(Click on image to enlarge)

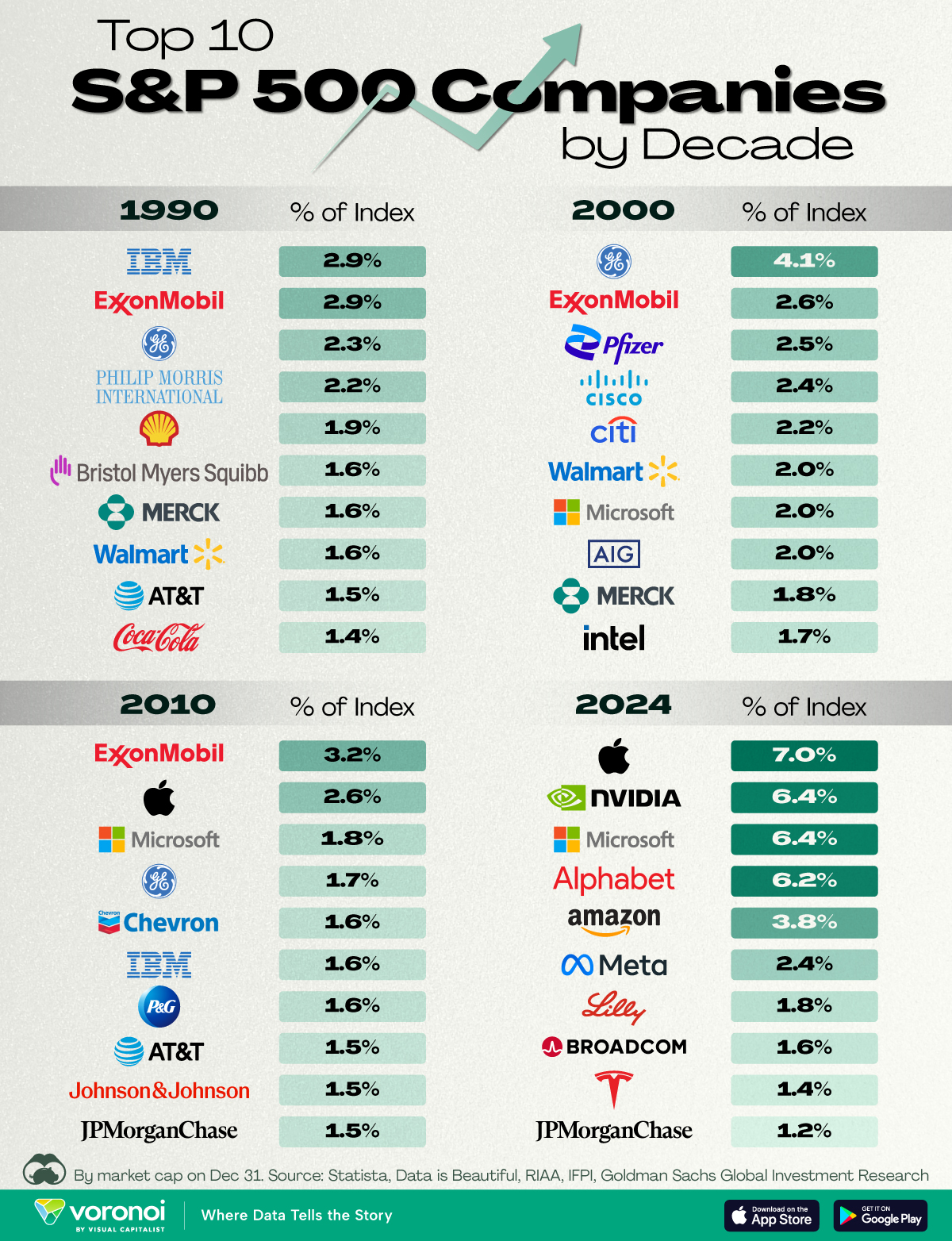

Launched in 1957, the S&P 500 is a benchmark index that tracks the performance of the 500 largest publicly traded companies in the U.S. It serves as a key barometer of the American economy and influences investment strategies globally.In this graphic, we show the top S&P 500 companies over the past several decades to see how the index has evolved over time.

Data and Key Takeaways

The data we used to create this graphic was sourced from (September 2024 edition). All figures are as of December 31st.Starting with 1990, the three biggest companies on the S&P 500 were , Exxon Mobil , and General Electric ..webp) IBM dominated the tech space in 1990 with its leadership in computers and enterprise systems. Today’s IBM is quite a different business, with a focus on cybersecurity, cloud computing, and artificial intelligence.Moving forward to 2000, IBM has fallen out of the top 10, replaced by other rising tech companies in Cisco Systems , Microsoft , and Intel .

IBM dominated the tech space in 1990 with its leadership in computers and enterprise systems. Today’s IBM is quite a different business, with a focus on cybersecurity, cloud computing, and artificial intelligence.Moving forward to 2000, IBM has fallen out of the top 10, replaced by other rising tech companies in Cisco Systems , Microsoft , and Intel ..webp)

Cisco’s stock experienced a massive rally in the late 1990s (as did many other tech stocks), reaching a peak of $79.37 per share in 2000. The company’s shares have never reached this point since.Next, in 2010, Exxon Mobil became the biggest constituent on the S&P 500. The company benefited from rising energy demand and increasing oil prices following the 2008 financial crisis..webp)

Note that Chevron, another , also made it into the top 10 in this year.Lastly, we look at the top 10 stocks of 2024 (the exact date of these numbers was not specified in the source material)..webp)

We can see how today’s tech giants have come to dominate the S&P 500 by looking at their relatively high percentage share of the index. The reason for this is that the S&P 500 is a capitalization weighted index, meaning stocks with higher market caps carry greater weight.For investors who dislike this method, S&P offers an which includes the same constituents, but each is allocated a fixed weight of 0.2%.Invesco manages the largest ETF tracking the S&P 500 EWI (Ticker: ), which has $63.6 billion in assets under management.More By This Author:The World’s Most Valuable Unicorns In 2024 Charted: The Most Popular Investing Strategies, By GenerationVisualizing The Decline Of Copper Usage In EVs