The 2024 Q3 earnings season is just days from kicking into a much higher gear with the release of the big banks’ results on Friday. The period looks to be constructive, with earnings growth expected to be positive again despite recent downward revisions that have contrasted with recent periods.Let’s take a closer look at a few key reports across different sectors.

Nvidia’s Data Center Results in Focus

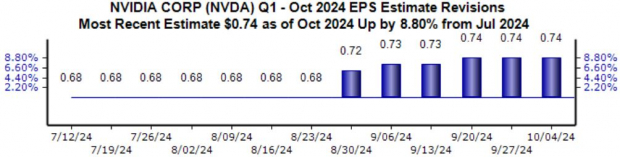

It’s hard to put Nvidia’s ( – ) success into words anymore, with record-breaking quarterly results over the last year driven by the AI frenzy leading to remarkable share performance. Though shares have been relatively quiet over the last three months, essentially flat, revisions for the upcoming release continue to reflect bullishness.The $0.74 Zacks Consensus EPS estimate is up nearly 9% since mid-July, suggesting a sizable 85% increase from the year-ago period. Revenue expectations have also remained bullish, with the $32.6 billion expected also 7% higher over the same period. Image Source: Zacks Investment ResearchOf course, Data Center results will be the real highlight of the release, no different than recent periods. The results have consistently blown away our consensus expectations, exceeding estimates by at least $1.4 billion across its last five releases.

Image Source: Zacks Investment ResearchOf course, Data Center results will be the real highlight of the release, no different than recent periods. The results have consistently blown away our consensus expectations, exceeding estimates by at least $1.4 billion across its last five releases.

Image Source: Zacks Investment ResearchAnd despite its strong run, the valuation picture here remains attractive, with the current 36.2X forward 12-month earnings multiple comparing favorably to the 50.7X five-year median. The current PEG works out to 0.9X, reflective of both growth and value.Remember that NVDA is one of the ‘late’ reporters during earnings season, with its release scheduled for November 19th.

MCD Faces Bearish Expectations

MCD’s ( – ) quarterly release will likely provide some insight into the state of consumers, particularly given that it’s recently faced a slowdown in restaurant foot traffic. High menu prices have been behind the slowdown, though it’s worth noting that recent value propositions could help close the gap.Earnings expectations for the restaurant titan have been taken lower over recent months, with the current $3.15 Zacks Consensus EPS estimate down 4.5% and suggesting a 1.2% pullback from the year-ago period.

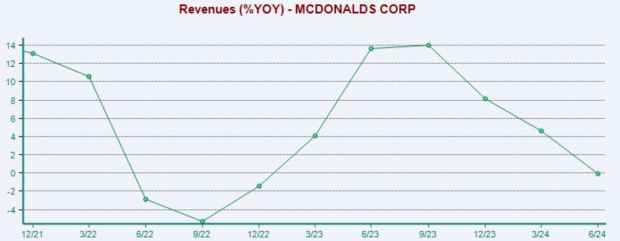

Image Source: Zacks Investment ResearchRevenue expectations have largely followed the same trajectory, with McDonald’s expected to see $6.7 billion in revenue throughout the period, 1% higher year-over-year. The company’s sales growth rates have been decreasing for some time now, as we can see below.Please note that the chart below tracks the year-over-year change in sales, not actual revenue numbers.

Image Source: Zacks Investment Research

Tesla Reveals EV Numbers

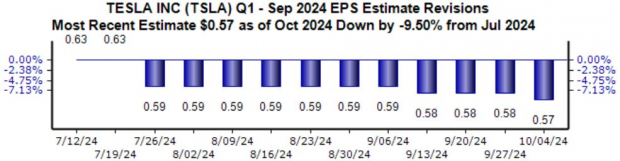

Tesla ( – ), another member of the Mag 7 group, will also see its quarterly release in focus, giving us further clues surrounding the current state of the EV industry. Shares have delivered a nice performance over the last month, gaining 11%.Still, expectations for the period have primarily reflected bearishness, with the $0.57 Zacks Consensus EPS estimate down nearly 10% since mid-July.

Image Source: Zacks Investment ResearchOf course, the key metric for Tesla is the company’s EV production/delivery numbers. The company unveiled its production and delivery numbers recently; Tesla delivered roughly 463k EVs and produced nearly 470k throughout the period.Bottom LineThe Q3 earnings season looks to pick up notable steam over the coming weeks, with the big banks delivering the results this Friday. It looks to be another positive period, with S&P 500 earnings growth again expected to be positive.More By This Author:What’s Going On With China Stocks? Alibaba, JD.com, PDD HoldingsShould Investors Buy PepsiCo Shares Before Earnings? Bull Of The Day: Sharkninja

3 Key Releases To Watch This Earnings Season: NVDA, MCD, TSLA