussed the ISM figures in the last issue (): The ISM Service Index was stronger than expected. The development of this index has a high correlation with inflation (CPI)…(Click on image to enlarge)

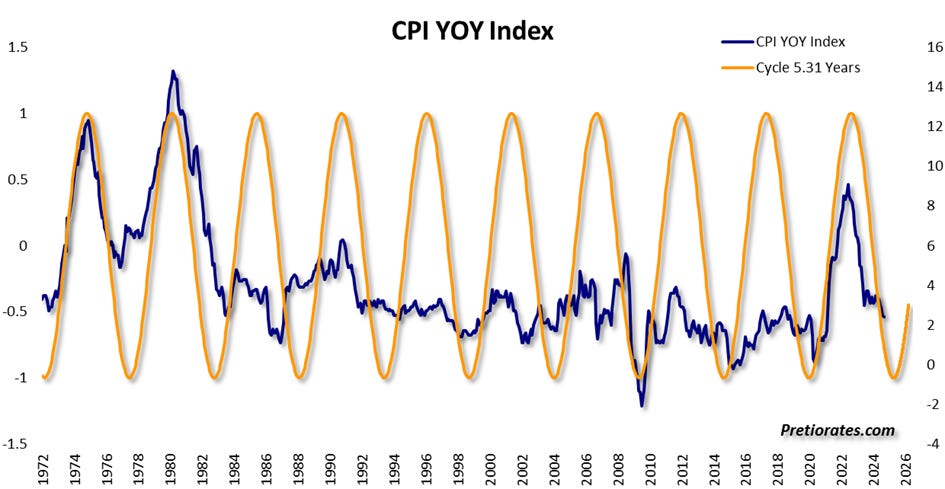

In fact, the 5.31-year CPI cycle also shows that inflation is apparently dying at the moment, but is not dead. Quite the opposite…(Click on image to enlarge)

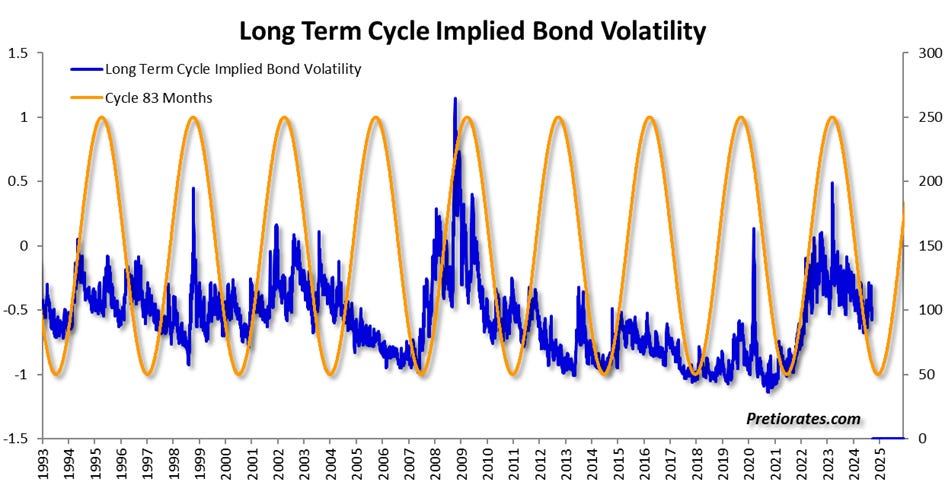

Should inflation actually rise again, the bond market would have to make an even sharper U-turn. This is indeed confirmed by the bond market’s 83-month cycle. The volatility of the US bond market will increase again if this 30-year cycle remains valid. Higher bond market volatility usually means rising yields – i.e. interest rates…(Click on image to enlarge)

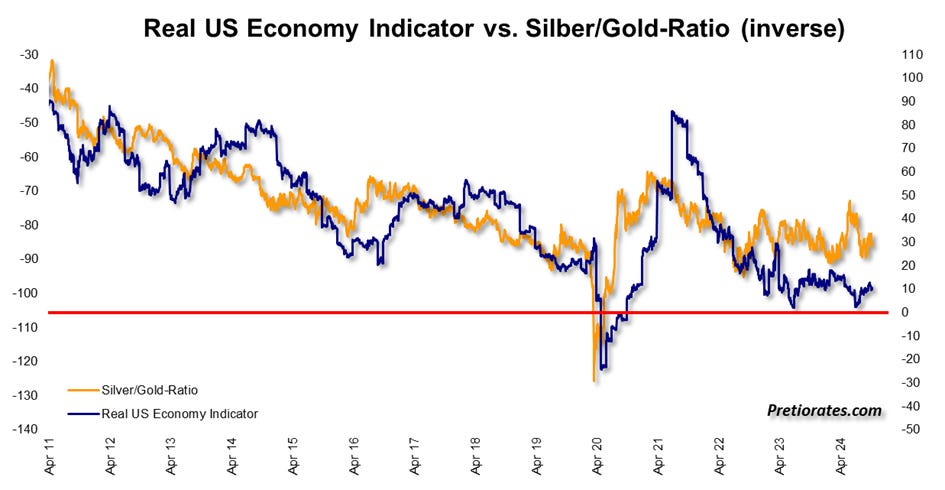

In order to better assess the development of the US economy, we have developed our own ‘Real US Economy Indicator’. This shows that, stripped of the usual number crunching of mathematicians, the US economy has in fact been showing a negative development for three years. This is probably why we can see the rather pessimistic sentiment in the market. However, the Real US Economy Indicator never fell into negative territory, but instead recently formed a double low exactly on the border to a recession. The development is also confirmed by the Gold/Silver ratio. We remember: The Gold is for the bust phase, Silver performs better during the boom phase of the economy…(Click on image to enlarge)

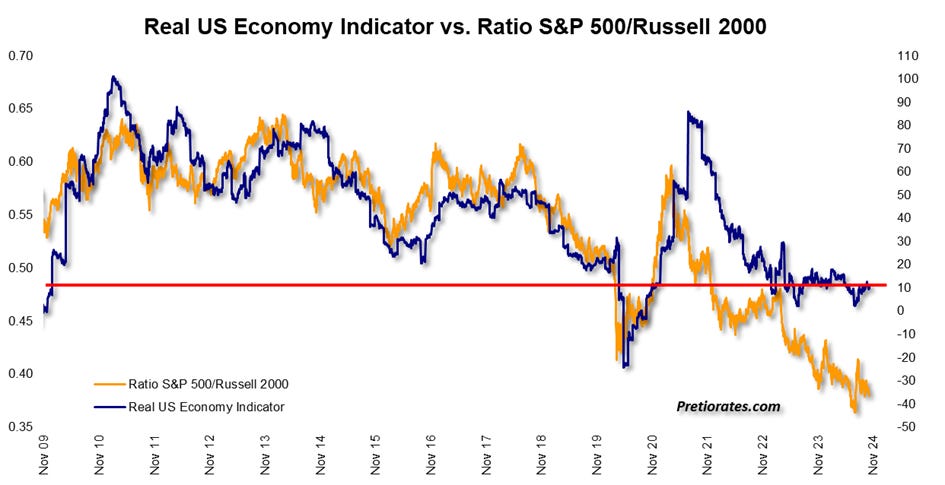

And should the US economy not actually perform as negatively as has been perceived in the market for some time, then it is clear that mid- and small-caps are now trading at a much too favorable level. The weak performance of the ratio between the S&P500 and the Russell 2000 index shows that second-tier stocks have performed extremely poorly since the pandemic.(Click on image to enlarge)

In fact, the overall picture would be accurate: if US interest rates do not fall further, the interest-sensitive Big Tech stocks would not benefit much from it. On the other hand, if the US economy actually performs better than perceived, the small-cap stocks of the Russell 2000 would be undervalued…More By This Author:Will The Chinese Party Be Followed By A Hangover? Does The Sun Really Rise In China? Interest Rates Are Set To Fall Again, But For How Long And By How Much?

Inflation Seems To Be Dying, But It Is Not Dead